- United States

- /

- Banks

- /

- NasdaqGS:PNFP

3 US Stocks Estimated To Be Up To 49.8% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. stock market hovers near record highs, investors are keenly observing key inflation data that could influence future interest rate decisions by the Federal Reserve. In this environment, identifying undervalued stocks becomes crucial, as they may offer potential opportunities for growth even amid fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victory Capital Holdings (NasdaqGS:VCTR) | $72.24 | $144.03 | 49.8% |

| NBT Bancorp (NasdaqGS:NBTB) | $50.12 | $99.93 | 49.8% |

| UMB Financial (NasdaqGS:UMBF) | $125.88 | $243.34 | 48.3% |

| Synovus Financial (NYSE:SNV) | $57.97 | $115.67 | 49.9% |

| West Bancorporation (NasdaqGS:WTBA) | $24.01 | $46.82 | 48.7% |

| First Advantage (NasdaqGS:FA) | $19.73 | $38.66 | 49% |

| South Atlantic Bancshares (OTCPK:SABK) | $15.53 | $30.25 | 48.7% |

| Nutanix (NasdaqGS:NTNX) | $72.35 | $143.99 | 49.8% |

| Snap (NYSE:SNAP) | $11.60 | $22.76 | 49% |

| Roku (NasdaqGS:ROKU) | $66.31 | $128.59 | 48.4% |

Let's take a closer look at a couple of our picks from the screened companies.

Oddity Tech (NasdaqGM:ODD)

Overview: Oddity Tech Ltd. is a consumer tech company that develops digital-first brands for the beauty and wellness industries both in the United States and internationally, with a market cap of approximately $2.74 billion.

Operations: The company's revenue is derived from its Personal Products segment, totaling $620.65 million.

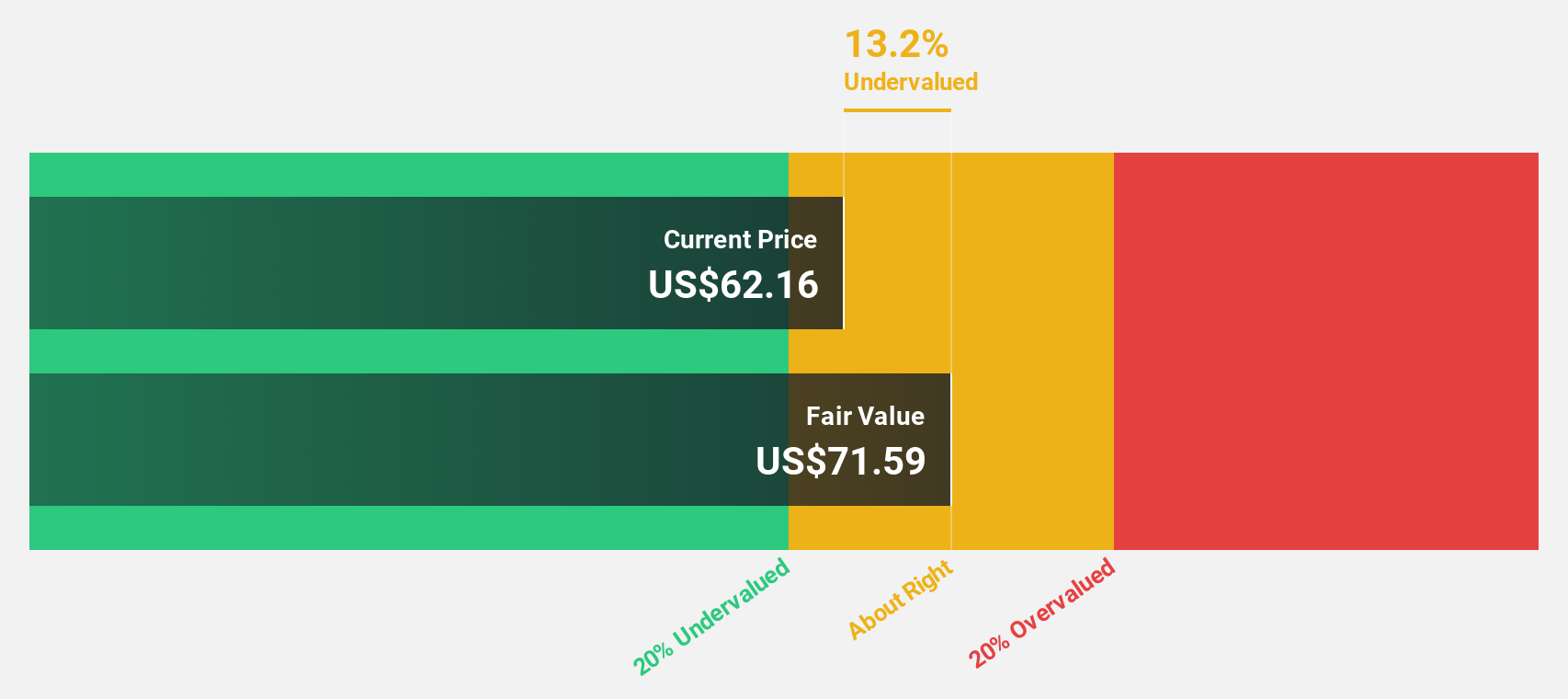

Estimated Discount To Fair Value: 44.7%

Oddity Tech appears undervalued, trading 44.7% below its estimated fair value of US$84.63 per share, with a current price of US$46.81. The company is executing a significant share buyback program worth up to US$100 million, funded by existing cash resources, which may enhance shareholder value. Recent financial results show strong growth in earnings and revenue, with net income for Q3 2024 at US$17.72 million compared to US$3.83 million the previous year.

- Our expertly prepared growth report on Oddity Tech implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of Oddity Tech stock in this financial health report.

Pinnacle Financial Partners (NasdaqGS:PNFP)

Overview: Pinnacle Financial Partners, Inc. is a bank holding company for Pinnacle Bank, offering a range of banking products and services to individuals, businesses, and professional entities in the United States with a market cap of approximately $9.94 billion.

Operations: The company's revenue primarily comes from its banking segment, which generated approximately $1.55 billion.

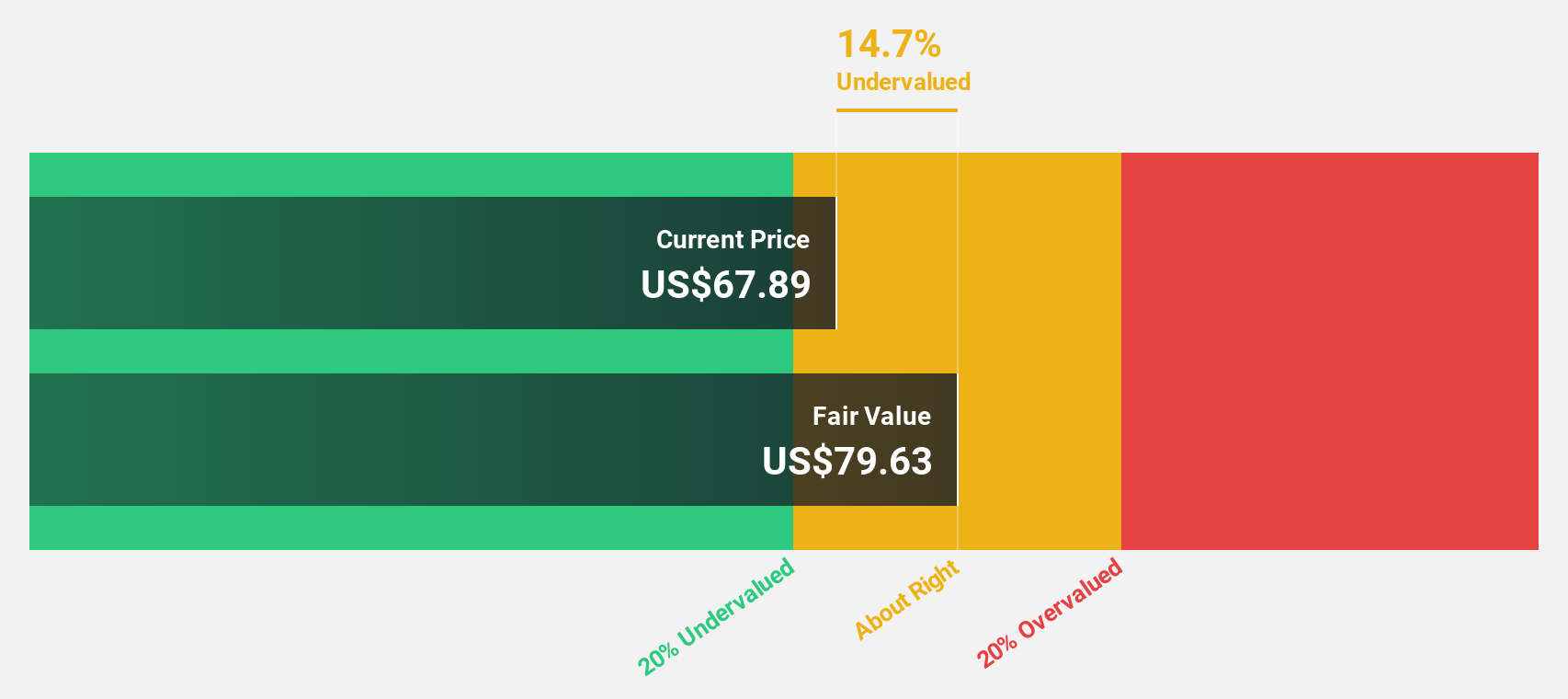

Estimated Discount To Fair Value: 28.2%

Pinnacle Financial Partners is trading at US$128.25, significantly undervalued compared to its estimated fair value of US$178.65, suggesting potential for appreciation. Recent earnings show a rise in net interest income to US$351.5 million for Q3 2024, up from US$317.24 million the previous year, though net income for nine months has decreased to US$323.8 million from US$467.17 million a year ago due to higher loan charge-offs and other factors impacting profitability.

- In light of our recent growth report, it seems possible that Pinnacle Financial Partners' financial performance will exceed current levels.

- Get an in-depth perspective on Pinnacle Financial Partners' balance sheet by reading our health report here.

Victory Capital Holdings (NasdaqGS:VCTR)

Overview: Victory Capital Holdings, Inc. is an asset management company operating in the United States and internationally, with a market cap of approximately $4.62 billion.

Operations: The company generates revenue of $866.90 million through its investment management services and products segment.

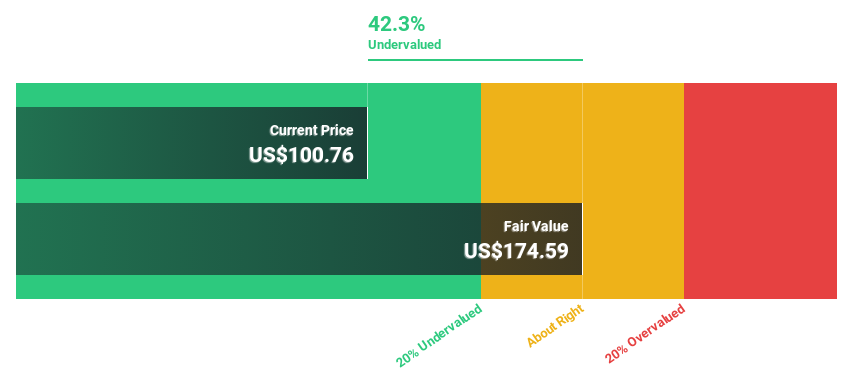

Estimated Discount To Fair Value: 49.8%

Victory Capital Holdings is trading at US$72.24, considerably below its estimated fair value of US$144.03, indicating potential undervaluation based on cash flows. The company reported Q3 2024 revenue of US$225.63 million and net income of US$81.98 million, both up from the previous year. Despite a high debt level, its earnings are forecast to grow significantly at 31.5% annually over the next three years, outpacing the broader market growth expectations.

- Insights from our recent growth report point to a promising forecast for Victory Capital Holdings' business outlook.

- Click to explore a detailed breakdown of our findings in Victory Capital Holdings' balance sheet health report.

Seize The Opportunity

- Gain an insight into the universe of 193 Undervalued US Stocks Based On Cash Flows by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PNFP

Pinnacle Financial Partners

Operates as the bank holding company for Pinnacle Bank that provides various banking products and services to individuals, businesses, and professional entities in the United States.

Flawless balance sheet with reasonable growth potential.