- United States

- /

- Life Sciences

- /

- NasdaqGS:TECH

Should Bio-Techne's (TECH) US$496 Million Share Buyback Prompt Investors to Reevaluate Its Capital Strategy?

Reviewed by Simply Wall St

- Bio-Techne recently completed two share repurchase tranches, retiring a total of 1.24% and 2.76% of its outstanding shares, representing a combined capital return of approximately US$496.33 million as of June 2025.

- This large-scale buyback initiative underscores the company’s shareholder capital allocation priorities and may impact both earnings per share and investor sentiment going forward.

- We'll assess how Bio-Techne's completion of a US$100.05 million buyback could influence its investment narrative and future expectations.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Bio-Techne Investment Narrative Recap

To be a Bio-Techne shareholder is to believe in the company's essential role supplying life science tools that enable innovation in diagnostics and therapeutics, even amid sector funding pressures. The recent US$500 million combined share repurchase appears unlikely to materially shift short-term catalysts, which remain driven by increasing demand for advanced reagents in cell and gene therapy, nor does it diminish the immediate risk of waning biotech and academic R&D spending. Among recent developments, the July 2025 partnership with Spear Bio to distribute ultrasensitive immunoassays for Alzheimer’s disease is especially relevant. This announcement reinforces Bio-Techne’s ongoing pivot to higher-growth, innovation-driven revenue streams, supporting future resilience even as core customer funding remains uncertain. In contrast, investors should be aware of continued biotech funding declines and how...

Read the full narrative on Bio-Techne (it's free!)

Bio-Techne's outlook suggests revenues will reach $1.5 billion and earnings $250.1 million by 2028. This forecast requires 6.5% annual revenue growth and a $176.7 million increase in earnings from the current $73.4 million.

Uncover how Bio-Techne's forecasts yield a $65.31 fair value, a 20% upside to its current price.

Exploring Other Perspectives

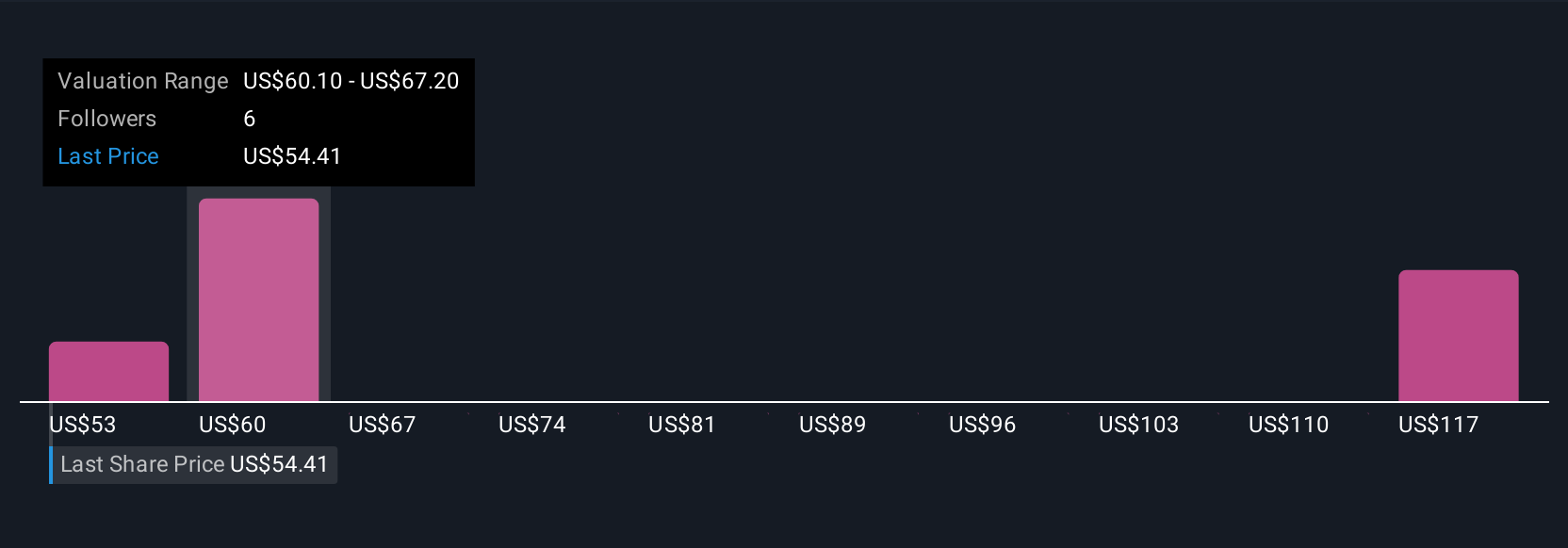

Three Simply Wall St Community contributors identified fair values for Bio-Techne ranging from US$53 to US$125.50. With persistent funding cuts posing challenges to recurring revenue, you can compare how different investors weigh short-term uncertainty versus long-term healthcare trends.

Explore 3 other fair value estimates on Bio-Techne - why the stock might be worth just $53.00!

Build Your Own Bio-Techne Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bio-Techne research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Bio-Techne research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bio-Techne's overall financial health at a glance.

Curious About Other Options?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 23 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bio-Techne might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:TECH

Bio-Techne

Develops, manufactures, and sells life science reagents, instruments, and services for the research, diagnostics, and bioprocessing markets worldwide.

Flawless balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives