- United States

- /

- Life Sciences

- /

- NasdaqGS:SHC

Sotera Health Company Just Missed Earnings - But Analysts Have Updated Their Models

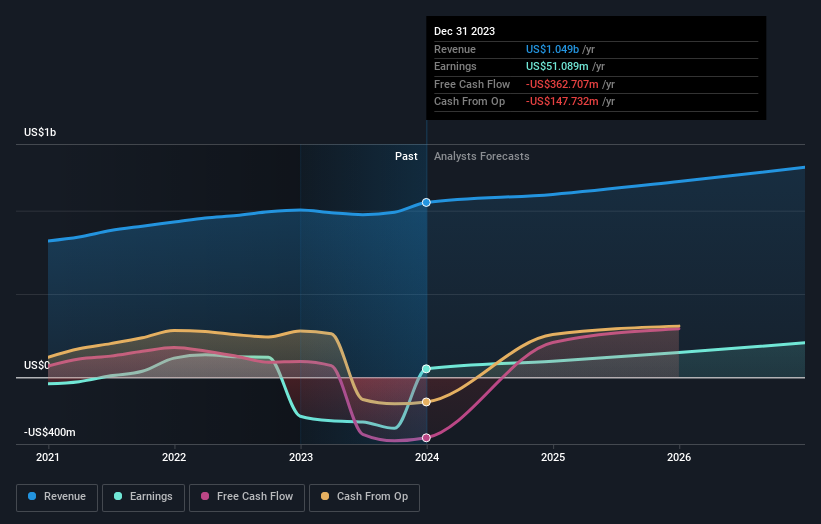

Sotera Health Company (NASDAQ:SHC) shareholders are probably feeling a little disappointed, since its shares fell 9.6% to US$15.01 in the week after its latest yearly results. It was not a great result overall. While revenues of US$1.0b were in line with analyst predictions, earnings were less than expected, missing statutory estimates by 17% to hit US$0.18 per share. This is an important time for investors, as they can track a company's performance in its report, look at what experts are forecasting for next year, and see if there has been any change to expectations for the business. So we gathered the latest post-earnings forecasts to see what estimates suggest is in store for next year.

View our latest analysis for Sotera Health

Taking into account the latest results, the current consensus from Sotera Health's six analysts is for revenues of US$1.10b in 2024. This would reflect a reasonable 4.6% increase on its revenue over the past 12 months. Statutory earnings per share are predicted to leap 89% to US$0.34. In the lead-up to this report, the analysts had been modelling revenues of US$1.10b and earnings per share (EPS) of US$0.52 in 2024. The analysts seem to have become more bearish following the latest results. While there were no changes to revenue forecasts, there was a pretty serious reduction to EPS estimates.

Althoughthe analysts have revised their earnings forecasts for next year, they've also lifted the consensus price target 5.9% to US$17.83, suggesting the revised estimates are not indicative of a weaker long-term future for the business. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. The most optimistic Sotera Health analyst has a price target of US$20.00 per share, while the most pessimistic values it at US$15.00. Still, with such a tight range of estimates, it suggeststhe analysts have a pretty good idea of what they think the company is worth.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the Sotera Health's past performance and to peers in the same industry. We would highlight that Sotera Health's revenue growth is expected to slow, with the forecast 4.6% annualised growth rate until the end of 2024 being well below the historical 7.4% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 6.1% per year. So it's pretty clear that, while revenue growth is expected to slow down, the wider industry is also expected to grow faster than Sotera Health.

The Bottom Line

The biggest concern is that the analysts reduced their earnings per share estimates, suggesting business headwinds could lay ahead for Sotera Health. Fortunately, the analysts also reconfirmed their revenue estimates, suggesting that it's tracking in line with expectations. Although our data does suggest that Sotera Health's revenue is expected to perform worse than the wider industry. There was also a nice increase in the price target, with the analysts clearly feeling that the intrinsic value of the business is improving.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At Simply Wall St, we have a full range of analyst estimates for Sotera Health going out to 2026, and you can see them free on our platform here..

Plus, you should also learn about the 2 warning signs we've spotted with Sotera Health (including 1 which can't be ignored) .

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SHC

Sotera Health

Provides sterilization, lab testing, and advisory services for the healthcare industry in the United States, Canada, Europe, and internationally.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives