- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX): Valuation Update Following Insider Sales and Widened Quarterly Losses

Reviewed by Simply Wall St

Recursion Pharmaceuticals (RXRX) has been turning heads lately after its stock dropped for a third consecutive day. The move followed news that several top executives, including the CEO, CFO, and chief research and development officer, sold company shares in mid-August. This step was taken to cover tax withholding requirements. Alongside news of a much wider net loss in the recent quarter, investors are now faced with questions about what these insider actions signal for the path forward.

This wave of selling by company insiders comes as Recursion Pharmaceuticals reported significant revenue growth over the year, but also posted a net loss that more than doubled compared to last year. The stock has had a rough time in 2024, falling 37% over the past year. It did see a 13% rebound in the past three months before the latest downturn. With momentum looking choppy and the market still digesting the second-quarter numbers, the price remains well below recent highs.

All eyes are now on whether the market’s negative reaction has created an attractive entry point, or if the challenges ahead are already reflected in the stock price. What do you think?

Most Popular Narrative: 24% Undervalued

Recursion Pharmaceuticals is currently viewed as significantly undervalued according to community narrative, with a fair value pegged above the latest share price.

"Increasing digitization and utilization of large, proprietary, multimodal biological and patient datasets (e.g., phenomaps, multi-omic data) enables Recursion to strengthen its competitive position and become more attractive to big pharma partners. This supports potential growth in collaboration revenue and gross profit."

Curious what’s powering this bullish forecast? The full narrative reveals bold assumptions about Recursion’s growth. This story hinges on ambitious projections for future revenue, profit margins, and industry-leading innovation. Find out what makes analysts believe the company deserves a premium valuation, as well as which outsized expectations could redefine its place in biotech.

Result: Fair Value of $6.5 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, if pharma collaborations underdeliver or key drug programs face delays, the current bullish outlook on Recursion's valuation could quickly unravel.

Find out about the key risks to this Recursion Pharmaceuticals narrative.Another View: Pricing Metric Raises Questions

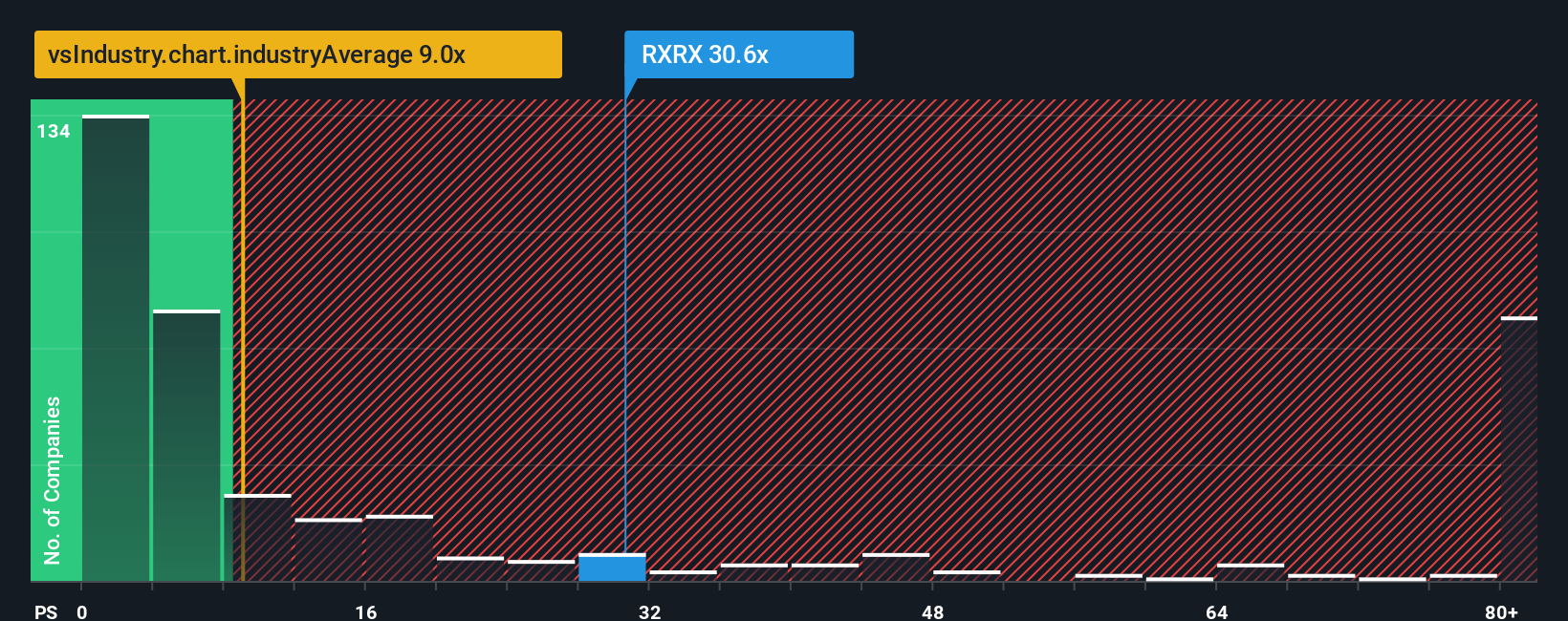

While the community points to undervaluation, looking at the company using a typical valuation method paints a different picture. Recursion's price-to-sales ratio is significantly higher than the industry average, which challenges the idea that shares are inexpensive. Which story will play out over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Recursion Pharmaceuticals Narrative

If you see things differently or want to dig into the data your own way, it takes less than three minutes to build your own narrative. do it your way.

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for More Winning Investment Ideas?

Smart investors keep their portfolios fresh with opportunities others miss. Give yourself an edge with innovative growth themes, reliable dividend picks, and tomorrow’s tech pioneers. Open the door to unique stocks you may not have considered. Your next game-changing move could be one click away.

- Capture reliable income streams when you start tracking dividend stocks with yields > 3%. This selection features companies delivering strong yields that help cushion market swings.

- Get in front of healthcare’s revolutionary shift and explore the most promising breakthroughs with healthcare AI stocks to find leaders driving advancements in medical AI.

- Spot opportunities in tomorrow’s technology race and search for hidden gems powered by artificial intelligence using AI penny stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives