- United States

- /

- Biotech

- /

- NasdaqGM:SPRY

Revenues Not Telling The Story For ARS Pharmaceuticals, Inc. (NASDAQ:SPRY) After Shares Rise 28%

ARS Pharmaceuticals, Inc. (NASDAQ:SPRY) shareholders would be excited to see that the share price has had a great month, posting a 28% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 39%.

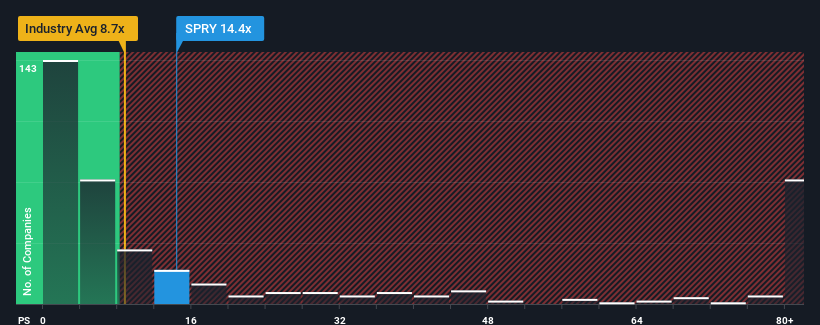

Since its price has surged higher, ARS Pharmaceuticals' price-to-sales (or "P/S") ratio of 14.4x might make it look like a strong sell right now compared to other companies in the Biotechs industry in the United States, where around half of the companies have P/S ratios below 8.7x and even P/S below 3x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

See our latest analysis for ARS Pharmaceuticals

How ARS Pharmaceuticals Has Been Performing

ARS Pharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think ARS Pharmaceuticals' future stacks up against the industry? In that case, our free report is a great place to start .How Is ARS Pharmaceuticals' Revenue Growth Trending?

ARS Pharmaceuticals' P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Retrospectively, the last year delivered an explosive gain to the company's top line. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 98% each year during the coming three years according to the six analysts following the company. With the industry predicted to deliver 147% growth each year, the company is positioned for a weaker revenue result.

In light of this, it's alarming that ARS Pharmaceuticals' P/S sits above the majority of other companies. Apparently many investors in the company are way more bullish than analysts indicate and aren't willing to let go of their stock at any price. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does ARS Pharmaceuticals' P/S Mean For Investors?

The strong share price surge has lead to ARS Pharmaceuticals' P/S soaring as well. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

It comes as a surprise to see ARS Pharmaceuticals trade at such a high P/S given the revenue forecasts look less than stellar. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

You always need to take note of risks, for example - ARS Pharmaceuticals has 1 warning sign we think you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

If you're looking to trade ARS Pharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:SPRY

ARS Pharmaceuticals

A biopharmaceutical company, develops and commercializes treatments for severe allergic reactions.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives