- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

Scholar Rock (SRRK) Valuation in Focus as Analyst Initiation and Insider Buying Signal Renewed Optimism

Reviewed by Kshitija Bhandaru

Scholar Rock Holding (SRRK) is attracting fresh attention after Bank of America Securities launched coverage, citing optimism for its experimental drug targeting spinal muscular atrophy. Notably, substantial insider buying points to renewed confidence in the company’s outlook.

See our latest analysis for Scholar Rock Holding.

Even after a week of volatility, Scholar Rock’s 1-year total shareholder return of 20% reflects solid longer-term momentum and outpaces its share price pullback since January. Recent analyst coverage and insider buying appear to be reshaping sentiment around its growth potential.

If breakthroughs in biotech are on your radar, you can discover more innovators with our curated See the full list for free..

With analyst price targets well above current levels and insiders buying in at a premium, the question now is whether Scholar Rock is flying under the radar or if the market is already factoring in its pipeline potential.

Price-to-Book of 14.1: Is it justified?

Scholar Rock’s shares are trading at a price-to-book (P/B) ratio of 14.1, which puts it far above the average valuation seen in the US Biotechs sector.

The price-to-book ratio reflects what investors are currently willing to pay for each dollar of net assets. For biotech companies like Scholar Rock, this metric is especially important, as many operate at a loss and tangible assets often underpin investor sentiment in the growth phase.

Scholar Rock’s current P/B multiple is not only significantly higher than the industry average of 2.5, but it also points to a strong premium being placed on future growth expectations or potentially market optimism that may not fully align with its unprofitable status and negative returns on equity. Compared to direct peers, the stock does offer better relative value, as their average sits at 19.8. However, the sector comparison underscores just how aggressively the market is pricing in upside.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 14.1 (OVERVALUED)

However, risks remain, including ongoing net losses and unproven revenue. These factors could limit upside if clinical or commercial milestones are delayed.

Find out about the key risks to this Scholar Rock Holding narrative.

Another View: Discounted Cash Flow Signals Deep Discount

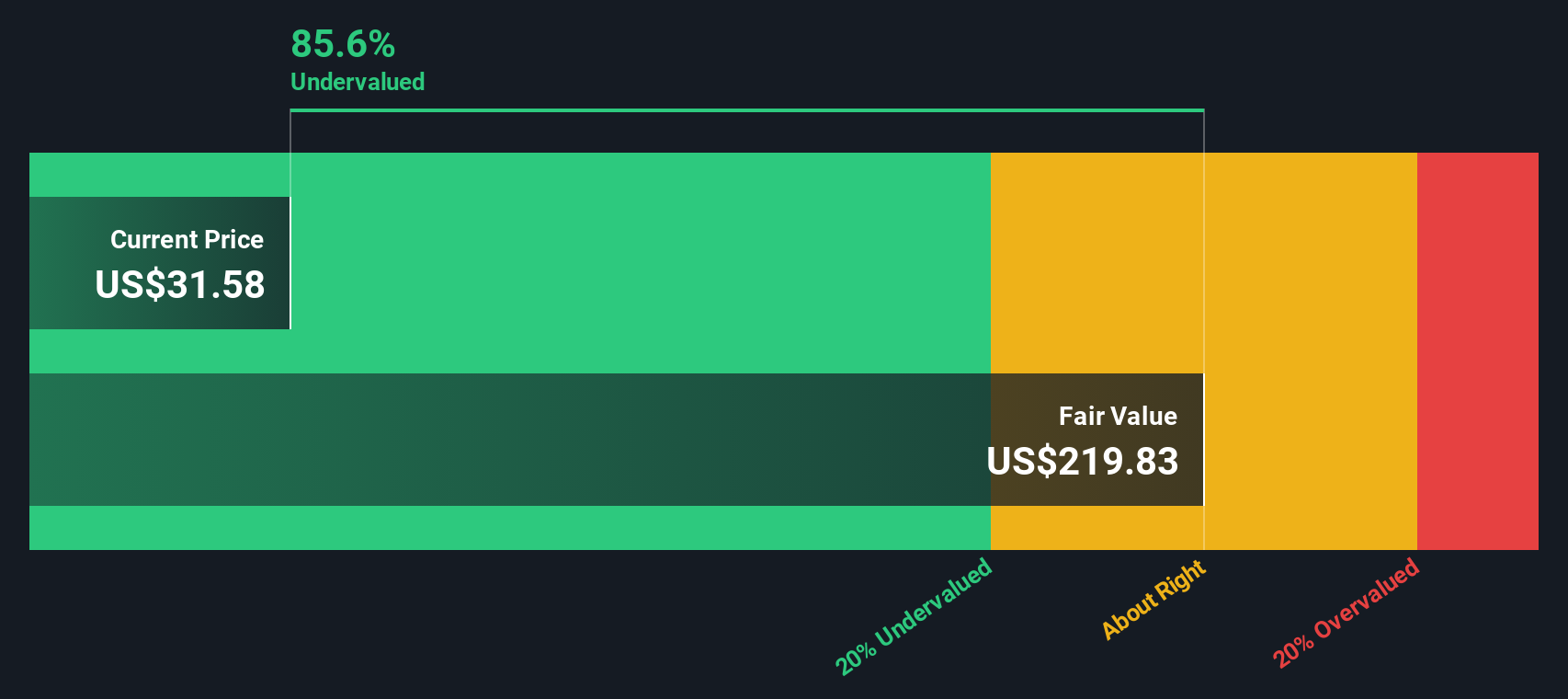

Looking beyond the price-to-book ratio, our DCF model paints a very different picture. It suggests Scholar Rock is trading at a massive 84% discount to its estimated fair value, with shares at $34.28 compared to a calculated value of $216.69. Which number reflects reality? Is the market missing something big?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Scholar Rock Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Scholar Rock Holding Narrative

If you believe a different story is hidden in the numbers or want to dive deeper on your own, you can put together a personal take in just a few minutes. Do it your way.

A great starting point for your Scholar Rock Holding research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors are always searching for the next big opportunity. Don’t let tomorrow’s top stocks slip through your fingers. See what else is out there right now.

- Unlock potential growth with these 891 undervalued stocks based on cash flows that are trading below their fair value. This may give you a head start before the market catches on.

- Capture income and resilience by checking out these 18 dividend stocks with yields > 3% offering reliable yields above 3% for your portfolio stability.

- Accelerate your gains by targeting these 25 AI penny stocks at the forefront of artificial intelligence innovation and rapid expansion.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Good value with adequate balance sheet.

Market Insights

Community Narratives