- United States

- /

- Pharma

- /

- NasdaqGM:TBPH

Theravance Biopharma, Inc. (NASDAQ:TBPH) Analysts Are Reducing Their Forecasts For This Year

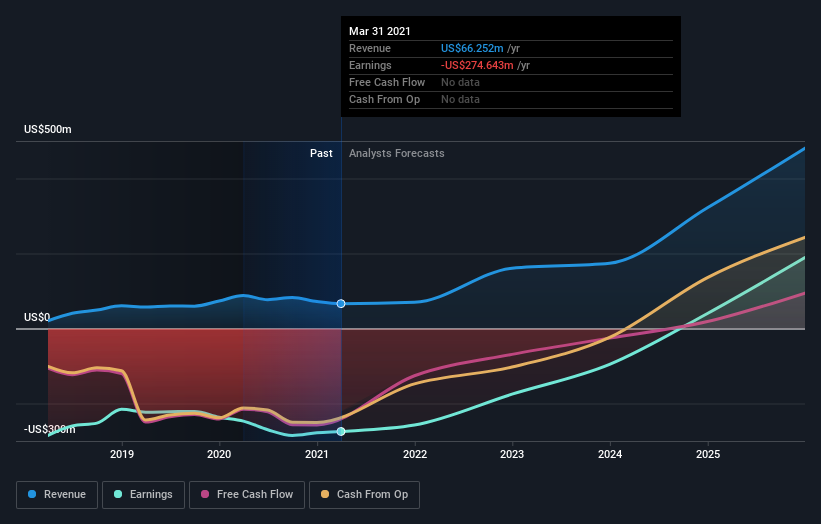

Today is shaping up negative for Theravance Biopharma, Inc. (NASDAQ:TBPH) shareholders, with the analysts delivering a substantial negative revision to this year's forecasts. Both revenue and earnings per share (EPS) estimates were cut sharply as analysts factored in the latest outlook for the business, concluding that they were too optimistic previously.

After this downgrade, Theravance Biopharma's nine analysts are now forecasting revenues of US$70m in 2021. This would be a credible 5.2% improvement in sales compared to the last 12 months. Losses are presumed to reduce, shrinking 10% from last year to US$3.88. Yet before this consensus update, the analysts had been forecasting revenues of US$136m and losses of US$2.88 per share in 2021. So there's been quite a change-up of views after the recent consensus updates, with the analysts making a serious cut to their revenue forecasts while also expecting losses per share to increase.

See our latest analysis for Theravance Biopharma

There was no major change to the consensus price target of US$30.56, signalling that the business is performing roughly in line with expectations, despite lower earnings per share forecasts. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Theravance Biopharma analyst has a price target of US$42.00 per share, while the most pessimistic values it at US$20.00. This is a fairly broad spread of estimates, suggesting that the analysts are forecasting a wide range of possible outcomes for the business.

Of course, another way to look at these forecasts is to place them into context against the industry itself. We would highlight that Theravance Biopharma's revenue growth is expected to slow, with the forecast 7.0% annualised growth rate until the end of 2021 being well below the historical 20% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 4.1% annually. Even after the forecast slowdown in growth, it seems obvious that Theravance Biopharma is also expected to grow faster than the wider industry.

The Bottom Line

The most important thing to take away is that analysts increased their loss per share estimates for this year. While analysts did downgrade their revenue estimates, these forecasts still imply revenues will perform better than the wider market. We're also surprised to see that the price target went unchanged. Still, deteriorating business conditions (assuming accurate forecasts!) can be a leading indicator for the stock price, so we wouldn't blame investors for being more cautious on Theravance Biopharma after the downgrade.

As you can see, the analysts clearly aren't bullish, and there might be good reason for that. We've identified some potential issues with Theravance Biopharma's financials, such as recent substantial insider selling. For more information, you can click here to discover this and the 4 other warning signs we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

If you’re looking to trade Theravance Biopharma, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Theravance Biopharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGM:TBPH

Theravance Biopharma

A biopharmaceutical company, discovers, develops, and commercializes respiratory medicines in the United States and Europe.

High growth potential with adequate balance sheet.