- United States

- /

- Life Sciences

- /

- NasdaqGS:SEER

US Penny Stocks: 3 Picks With Market Caps As Low As $70M

Reviewed by Simply Wall St

The U.S. stock market has recently experienced a pullback after record highs in the S&P 500, reflecting ongoing volatility amid mixed corporate earnings and economic policy shifts. Penny stocks, though considered an older term, still hold significant potential for investors looking to explore opportunities in smaller or newer companies. These stocks can offer a blend of affordability and growth potential when they exhibit strong financials, making them intriguing options for those seeking to uncover hidden gems in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $130.85M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.82 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.45 | $47.85M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.2601 | $9.93M | ★★★★★★ |

| PHX Minerals (NYSE:PHX) | $4.18 | $153.67M | ★★★★★☆ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.40 | $25.9M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.889 | $80.05M | ★★★★★☆ |

| BAB (OTCPK:BABB) | $0.86825 | $6.26M | ★★★★★☆ |

| Lifetime Brands (NasdaqGS:LCUT) | $5.00 | $114.11M | ★★★★★☆ |

Click here to see the full list of 708 stocks from our US Penny Stocks screener.

Let's dive into some prime choices out of the screener.

WM Technology (NasdaqGS:MAPS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: WM Technology, Inc. offers ecommerce and compliance software solutions for retailers and brands in the cannabis market both in the United States and internationally, with a market cap of approximately $231.21 million.

Operations: The company's revenue is primarily generated from its Software & Programming segment, amounting to $183.31 million.

Market Cap: $231.21M

WM Technology, Inc., with a market cap of US$231.21 million, is notable for its ecommerce and compliance software in the cannabis sector. Despite being unprofitable, it has no debt and maintains a cash runway exceeding three years. Recent executive changes include appointing Sarah Griffis as CTO to bolster technological leadership. A proposed acquisition by Douglas Francis and Justin Hartfield aims to buy the remaining 68% of shares they don't own for US$240 million. However, legal challenges persist due to past SEC charges related to misreporting monthly active users, impacting investor sentiment.

- Take a closer look at WM Technology's potential here in our financial health report.

- Understand WM Technology's earnings outlook by examining our growth report.

Seer (NasdaqGS:SEER)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Seer, Inc. is a life sciences company focused on developing and commercializing products to decode the biology of the proteome, with a market cap of approximately $135.62 million.

Operations: The company generates revenue primarily from its Biotechnology (Startups) segment, which accounts for $14.61 million.

Market Cap: $135.62M

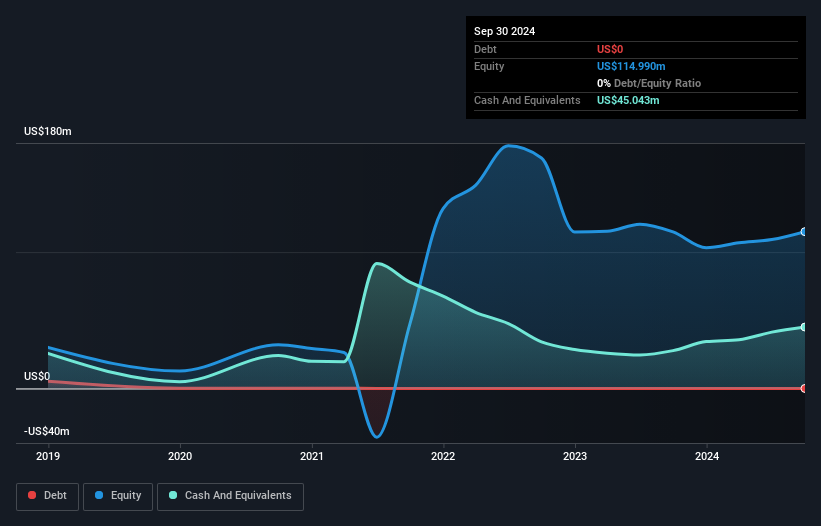

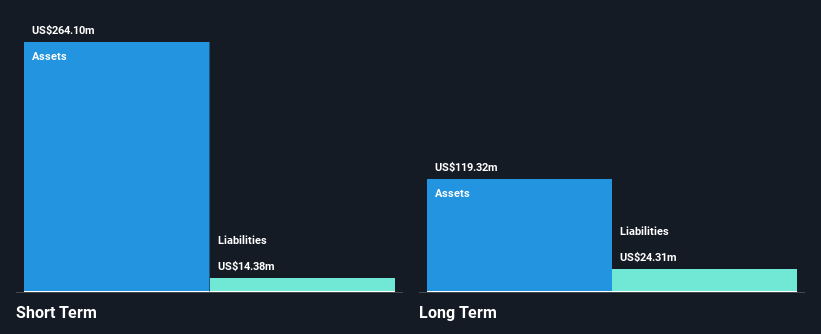

Seer, Inc., with a market cap of US$135.62 million, focuses on proteomics in the life sciences sector. Despite being unprofitable and having increased losses over the past five years, it is debt-free and maintains a stable weekly volatility of 5%. The company forecasts revenue growth of 31.92% annually but remains unprofitable for at least the next three years. Seer's board and management teams are experienced, with average tenures of seven and 3.7 years respectively. Its short-term assets exceed both short-term and long-term liabilities significantly, ensuring a cash runway exceeding three years without shareholder dilution last year.

- Dive into the specifics of Seer here with our thorough balance sheet health report.

- Examine Seer's earnings growth report to understand how analysts expect it to perform.

Xtant Medical Holdings (NYSEAM:XTNT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Xtant Medical Holdings, Inc. specializes in regenerative medicine products and medical devices for orthopedic and neurological surgeons, with a market cap of $78.62 million.

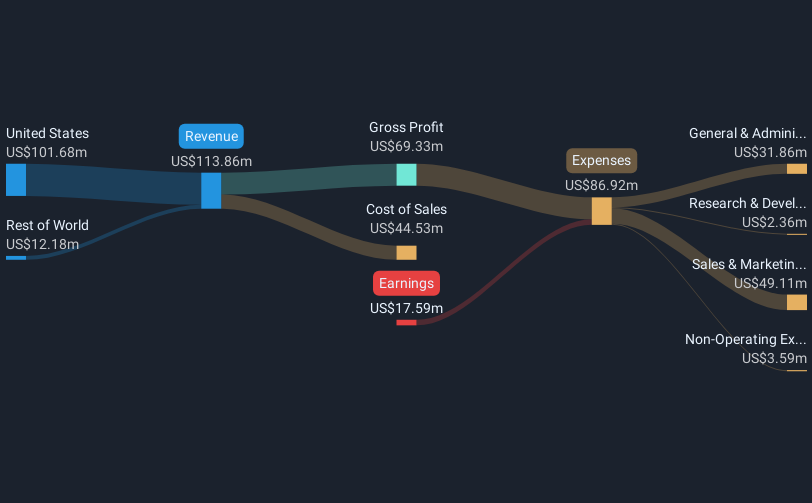

Operations: Xtant Medical Holdings generates $113.86 million in revenue from the development, manufacture, and marketing of orthopedic medical products and devices.

Market Cap: $78.62M

Xtant Medical Holdings, with a market cap of US$78.62 million, focuses on orthopedic and neurological products. Although currently unprofitable, it has reduced losses by 35.2% annually over the past five years. The company's net debt to equity ratio is high at 61.6%, but short-term assets of US$71.4 million cover both short-term and long-term liabilities comfortably. Xtant's cash runway is less than a year based on current free cash flow trends; however, earnings are forecast to grow significantly at 93.09% per year. Its management team and board are experienced with average tenures exceeding four years without recent shareholder dilution.

- Jump into the full analysis health report here for a deeper understanding of Xtant Medical Holdings.

- Evaluate Xtant Medical Holdings' prospects by accessing our earnings growth report.

Make It Happen

- Take a closer look at our US Penny Stocks list of 708 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:SEER

Seer

A life sciences company, engages in developing and commercializing products to decode the biology of the proteome.

Flawless balance sheet with limited growth.

Similar Companies

Market Insights

Community Narratives