- United States

- /

- Biotech

- /

- NasdaqGM:SPRY

US Growth Stocks With High Insider Ownership For November 2024

Reviewed by Simply Wall St

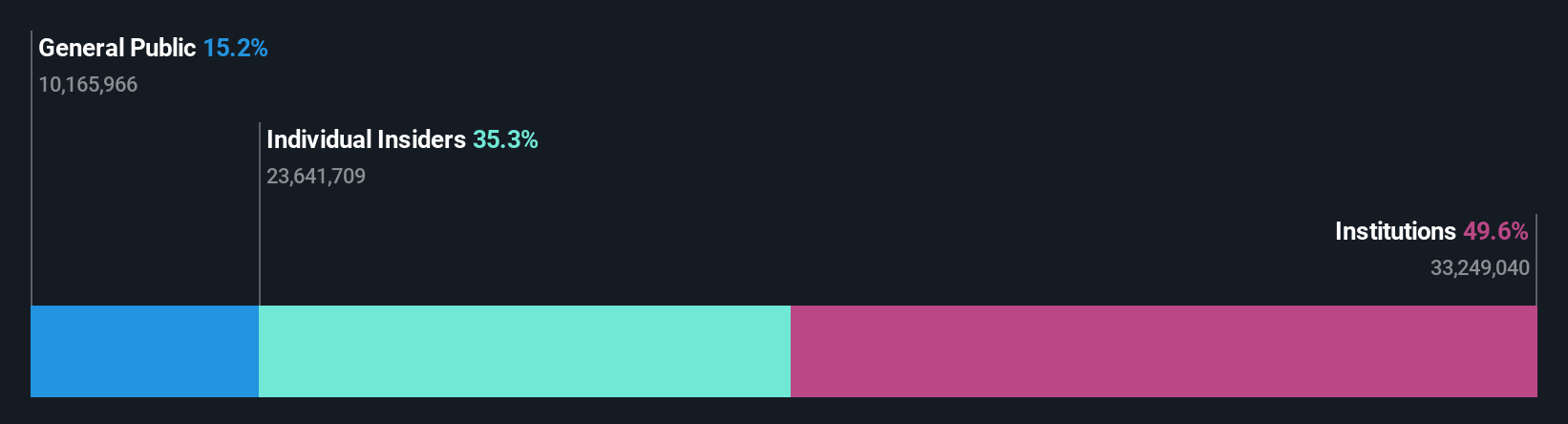

As the U.S. market navigates a mixed landscape with the Dow Jones Industrial Average reaching record highs and investors closely monitoring inflation data, growth stocks continue to capture attention for their potential returns. In this environment, companies with high insider ownership can be particularly appealing, as they often signal confidence from those who know the business best.

Top 10 Growth Companies With High Insider Ownership In The United States

| Name | Insider Ownership | Earnings Growth |

| Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 25.7% |

| Super Micro Computer (NasdaqGS:SMCI) | 14.4% | 24.3% |

| Duolingo (NasdaqGS:DUOL) | 14.6% | 41.6% |

| On Holding (NYSE:ONON) | 19.1% | 29.6% |

| Coastal Financial (NasdaqGS:CCB) | 18% | 46.1% |

| EHang Holdings (NasdaqGM:EH) | 32.8% | 81.5% |

| Alkami Technology (NasdaqGS:ALKT) | 11% | 98.6% |

| BBB Foods (NYSE:TBBB) | 22.9% | 44.2% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.7% | 95% |

| Credit Acceptance (NasdaqGS:CACC) | 14.1% | 50% |

Let's explore several standout options from the results in the screener.

ARS Pharmaceuticals (NasdaqGM:SPRY)

Simply Wall St Growth Rating: ★★★★★☆

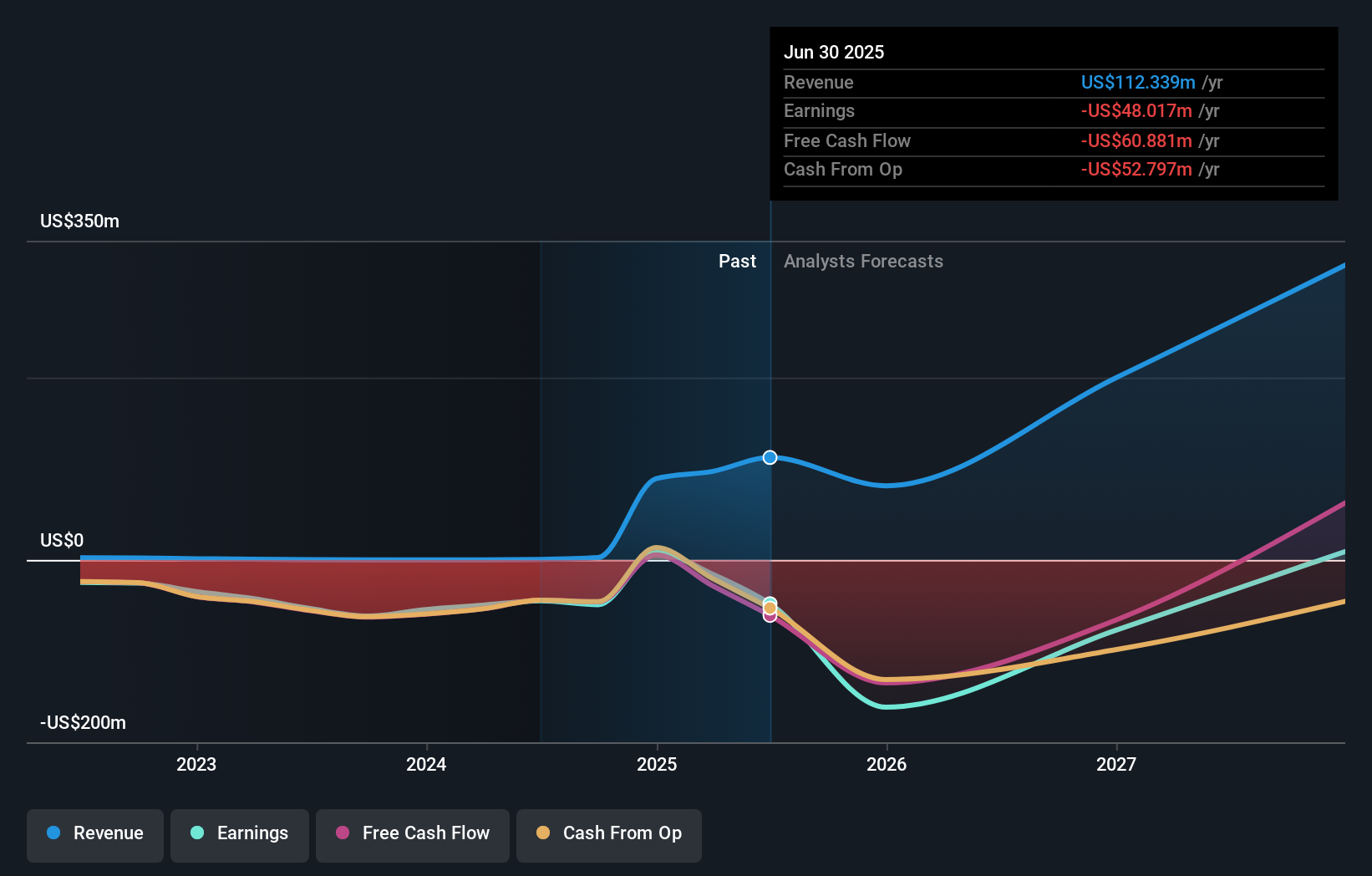

Overview: ARS Pharmaceuticals, Inc. is a biopharmaceutical company focused on developing treatments for severe allergic reactions, with a market cap of approximately $1.33 billion.

Operations: The company generates its revenue from the Pharmaceuticals segment, amounting to $2.57 million.

Insider Ownership: 19.6%

Earnings Growth Forecast: 69.8% p.a.

ARS Pharmaceuticals, with significant insider ownership, is poised for substantial growth. The company forecasts a robust annual revenue increase of 55.5%, significantly outpacing the US market average. Recent developments include a licensing agreement with ALK-Abelló for neffy®, securing an upfront payment of US$145 million and potential milestones up to US$320 million. Despite current losses, ARS's innovative products and strategic partnerships position it well for future profitability within three years.

- Get an in-depth perspective on ARS Pharmaceuticals' performance by reading our analyst estimates report here.

- Our valuation report here indicates ARS Pharmaceuticals may be undervalued.

Afya (NasdaqGS:AFYA)

Simply Wall St Growth Rating: ★★★★★☆

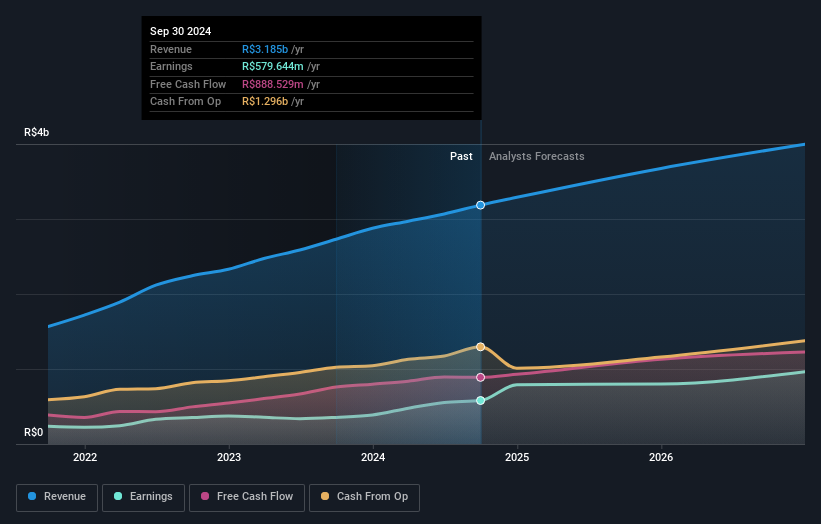

Overview: Afya Limited is a medical education group operating in Brazil with a market cap of $1.52 billion.

Operations: The company's revenue segments include Undergrad at R$2.78 billion and Continuing Education at R$164.55 million.

Insider Ownership: 23.7%

Earnings Growth Forecast: 21.2% p.a.

Afya, with strong insider ownership, is set for significant earnings growth of 21.2% annually, surpassing the US market average. Despite slower revenue growth at 9.8%, it remains above the market rate and trades at a substantial discount to its estimated fair value. Recent financial results show improved third-quarter performance with net income rising to BRL 119.98 million from BRL 93.35 million year-over-year, affirming its positive trajectory amidst reaffirmed annual guidance.

- Dive into the specifics of Afya here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential undervaluation of Afya shares in the market.

Daqo New Energy (NYSE:DQ)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Daqo New Energy Corp. manufactures and sells polysilicon to photovoltaic product manufacturers in China, with a market cap of approximately $1.28 billion.

Operations: The company generates revenue of $1.31 billion from the sale of polysilicon to photovoltaic product manufacturers in China.

Insider Ownership: 22.2%

Earnings Growth Forecast: 82.6% p.a.

Daqo New Energy, with substantial insider ownership, is forecasted for robust revenue growth of 24% annually, outpacing the US market. Despite this potential, recent financials reveal challenges; third-quarter sales dropped to US$198.5 million from US$484.84 million year-over-year, and a net loss of US$60.72 million was reported. The company's stock trades at good value relative to peers despite high volatility and low projected return on equity in three years (4.6%).

- Click here and access our complete growth analysis report to understand the dynamics of Daqo New Energy.

- According our valuation report, there's an indication that Daqo New Energy's share price might be on the cheaper side.

Key Takeaways

- Gain an insight into the universe of 208 Fast Growing US Companies With High Insider Ownership by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SPRY

ARS Pharmaceuticals

A biopharmaceutical company, develops treatments for severe allergic reactions.

Flawless balance sheet with high growth potential.