- United States

- /

- Biotech

- /

- NasdaqGS:SYRE

Does Spyre Therapeutics' (SYRE) Analyst Upgrade Reveal Growing Conviction in Its Autoimmune Pipeline Strategy?

Reviewed by Sasha Jovanovic

- Spyre Therapeutics recently presented at Evercore’s 8th Annual Healthcare Conference in Coral Gables, Florida, while also attracting fresh attention from Wall Street research.

- A key development was an analyst at JonesTrading assigning a buy rating to Spyre Therapeutics, highlighting increased confidence backed by the analyst’s strong recent track record.

- With that backdrop, we’ll explore how the JonesTrading upgrade shapes Spyre Therapeutics’ investment narrative and what it may mean for investors.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

What Is Spyre Therapeutics' Investment Narrative?

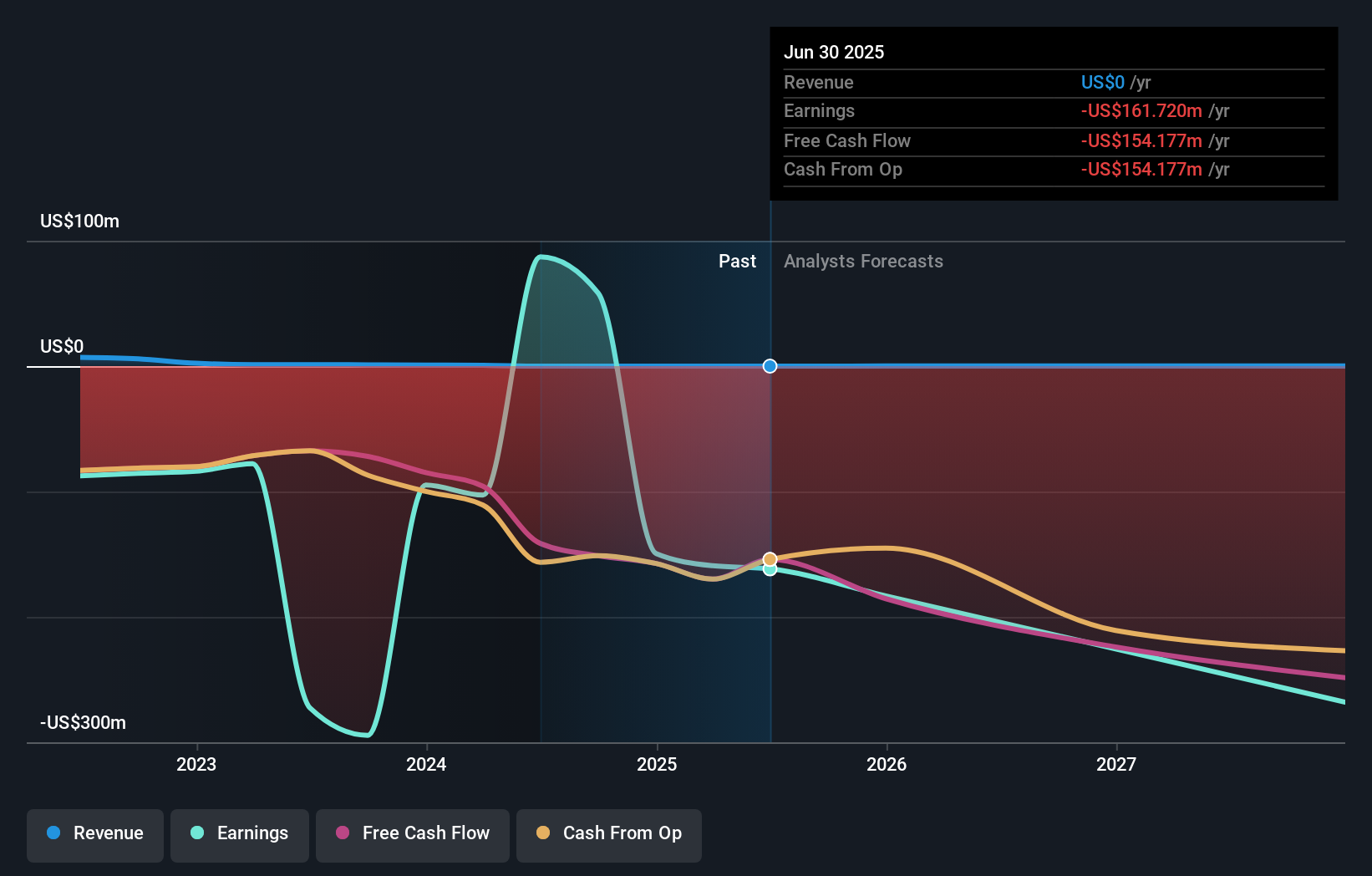

To own Spyre Therapeutics, you really have to believe its IL-23 and TL1A antibody platforms can convert clean early data and a stronger balance sheet into meaningful ulcerative colitis and rheumatology franchises, despite zero revenue and ongoing losses. The recent follow-on offering and reduced Q3 loss give it more time to execute, but also came with substantial dilution and a looming lock-up expiry that could pressure the stock. In that context, the JonesTrading upgrade and conference appearance mostly reinforce the existing near term catalysts rather than create new ones: upcoming Phase 2 SKYLINE and SKYWAY readouts and any signs of partnership interest. The upgrade, backed by the analyst’s track record, may support sentiment after a very large 3-year total return, yet it does not change core risks around trial outcomes, valuation, or future financing needs.

However, one key financing-related overhang here is easy to underestimate. According our valuation report, there's an indication that Spyre Therapeutics' share price might be on the expensive side.Exploring Other Perspectives

Two fair value estimates from the Simply Wall St Community span roughly US$5 to US$54, underlining how far apart individual views are. Set that against a cash burning, pre revenue pipeline where upcoming Phase 2 data could sharply shift perceptions of Spyre’s long term potential. If you are weighing an entry, it can be helpful to see how other investors frame both the upside and the clinical, dilution and execution risks before deciding what you are comfortable with.

Explore 2 other fair value estimates on Spyre Therapeutics - why the stock might be worth less than half the current price!

Build Your Own Spyre Therapeutics Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Spyre Therapeutics research is our analysis highlighting 5 important warning signs that could impact your investment decision.

- Our free Spyre Therapeutics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Spyre Therapeutics' overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SYRE

Spyre Therapeutics

A clinical stage biotechnology company, focuses on developing therapeutics for patients living with inflammatory bowel disease (IBD).

Flawless balance sheet with moderate risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026