- United States

- /

- Biotech

- /

- NasdaqGS:STOK

We're Keeping An Eye On Stoke Therapeutics' (NASDAQ:STOK) Cash Burn Rate

We can readily understand why investors are attracted to unprofitable companies. For example, biotech and mining exploration companies often lose money for years before finding success with a new treatment or mineral discovery. Nonetheless, only a fool would ignore the risk that a loss making company burns through its cash too quickly.

Given this risk, we thought we'd take a look at whether Stoke Therapeutics (NASDAQ:STOK) shareholders should be worried about its cash burn. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

See our latest analysis for Stoke Therapeutics

When Might Stoke Therapeutics Run Out Of Money?

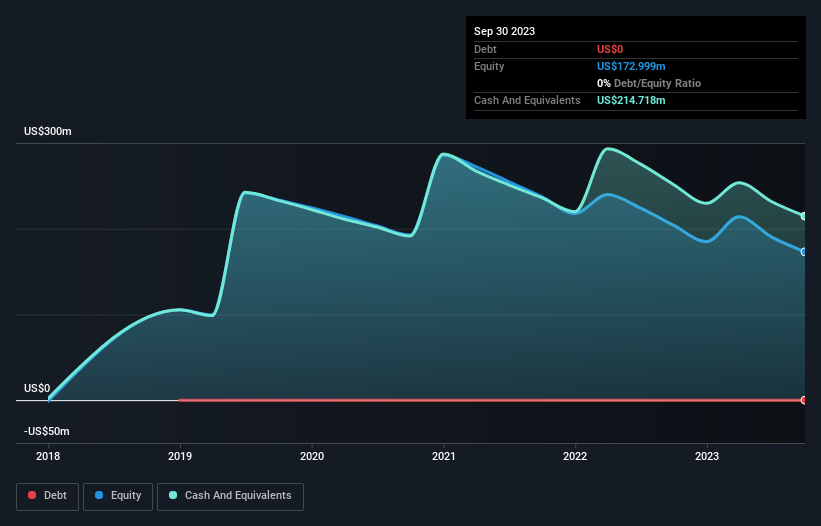

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. As at September 2023, Stoke Therapeutics had cash of US$215m and no debt. Importantly, its cash burn was US$85m over the trailing twelve months. Therefore, from September 2023 it had 2.5 years of cash runway. That's decent, giving the company a couple years to develop its business. The image below shows how its cash balance has been changing over the last few years.

How Well Is Stoke Therapeutics Growing?

Notably, Stoke Therapeutics actually ramped up its cash burn very hard and fast in the last year, by 187%, signifying heavy investment in the business. On top of that, the fact that operating revenue was basically flat over the same period compounds the concern. Considering these two factors together makes us nervous about the direction the company seems to be heading. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

Can Stoke Therapeutics Raise More Cash Easily?

Stoke Therapeutics seems to be in a fairly good position, in terms of cash burn, but we still think it's worthwhile considering how easily it could raise more money if it wanted to. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. Many companies end up issuing new shares to fund future growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Stoke Therapeutics' cash burn of US$85m is about 45% of its US$188m market capitalisation. That's high expenditure relative to the value of the entire company, so if it does have to issue shares to fund more growth, that could end up really hurting shareholders returns (through significant dilution).

How Risky Is Stoke Therapeutics' Cash Burn Situation?

On this analysis of Stoke Therapeutics' cash burn, we think its cash runway was reassuring, while its increasing cash burn has us a bit worried. Looking at the factors mentioned in this short report, we do think that its cash burn is a bit risky, and it does make us slightly nervous about the stock. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Stoke Therapeutics (of which 1 is potentially serious!) you should know about.

If you would prefer to check out another company with better fundamentals, then do not miss this free list of interesting companies, that have HIGH return on equity and low debt or this list of stocks which are all forecast to grow.

If you're looking to trade Stoke Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:STOK

Stoke Therapeutics

An early-stage biopharmaceutical company, engages in restoring protein expression by harnessing the body's potential with RNA medicine.

Flawless balance sheet and fair value.