- United States

- /

- Biotech

- /

- NasdaqGS:SWTX

SpringWorks Therapeutics, Inc.'s (NASDAQ:SWTX) Shares Climb 26% But Its Business Is Yet to Catch Up

The SpringWorks Therapeutics, Inc. (NASDAQ:SWTX) share price has done very well over the last month, posting an excellent gain of 26%. Notwithstanding the latest gain, the annual share price return of 2.3% isn't as impressive.

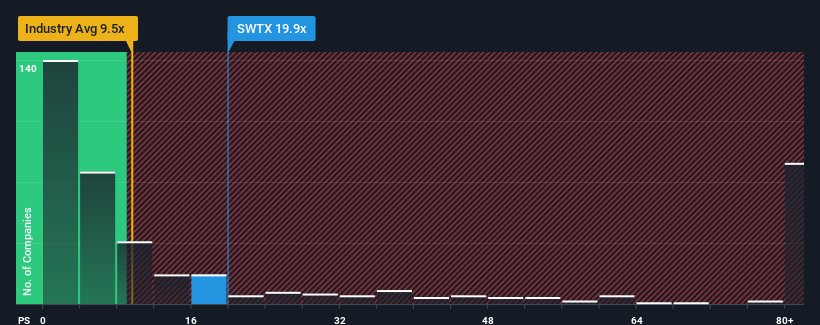

After such a large jump in price, SpringWorks Therapeutics' price-to-sales (or "P/S") ratio of 19.9x might make it look like a strong sell right now compared to other companies in the Biotechs industry in the United States, where around half of the companies have P/S ratios below 9.5x and even P/S below 3x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/S.

See our latest analysis for SpringWorks Therapeutics

How Has SpringWorks Therapeutics Performed Recently?

With revenue growth that's superior to most other companies of late, SpringWorks Therapeutics has been doing relatively well. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think SpringWorks Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The High P/S?

The only time you'd be truly comfortable seeing a P/S as steep as SpringWorks Therapeutics' is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, we see that the company's revenues underwent some rampant growth over the last 12 months. In spite of this unbelievable short-term growth, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 66% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 136% each year, which is noticeably more attractive.

With this in consideration, we believe it doesn't make sense that SpringWorks Therapeutics' P/S is outpacing its industry peers. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Shares in SpringWorks Therapeutics have seen a strong upwards swing lately, which has really helped boost its P/S figure. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that SpringWorks Therapeutics currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with SpringWorks Therapeutics, and understanding should be part of your investment process.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SWTX

SpringWorks Therapeutics

A commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for underserved patient populations suffering from rare diseases and cancer.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives