- United States

- /

- Pharma

- /

- NasdaqGS:SCPH

Market Cool On scPharmaceuticals Inc.'s (NASDAQ:SCPH) Revenues Pushing Shares 30% Lower

scPharmaceuticals Inc. (NASDAQ:SCPH) shareholders that were waiting for something to happen have been dealt a blow with a 30% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 55% share price decline.

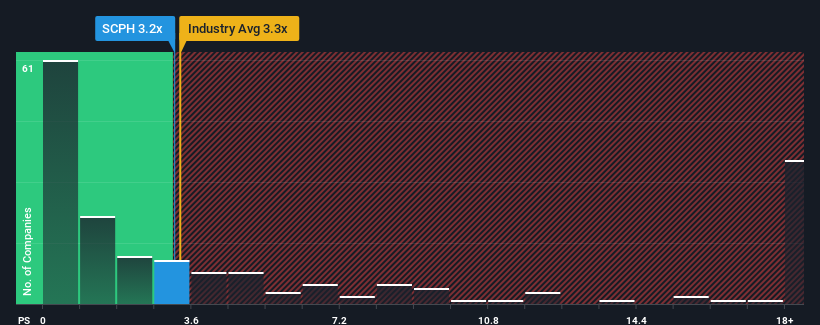

Even after such a large drop in price, there still wouldn't be many who think scPharmaceuticals' price-to-sales (or "P/S") ratio of 3.2x is worth a mention when the median P/S in the United States' Pharmaceuticals industry is similar at about 3.3x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for scPharmaceuticals

How Has scPharmaceuticals Performed Recently?

scPharmaceuticals certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on scPharmaceuticals .What Are Revenue Growth Metrics Telling Us About The P/S?

scPharmaceuticals' P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company grew revenue by an impressive 167% last year. Still, revenue has barely risen at all from three years ago in total, which is not ideal. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Shifting to the future, estimates from the six analysts covering the company suggest revenue should grow by 77% each year over the next three years. With the industry only predicted to deliver 20% per annum, the company is positioned for a stronger revenue result.

In light of this, it's curious that scPharmaceuticals' P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Key Takeaway

Following scPharmaceuticals' share price tumble, its P/S is just clinging on to the industry median P/S. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Despite enticing revenue growth figures that outpace the industry, scPharmaceuticals' P/S isn't quite what we'd expect. Perhaps uncertainty in the revenue forecasts are what's keeping the P/S ratio consistent with the rest of the industry. It appears some are indeed anticipating revenue instability, because these conditions should normally provide a boost to the share price.

Plus, you should also learn about this 1 warning sign we've spotted with scPharmaceuticals .

If these risks are making you reconsider your opinion on scPharmaceuticals, explore our interactive list of high quality stocks to get an idea of what else is out there.

If you're looking to trade scPharmaceuticals, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:SCPH

scPharmaceuticals

A pharmaceutical company, engages in the development and commercialization of various pharmaceutical products.

High growth potential with adequate balance sheet.

Market Insights

Community Narratives