- United States

- /

- Pharma

- /

- NasdaqGM:SIGA

Can SIGA Technologies’ (SIGA) High ROE and Reinvestment Strategy Transform Its Growth Trajectory?

Reviewed by Sasha Jovanovic

- In recent months, SIGA Technologies reported strong financial performance, highlighted by a return on equity that significantly outpaces the industry average, drawing industry attention.

- A unique aspect fueling optimism is the company’s effective reinvestment approach, which analysts believe could accelerate its earnings growth even further.

- We’ll now explore how SIGA Technologies’ robust return on equity may shape its investment narrative going forward.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is SIGA Technologies' Investment Narrative?

For shareholders of SIGA Technologies, the core belief centers around the company’s potential to translate strong operating momentum into future value. The recent surge in SIGA’s stock, up over 22% in three months, reflects renewed confidence driven by a standout return on equity and earnings acceleration. This momentum has the potential to reinforce existing short-term catalysts, such as new global sales of TPOXX, forward-looking guidance on revenue growth, and continued dividend payouts, areas where SIGA’s recent news appears to add weight. However, it also mildly reduces the significance of previous short-term uncertainties, including clinical trial setbacks or quarterly earnings volatility. The most material risk that remains is revenue concentration, especially given reliance on major government contracts. The evolving story is less about the old risks shifting out of view, and more about which catalysts investors now consider most important in light of the latest performance and optimism.

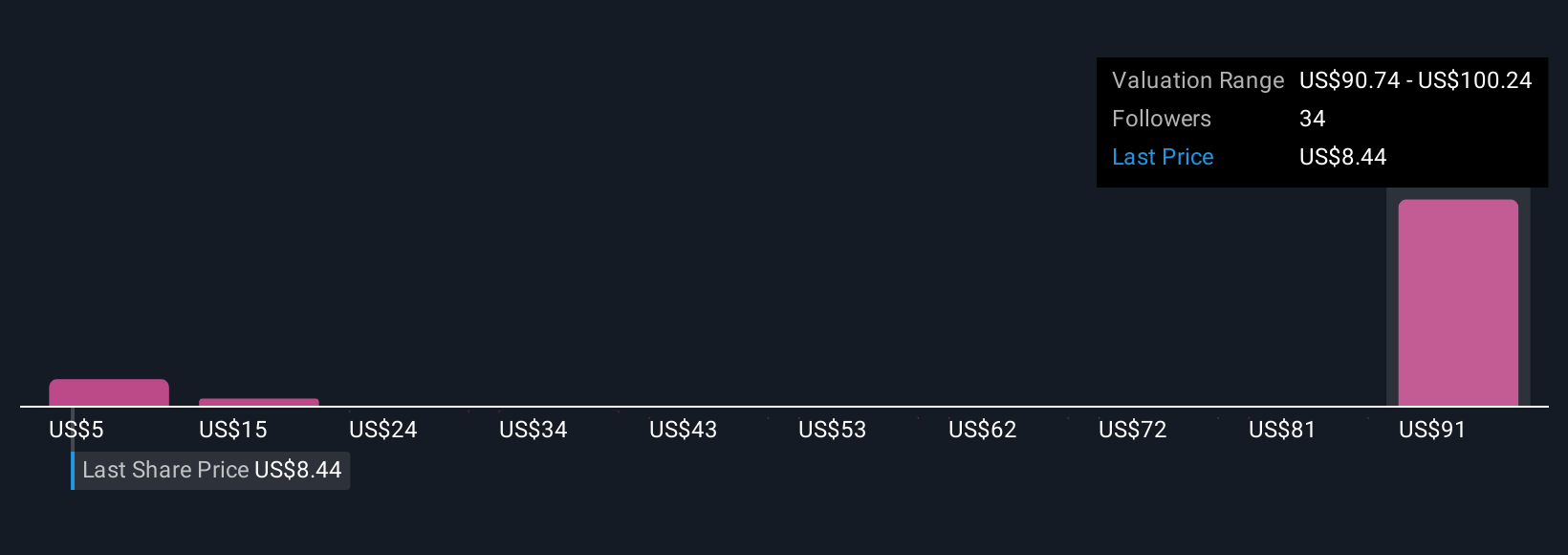

In contrast, investors should look closely at SIGA’s customer concentration risk. Despite retreating, SIGA Technologies' shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore 12 other fair value estimates on SIGA Technologies - why the stock might be a potential multi-bagger!

Build Your Own SIGA Technologies Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your SIGA Technologies research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free SIGA Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate SIGA Technologies' overall financial health at a glance.

Want Some Alternatives?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:SIGA

SIGA Technologies

A commercial-stage pharmaceutical company, focuses on the health security market in the United States.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives