- United States

- /

- Biotech

- /

- NasdaqGS:RXRX

Recursion Pharmaceuticals (NasdaqGS:RXRX) Reports Q1 Sales Increase and REC-4881 Trial Results

Reviewed by Simply Wall St

Recursion Pharmaceuticals (NasdaqGS:RXRX) has demonstrated resilience amid recent financial challenges, with the stock experiencing a 34% increase over the last month. This notable price movement may reflect the market's positive reception to promising developments in their Phase 1b/2 TUPELO trial for REC-4881, despite reporting a significant net loss increase. The trial results showing a 43% reduction in polyp burden for FAP and regulatory recognition of REC-4881 highlight the company's focus on addressing rare diseases. While broader market trends remained largely stable, Recursion's performance illustrates its potential appeal to investors amidst a mixed company earnings landscape.

The recent innovations from Recursion Pharmaceuticals, particularly the positive Phase 1b/2 TUPELO trial results, have generated market enthusiasm, propelling a significant short-term share price increase. However, over a longer time frame of three years, the company's total return, including share price and dividends, was 2.52%, highlighting a modest performance amidst a challenging biotechnology landscape. Compared to the broader U.S. Biotechs industry, Recursion's shares underperformed, as the industry saw a decline of 6.9% in the past year, showcasing Recursion's relative resilience despite its financial setbacks.

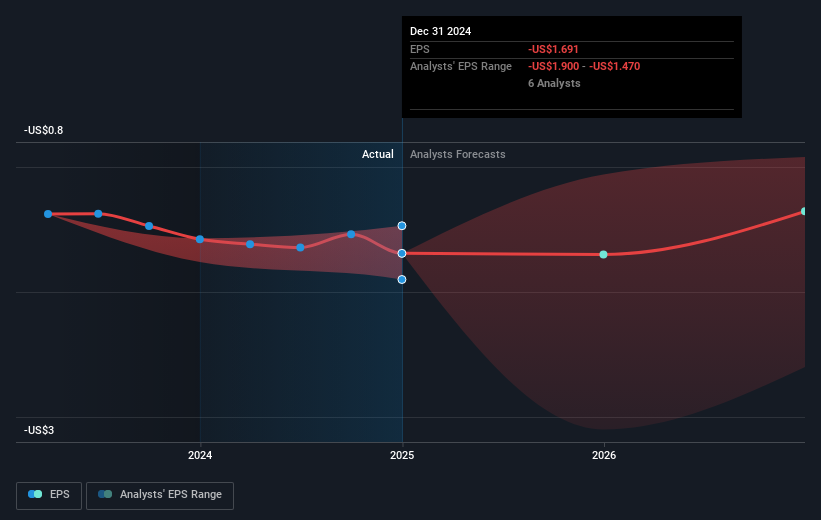

The market's response to the trial outcomes suggests potential upside for the company's future revenue and earnings forecasts, driven by increased investor confidence in its drug discovery pipeline. These strong trial results could bolster Recursion's revenue projections, supporting the assumption of a projected annual growth rate of 37.9%. However, despite this optimism, the firm remains unprofitable with earnings forecasted to decline by an average of 2.2% per year over the next three years.

Currently trading at US$5.72, Recursion's share price remains below the consensus analyst price target of US$8.71, indicating a potential 34.4% upside. Yet, given the complicated projections involving a high price-to-earnings ratio of 124.1x by 2028, it's crucial for investors to appraise the assumptions underlying the analyses. The sensitivity of these projections to clinical outcomes, partnerships, and technological advancements underscores the nuanced dynamics at play in evaluating the company's future performance.

Gain insights into Recursion Pharmaceuticals' future direction by reviewing our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RXRX

Recursion Pharmaceuticals

Operates as a clinical-stage biotechnology company, engages in the decoding biology and chemistry by integrating technological innovations across biology, chemistry, automation, data science, and engineering to industrialize drug discovery in the United States.

Flawless balance sheet slight.

Similar Companies

Market Insights

Community Narratives