- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

What You Need To Know About The Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) Analyst Downgrade Today

The analysts covering Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) delivered a dose of negativity to shareholders today, by making a substantial revision to their statutory forecasts for this year. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative. Surprisingly the share price has been buoyant, rising 17% to US$5.60 in the past 7 days. It will be interesting to see if the downgrade has an impact on buying demand for the company's shares.

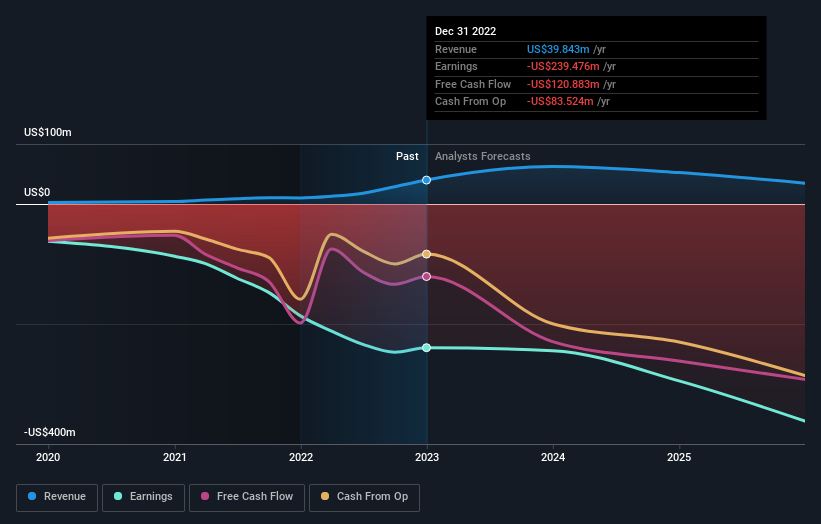

Following the downgrade, the latest consensus from Recursion Pharmaceuticals' seven analysts is for revenues of US$56m in 2023, which would reflect a huge 40% improvement in sales compared to the last 12 months. Losses are expected to increase slightly, to US$1.35 per share. Yet before this consensus update, the analysts had been forecasting revenues of US$63m and losses of US$1.32 per share in 2023. So there's definitely been a change in sentiment in this update, with the analysts administering a substantial haircut to this year's revenue estimates, while at the same time holding losses per share steady.

View our latest analysis for Recursion Pharmaceuticals

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. It's pretty clear that there is an expectation that Recursion Pharmaceuticals' revenue growth will slow down substantially, with revenues to the end of 2023 expected to display 57% growth on an annualised basis. This is compared to a historical growth rate of 78% over the past three years. Juxtapose this against the other companies in the industry with analyst coverage, which are forecast to grow their revenues (in aggregate) 17% per year. Even after the forecast slowdown in growth, it seems obvious that Recursion Pharmaceuticals is also expected to grow faster than the wider industry.

The Bottom Line

Unfortunately, analysts also downgraded their revenue estimates, although our data indicates revenues are expected to perform better than the wider market. Often, one downgrade can set off a daisy-chain of cuts, especially if an industry is in decline. So we wouldn't be surprised if the market became a lot more cautious on Recursion Pharmaceuticals after today.

After a downgrade like this, it's pretty clear that previous forecasts were too optimistic. What's more, we've spotted several possible issues with Recursion Pharmaceuticals' business, like dilutive stock issuance over the past year. For more information, you can click here to discover this and the 3 other warning signs we've identified.

Another way to search for interesting companies that could be reaching an inflection point is to track whether management are buying or selling, with our free list of growing companies that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery.

Excellent balance sheet slight.