- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

The Price Is Right For Sotera Health Company (NASDAQ:SHC) Even After Diving 29%

Sotera Health Company (NASDAQ:SHC) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 34% in that time.

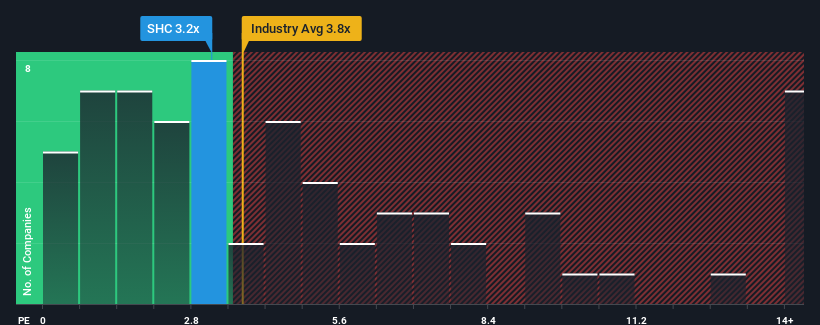

Although its price has dipped substantially, it's still not a stretch to say that Sotera Health's price-to-sales (or "P/S") ratio of 3.2x right now seems quite "middle-of-the-road" compared to the Life Sciences industry in the United States, where the median P/S ratio is around 3.8x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Sotera Health

What Does Sotera Health's Recent Performance Look Like?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Sotera Health has been doing quite well of late. It might be that many expect the strong revenue performance to deteriorate like the rest, which has kept the P/S ratio from rising. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

Keen to find out how analysts think Sotera Health's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The P/S Ratio?

The only time you'd be comfortable seeing a P/S like Sotera Health's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a worthy increase of 4.5%. The solid recent performance means it was also able to grow revenue by 28% in total over the last three years. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 6.3% each year over the next three years. That's shaping up to be similar to the 6.5% per year growth forecast for the broader industry.

In light of this, it's understandable that Sotera Health's P/S sits in line with the majority of other companies. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

What Does Sotera Health's P/S Mean For Investors?

Following Sotera Health's share price tumble, its P/S is just clinging on to the industry median P/S. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've seen that Sotera Health maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. Unless these conditions change, they will continue to support the share price at these levels.

It is also worth noting that we have found 3 warning signs for Sotera Health (1 is potentially serious!) that you need to take into consideration.

If you're unsure about the strength of Sotera Health's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives