- United States

- /

- Biotech

- /

- NasdaqGS:RPTX

We Think Repare Therapeutics (NASDAQ:RPTX) Can Easily Afford To Drive Business Growth

Just because a business does not make any money, does not mean that the stock will go down. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

Given this risk, we thought we'd take a look at whether Repare Therapeutics (NASDAQ:RPTX) shareholders should be worried about its cash burn. In this article, we define cash burn as its annual (negative) free cash flow, which is the amount of money a company spends each year to fund its growth. The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for Repare Therapeutics

How Long Is Repare Therapeutics' Cash Runway?

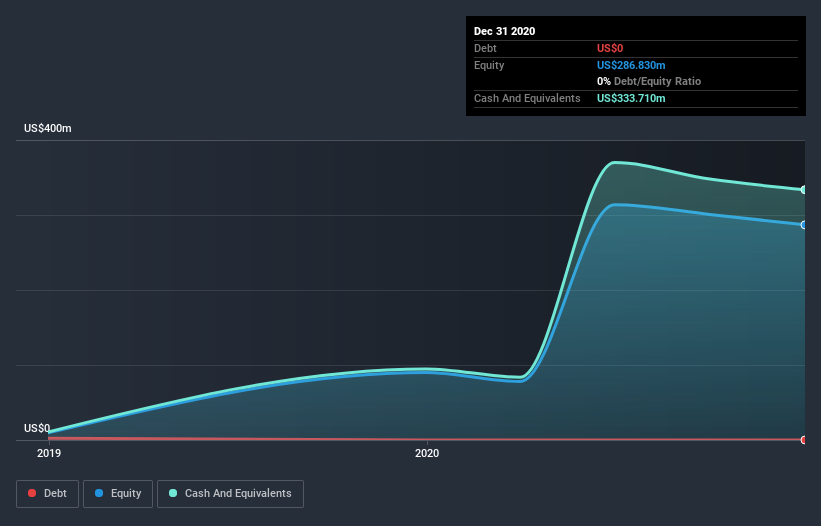

A cash runway is defined as the length of time it would take a company to run out of money if it kept spending at its current rate of cash burn. As at December 2020, Repare Therapeutics had cash of US$334m and no debt. Importantly, its cash burn was US$8.3m over the trailing twelve months. So it had a very long cash runway of many years from December 2020. Even though this is but one measure of the company's cash burn, the thought of such a long cash runway warms our bellies in a comforting way. You can see how its cash balance has changed over time in the image below.

How Is Repare Therapeutics' Cash Burn Changing Over Time?

Whilst it's great to see that Repare Therapeutics has already begun generating revenue from operations, last year it only produced US$135k, so we don't think it is generating significant revenue, at this point. As a result, we think it's a bit early to focus on the revenue growth, so we'll limit ourselves to looking at how the cash burn is changing over time. The 58% reduction in its cash burn over the last twelve months may be good for protecting the balance sheet but it hardly points to imminent growth. Clearly, however, the crucial factor is whether the company will grow its business going forward. For that reason, it makes a lot of sense to take a look at our analyst forecasts for the company.

How Easily Can Repare Therapeutics Raise Cash?

While we're comforted by the recent reduction evident from our analysis of Repare Therapeutics' cash burn, it is still worth considering how easily the company could raise more funds, if it wanted to accelerate spending to drive growth. Generally speaking, a listed business can raise new cash through issuing shares or taking on debt. Commonly, a business will sell new shares in itself to raise cash and drive growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Since it has a market capitalisation of US$683m, Repare Therapeutics' US$8.3m in cash burn equates to about 1.2% of its market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

Is Repare Therapeutics' Cash Burn A Worry?

As you can probably tell by now, we're not too worried about Repare Therapeutics' cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. And even its cash burn reduction was very encouraging. Taking all the factors in this report into account, we're not at all worried about its cash burn, as the business appears well capitalized to spend as needs be. On another note, we conducted an in-depth investigation of the company, and identified 5 warning signs for Repare Therapeutics (2 are a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

If you decide to trade Repare Therapeutics, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqGS:RPTX

Repare Therapeutics

A clinical-stage precision oncology company, engages in the discovery and development of therapeutics by using its synthetic lethality approach in Canada and the United States.

Flawless balance sheet slight.

Market Insights

Community Narratives