- United States

- /

- Biotech

- /

- NasdaqCM:SLNO

Exploring US High Growth Tech Stocks In March 2025

Reviewed by Simply Wall St

Over the last 7 days, the United States market has experienced a slight decline of 1.3%, yet it has shown resilience with a 15% increase over the past year and earnings forecast to grow by 14% annually. In this dynamic environment, identifying high growth tech stocks involves looking for companies that demonstrate strong innovation potential and adaptability to sustain growth amidst fluctuating market conditions.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.26% | 29.10% | ★★★★★★ |

| AsiaFIN Holdings | 51.75% | 82.69% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Alkami Technology | 20.94% | 85.17% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.90% | 58.64% | ★★★★★★ |

| Zai Lab | 28.84% | 67.49% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 236 stocks from our US High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Soleno Therapeutics (NasdaqCM:SLNO)

Simply Wall St Growth Rating: ★★★★★☆

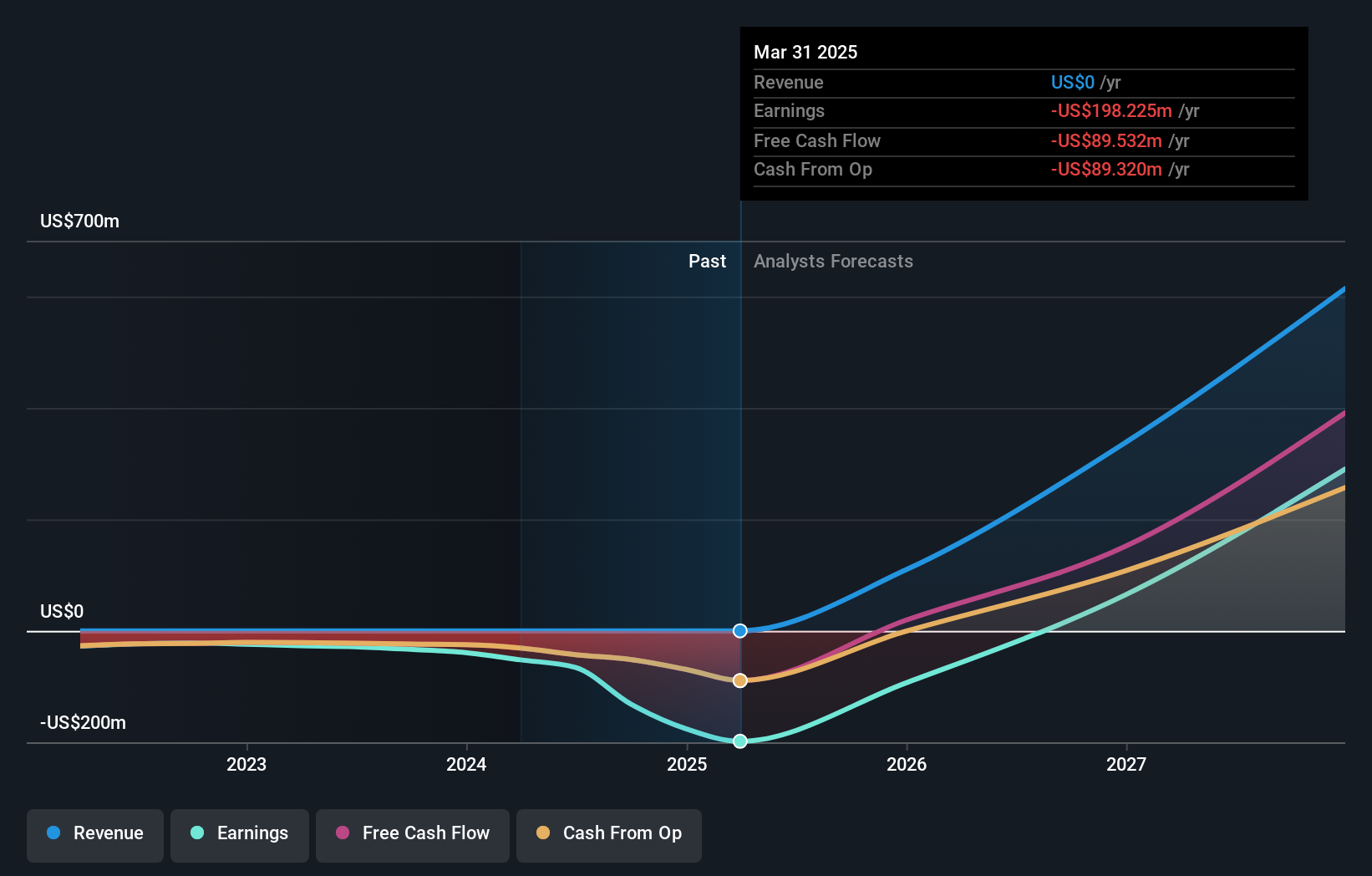

Overview: Soleno Therapeutics, Inc. is a clinical-stage biopharmaceutical company dedicated to developing and commercializing innovative treatments for rare diseases, with a market cap of $2.23 billion.

Operations: Soleno Therapeutics focuses on developing and commercializing novel therapeutics for rare diseases. As a clinical-stage biopharmaceutical company, it is currently not generating revenue from its operations.

Soleno Therapeutics, despite its recent financial challenges marked by a net loss of $175.85 million for the year, remains a focal point in biotech due to its aggressive R&D initiatives and anticipated revenue growth. The company's strategic maneuvers, including a significant shelf registration of $82.25 million and securing a $200 million loan for advancing Prader-Willi syndrome treatments, underscore its commitment to innovation and market expansion. With an expected annual revenue increase of 49.4%, Soleno is positioning itself strategically within the high-growth biotech sector, aiming to leverage R&D breakthroughs into commercial success in the coming years.

Ascendis Pharma (NasdaqGS:ASND)

Simply Wall St Growth Rating: ★★★★★☆

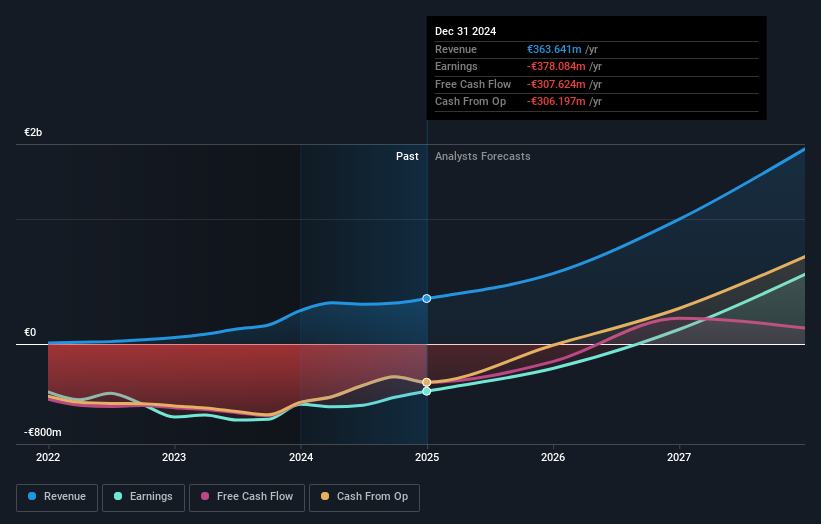

Overview: Ascendis Pharma A/S is a biopharmaceutical company that develops TransCon-based therapies for unmet medical needs across Denmark, Europe, North America, and internationally, with a market cap of $9.37 billion.

Operations: Ascendis Pharma generates revenue primarily from its biotechnology segment, amounting to €363.64 million. The company's focus is on developing therapies using its proprietary TransCon technology platform.

Ascendis Pharma has demonstrated resilience and strategic foresight in the high-growth biotech landscape, marked by a notable 32.5% annual revenue growth and a reduction in net loss from EUR 481.45 million to EUR 378.08 million year-over-year. The company's recent shelf registration of $108 million underscores its proactive approach to funding future innovations, while its R&D commitment is evident from the substantial advancements in its TransCon technology platforms, promising enhanced treatment efficacy across multiple therapeutic areas. Moreover, Ascendis' recent share repurchase program highlights confidence in its financial health and future prospects, positioning it as a dynamic player amidst challenging market conditions and ongoing patent disputes with competitors like BioMarin.

ServiceNow (NYSE:NOW)

Simply Wall St Growth Rating: ★★★★★☆

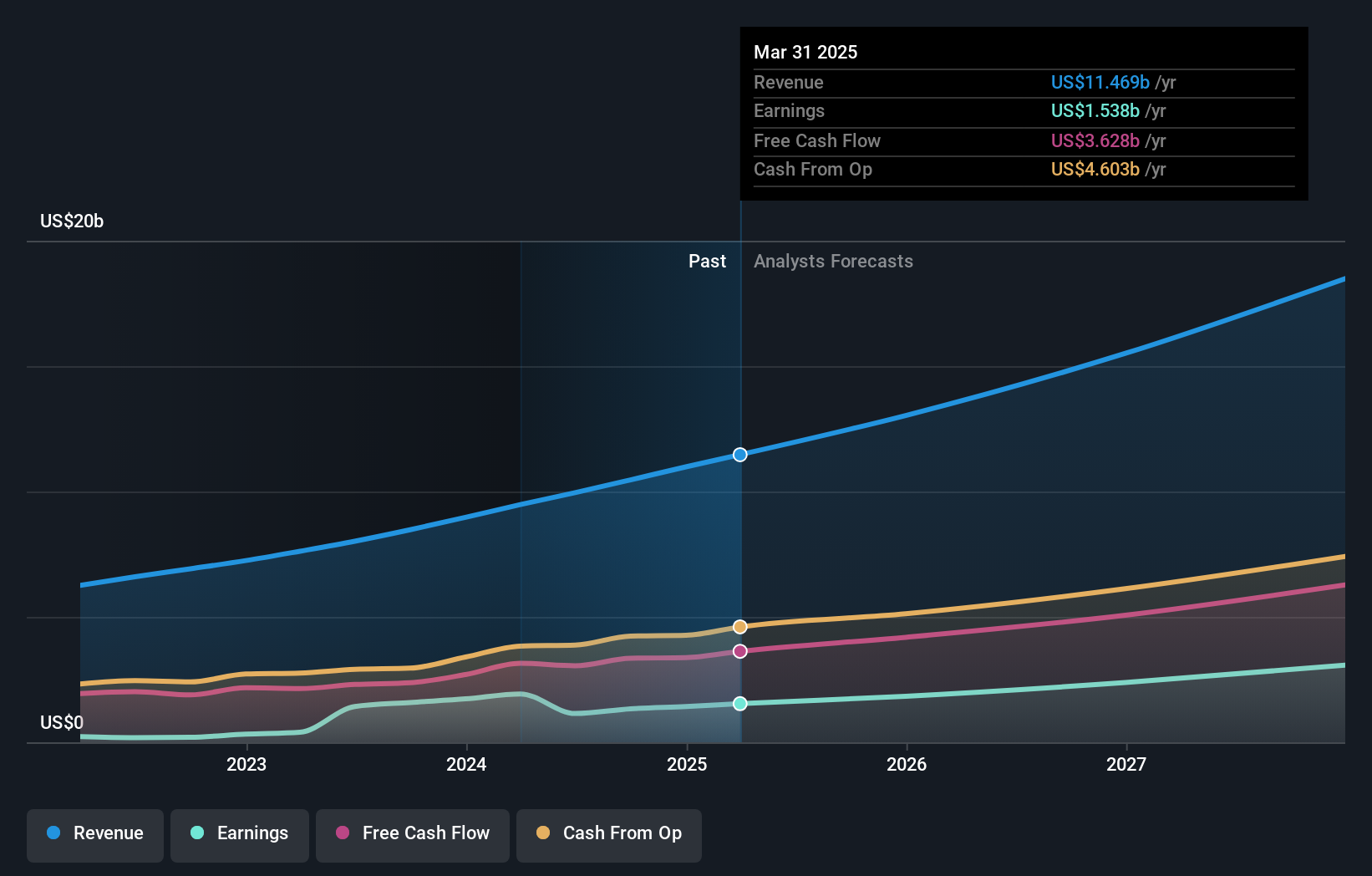

Overview: ServiceNow, Inc. offers cloud-based solutions for digital workflows across various regions globally and has a market capitalization of $191.53 billion.

Operations: The company generates revenue primarily from its Internet Software & Services segment, amounting to $10.98 billion.

ServiceNow, a leader in digital workflow solutions, is capitalizing on the AI-driven transformation across industries. With a robust 15.2% annual revenue growth and an impressive 20.6% forecast in earnings growth, the company is setting benchmarks in integrating AI to enhance operational efficiencies. Recently, ServiceNow introduced AI agents for telecoms, developed with NVIDIA's cutting-edge technology, aimed at automating complex customer service and network operations workflows. This innovation not only underscores ServiceNow's commitment to R&D (spending significant portions of its $10.98 billion revenue on these initiatives) but also positions it strategically within a sector poised for substantial growth due to AI adoption.

- Click to explore a detailed breakdown of our findings in ServiceNow's health report.

Assess ServiceNow's past performance with our detailed historical performance reports.

Where To Now?

- Investigate our full lineup of 236 US High Growth Tech and AI Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Soleno Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:SLNO

Soleno Therapeutics

A clinical-stage biopharmaceutical company, focuses on the development and commercialization of novel therapeutics for the treatment of rare diseases.

High growth potential and good value.

Market Insights

Community Narratives