- United States

- /

- Biotech

- /

- NasdaqGS:SRRK

FDA Manufacturing Letter And Backup Plant Plans Could Be A Game Changer For Scholar Rock (SRRK)

Reviewed by Sasha Jovanovic

- Earlier in 2025, Scholar Rock Holding reported that its manufacturing partner Catalent Indiana received an FDA warning letter, yet the company still plans to resubmit its biologics license application and pursue a 2026 U.S. launch of apitegromab for spinal muscular atrophy, subject to regulatory approval.

- Scholar Rock is also accelerating the transfer of commercial manufacturing capacity to a second facility, underscoring its effort to reduce regulatory risk around apitegromab’s potential commercialization.

- We’ll now examine how the FDA warning letter and Scholar Rock’s contingency manufacturing plans shape the company’s investment narrative.

Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

What Is Scholar Rock Holding's Investment Narrative?

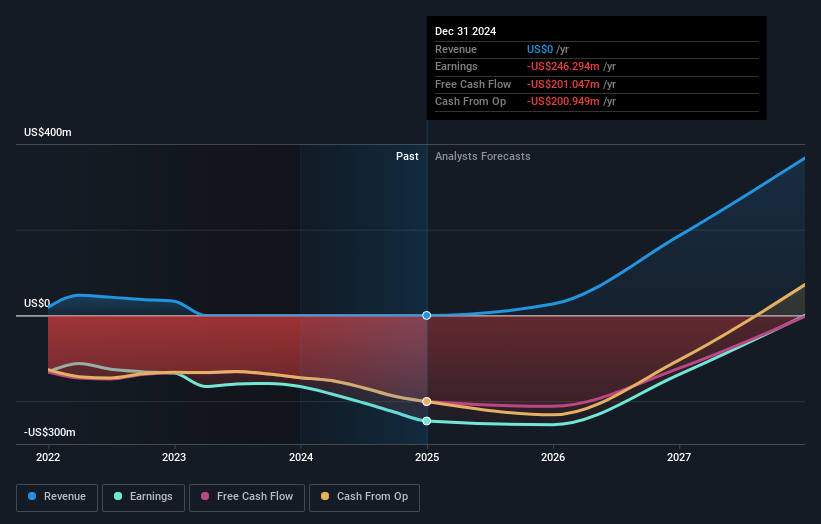

To own Scholar Rock today, you really have to believe that apitegromab can make the leap from a promising SMA therapy to an approved, commercially viable product before the cash burn becomes too heavy. The recent FDA warning letter to Catalent Indiana adds another layer to that bet, because it keeps regulatory execution front and center as the main short term catalyst and risk. The company’s plan to resubmit the BLA and push for a 2026 launch, while accelerating transfer to a second manufacturing site, shows it is trying to contain that risk rather than change course. Given the share price has held onto strong multi‑year gains despite deepening losses, the story now hinges even more on timing and quality of the FDA’s next response.

However, one operational wrinkle could still have outsized consequences for shareholders. Despite retreating, Scholar Rock Holding's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Scholar Rock Holding - why the stock might be worth just $47.33!

Build Your Own Scholar Rock Holding Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Scholar Rock Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Scholar Rock Holding research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Scholar Rock Holding's overall financial health at a glance.

Curious About Other Options?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SRRK

Scholar Rock Holding

A biopharmaceutical company, focuses on the discovery, development, and delivery of medicines for the treatment of serious diseases in which signaling by protein growth factors plays a fundamental role.

Adequate balance sheet and fair value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026