- United States

- /

- Biotech

- /

- NasdaqGM:TARA

Could Greater Index Exposure for Protara Therapeutics (TARA) Shift Its Path to Broader Investor Interest?

Reviewed by Simply Wall St

- Protara Therapeutics, Inc. (NasdaqGM:TARA) was recently added to the S&P Global BMI Index, reflecting its growing visibility in the market.

- Inclusion in a major benchmark index often brings the company onto the radar of institutional investors and passive funds, potentially expanding its shareholder base.

- We will explore how Protara Therapeutics's entry into the S&P Global BMI Index could reshape its investment narrative by increasing investor exposure.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

What Is Protara Therapeutics' Investment Narrative?

For many shareholders of Protara Therapeutics, the big picture involves belief in the company’s evolving product pipeline and its potential to move key clinical assets forward, despite a history of operating at a loss and its lack of revenue. The latest addition of Protara to the S&P Global BMI Index has slightly raised its visibility, and could prompt additional passive fund inflows over time. However, this development is unlikely to change the key short-term catalysts, which remain centered on upcoming clinical trial readouts and regulatory milestones, particularly for TARA-002 in bladder cancer. Investors will also likely continue to focus on the company's cash runway, operational losses, and the path to regulatory approvals, with recent price moves suggesting only moderate near-term impact from the index event. Ultimately, risk and reward remain tightly linked to pipeline execution and capital needs.

But, some investors may not be factoring in continuing operational losses, which could influence future funding.

Exploring Other Perspectives

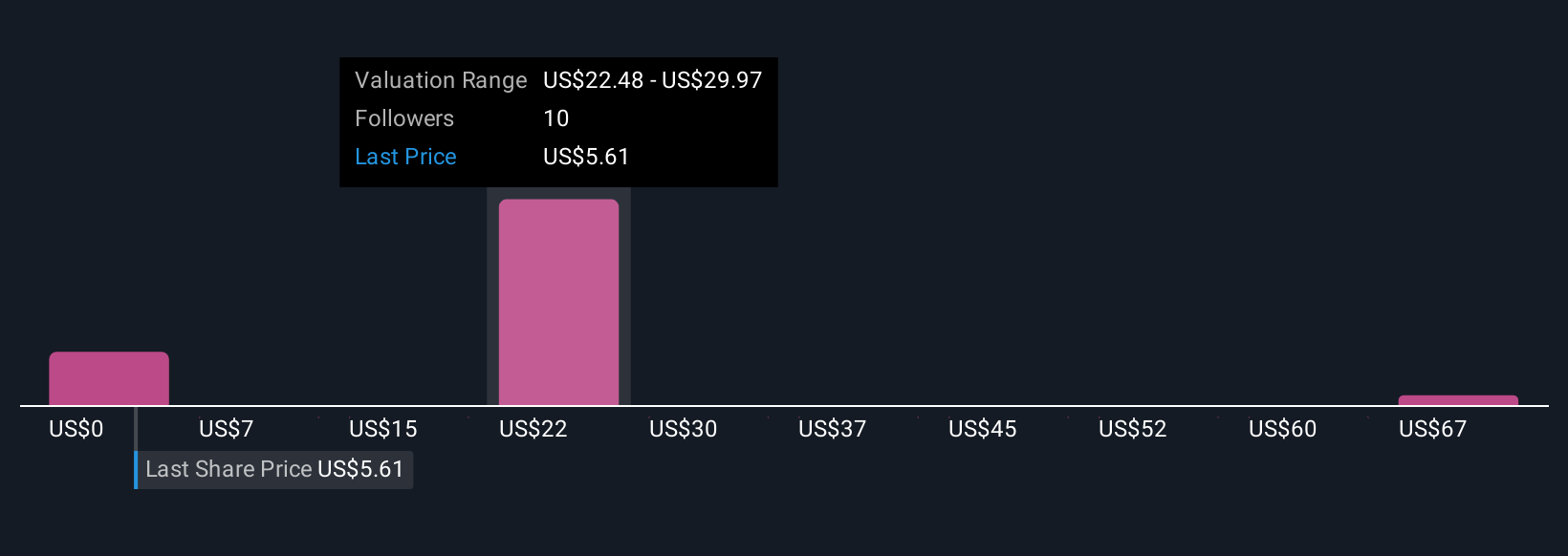

Explore 5 other fair value estimates on Protara Therapeutics - why the stock might be worth just $7.49!

Build Your Own Protara Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Protara Therapeutics research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Protara Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Protara Therapeutics' overall financial health at a glance.

Interested In Other Possibilities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 30 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:TARA

Protara Therapeutics

A clinical-stage biopharmaceutical company, engages in advancing transformative therapies for the treatment of cancer and rare diseases.

Flawless balance sheet and fair value.

Market Insights

Community Narratives