- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (RXRX): How Recent Drug Development Moves and Investor Outreach Shape Valuation

Reviewed by Simply Wall St

Recursion Pharmaceuticals (RXRX) just made a $12.5 million equity payment to Rallybio in a move that caught the eye of many investors. This payment, designed to accelerate the development of the investigational ENPP1 inhibitor REV102 for hypophosphatasia, signals ongoing forward motion in their clinical pipeline. The company is also set to participate in two major investor conferences and just wrapped up a significant meeting organized by Needham. There is a lot happening in terms of both scientific progress and investor outreach.

These latest events arrive at a point when Recursion Pharmaceuticals’ stock has seen a mixed run. After a modest 6.5% jump on positive FDA news and key drug updates earlier in the year, the stock’s momentum has faded. Over the past month, RXRX is down 16%, underscoring that risk perception remains elevated. For the year, shares are off nearly 27%, and the three-year record shows a 54% decline. The company’s annual revenue has climbed 42% and it reports a strong balance sheet with ongoing R&D investments, even as profitability remains negative.

With so much action both in the lab and in the markets, is RXRX shaping up to be an undervalued play, or has the market already priced in its future breakthroughs and risks?

Most Popular Narrative: 25% Undervalued

According to the most widely followed narrative, Recursion Pharmaceuticals is undervalued by over 25% compared to its calculated fair value, driven by ambitious expectations for future growth and technology-powered transformation.

“Rapid integration and iterative improvement of the Recursion OS 2.0 platform, incorporating advanced AI and ML tools (such as Boltz-2 and causal AI for clinical trial design), are expected to drive faster, more cost-effective drug discovery and development, improving R&D efficiency and supporting long-term margin expansion.”

Curious about the bold assumptions fueling this discounted valuation? Behind the scenes, there is a dramatic leap in projected sales, an ambitious turnaround in margins, and a sky-high future profit multiple that is rarely seen in biotech. Want a peek at the growth math pushing analyst targets above today’s price? Find out how this narrative connects AI breakthroughs and massive future revenues into one strikingly optimistic fair value.

Result: Fair Value of $6.47 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent cash burn and delays across the early-stage pipeline could quickly challenge the bullish outlook that is driving current analyst targets.

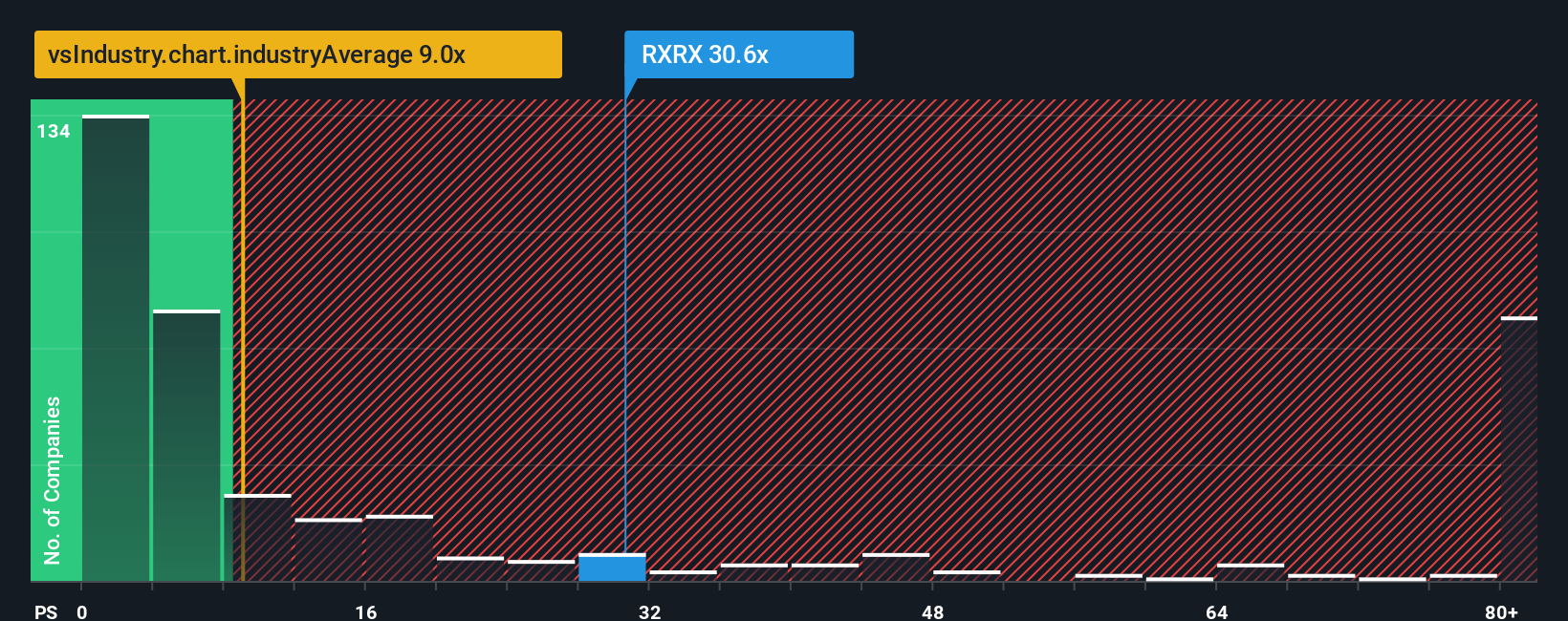

Find out about the key risks to this Recursion Pharmaceuticals narrative.Another View: Price Ratios Tell a Different Story

While some see Recursion as undervalued based on its future growth, a look at its price-to-sales ratio compared to the industry average suggests the stock may actually be expensive. Could the market be right after all?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Recursion Pharmaceuticals Narrative

If you have a different perspective or want to dig into the numbers yourself, you can craft your own assessment in just a few minutes. Do it your way.

A great starting point for your Recursion Pharmaceuticals research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Opportunities?

Don't just stop here. Step up your investment game by checking out other promising stocks using specialized screeners below. Miss these ideas and you might just miss your next big winner.

- Uncover the potential in companies using advanced algorithms to transform diagnostics and care by taking a look at healthcare AI stocks.

- Tap into stocks with high yields that reward your portfolio with steady returns, all through our dividend stocks with yields > 3%.

- Catch promising bargains among undervalued businesses ready to grow stronger, revealed by the undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026