- United States

- /

- Biotech

- /

- NasdaqGS:VRTX

High Growth Tech Stocks to Watch in November 2024

Reviewed by Simply Wall St

The United States market has shown robust performance recently, with a 2.0% increase over the last week and a substantial 32% climb in the past year, while earnings are projected to grow by 15% annually in the coming years. In this vibrant environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to maintain momentum alongside these promising market trends.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 23.83% | 24.32% | ★★★★★★ |

| Ardelyx | 25.24% | 69.64% | ★★★★★★ |

| Sarepta Therapeutics | 24.00% | 42.91% | ★★★★★★ |

| Clene | 78.50% | 60.16% | ★★★★★★ |

| TG Therapeutics | 34.66% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.89% | 98.60% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.45% | 70.66% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

| Seagen | 22.57% | 71.80% | ★★★★★★ |

| ImmunoGen | 26.00% | 45.85% | ★★★★★★ |

Click here to see the full list of 250 stocks from our US High Growth Tech and AI Stocks screener.

Let's review some notable picks from our screened stocks.

Soleno Therapeutics (NasdaqCM:SLNO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Soleno Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing novel therapeutics for rare diseases, with a market cap of $2.47 billion.

Operations: Soleno Therapeutics is engaged in developing therapeutics for rare diseases, focusing on innovative treatments. Currently, it does not generate revenue from its operations as it remains in the clinical-stage of development.

Soleno Therapeutics is navigating a transformative phase with its DCCR tablets for Prader-Willi syndrome, highlighting its commitment to addressing severe genetic disorders. The recent FDA extension of the review period for their New Drug Application until March 2025 underscores the complexity and potential of their product pipeline. Financially, despite a significant net loss increase to $76.62 million in Q3 2024 from $10.86 million the previous year, Soleno's strategic R&D investments align with anticipated revenue growth forecasts of 66.5% annually, outpacing the US market average of 8.9%. Moreover, earnings are expected to surge by 67.27% per year as they move towards profitability within three years, reflecting an aggressive growth trajectory fueled by innovative healthcare solutions and robust clinical outcomes.

- Click here to discover the nuances of Soleno Therapeutics with our detailed analytical health report.

Evaluate Soleno Therapeutics' historical performance by accessing our past performance report.

Tenable Holdings (NasdaqGS:TENB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Tenable Holdings, Inc. offers cyber exposure solutions across the Americas, Europe, the Middle East, Africa, the Asia Pacific, and Japan with a market cap of approximately $5.13 billion.

Operations: The company generates revenue primarily from its Security Software & Services segment, totaling approximately $877.60 million.

Tenable Holdings has demonstrated resilience and adaptability in the cybersecurity landscape, notably enhancing its offerings with new data security posture management (DSPM) and artificial intelligence security posture management (AI-SPM) capabilities. These innovations are crucial as they address emerging threats in increasingly complex cloud environments, a strategic move reflected by a 9.3% annual revenue growth forecast, outpacing the US market average of 8.9%. Furthermore, Tenable's commitment to reinvesting in its technology is evident from its R&D expenses, ensuring the company remains at the forefront of cybersecurity solutions. This approach not only mitigates risks but also positions Tenable for future profitability, with earnings expected to surge by 65.3% annually over the next three years.

- Click here and access our complete health analysis report to understand the dynamics of Tenable Holdings.

Understand Tenable Holdings' track record by examining our Past report.

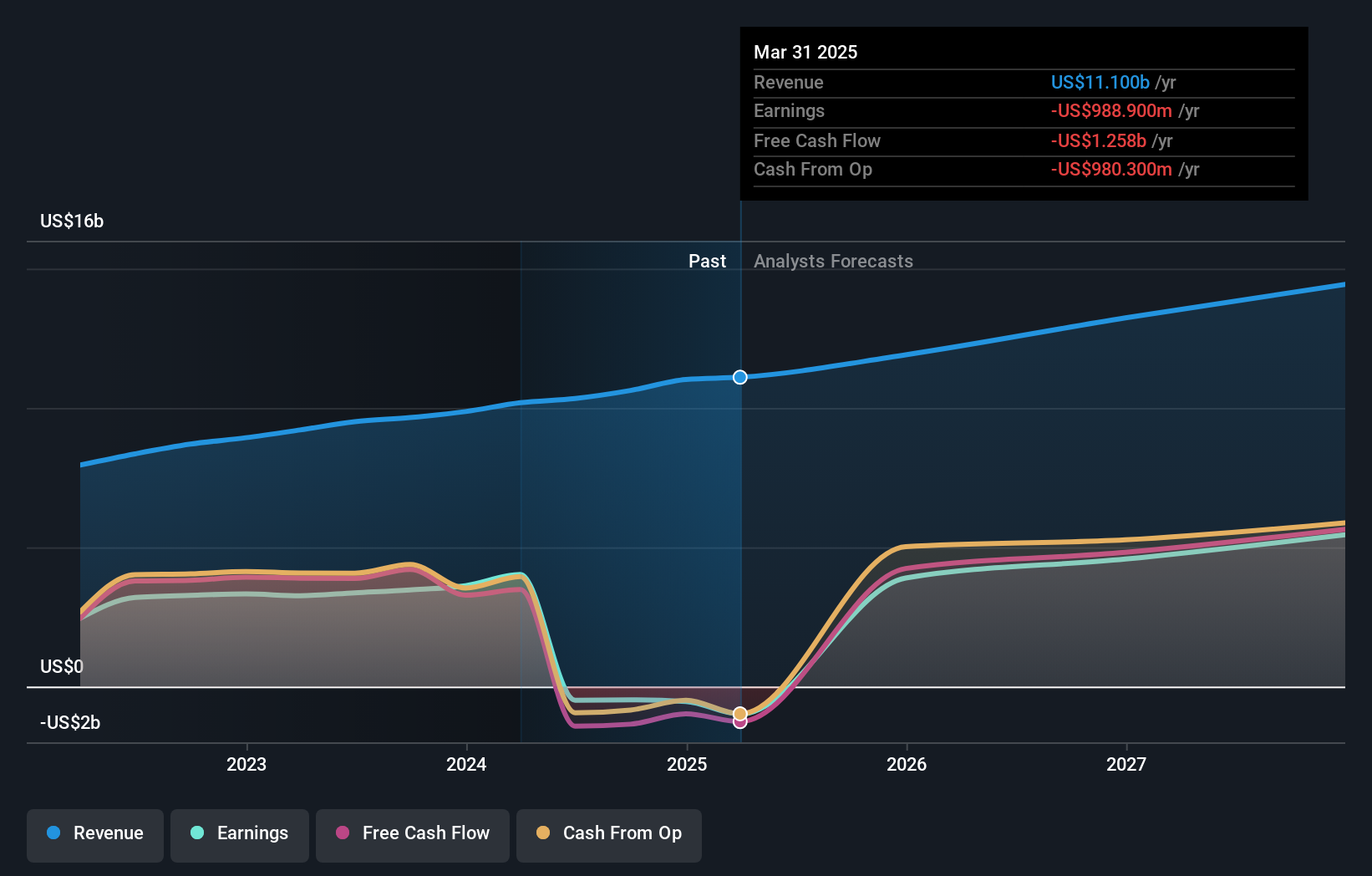

Vertex Pharmaceuticals (NasdaqGS:VRTX)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vertex Pharmaceuticals Incorporated is a biotechnology company focused on developing and commercializing therapies for cystic fibrosis, with a market cap of approximately $118.90 billion.

Operations: The company's primary revenue stream is from its pharmaceuticals segment, generating approximately $10.63 billion. As a biotechnology firm, it specializes in therapies for cystic fibrosis.

Vertex Pharmaceuticals, amid a challenging landscape, is steering towards profitability with an expected earnings growth of 47.4% per year. This trajectory is supported by strategic R&D investments, which are crucial for sustaining innovation and competitiveness in the biotech sector. In the recent quarter, Vertex repurchased shares worth $307.58 million, underscoring its confidence in long-term value creation despite current unprofitability. The firm also raised its full-year revenue guidance to between $10.8 billion and $10.9 billion, reflecting optimism driven by new product launches and market expansions. These moves highlight Vertex’s robust strategy to leverage scientific advancements and enhance shareholder value in a rapidly evolving industry landscape.

- Get an in-depth perspective on Vertex Pharmaceuticals' performance by reading our health report here.

Assess Vertex Pharmaceuticals' past performance with our detailed historical performance reports.

Seize The Opportunity

- Click through to start exploring the rest of the 247 US High Growth Tech and AI Stocks now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:VRTX

Vertex Pharmaceuticals

A biotechnology company, engages in developing and commercializing therapies for treating cystic fibrosis (CF).

Flawless balance sheet with reasonable growth potential.