- United States

- /

- Pharma

- /

- NasdaqCM:SNOA

Investors Aren't Entirely Convinced By Sonoma Pharmaceuticals, Inc.'s (NASDAQ:SNOA) Revenues

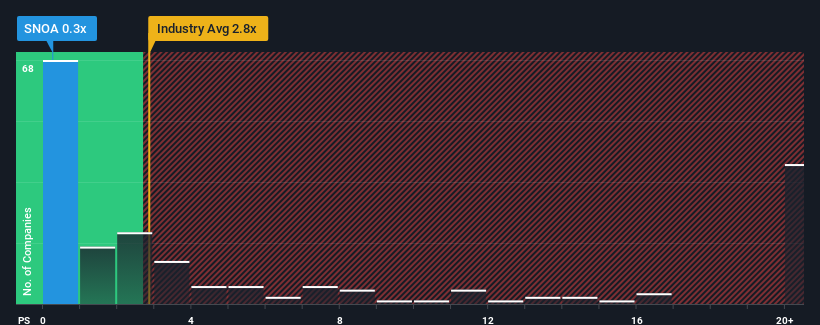

You may think that with a price-to-sales (or "P/S") ratio of 0.3x Sonoma Pharmaceuticals, Inc. (NASDAQ:SNOA) is definitely a stock worth checking out, seeing as almost half of all the Pharmaceuticals companies in the United States have P/S ratios greater than 2.8x and even P/S above 13x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

Check out our latest analysis for Sonoma Pharmaceuticals

What Does Sonoma Pharmaceuticals' Recent Performance Look Like?

While the industry has experienced revenue growth lately, Sonoma Pharmaceuticals' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Sonoma Pharmaceuticals.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Sonoma Pharmaceuticals would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 2.0% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 41% in aggregate. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Looking ahead now, revenue is anticipated to climb by 39% during the coming year according to the only analyst following the company. With the industry only predicted to deliver 17%, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Sonoma Pharmaceuticals' P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

The Bottom Line On Sonoma Pharmaceuticals' P/S

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Sonoma Pharmaceuticals' analyst forecasts revealed that its superior revenue outlook isn't contributing to its P/S anywhere near as much as we would have predicted. When we see strong growth forecasts like this, we can only assume potential risks are what might be placing significant pressure on the P/S ratio. At least price risks look to be very low, but investors seem to think future revenues could see a lot of volatility.

There are also other vital risk factors to consider and we've discovered 4 warning signs for Sonoma Pharmaceuticals (3 are potentially serious!) that you should be aware of before investing here.

If you're unsure about the strength of Sonoma Pharmaceuticals' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:SNOA

Sonoma Pharmaceuticals

Develops and produces stabilized hypochlorous acid (HOCl) products for wound care, animal health care, eye and nasal care, oral care, and dermatological conditions in the United States, Europe, Asia, Latin America, and internationally.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives