- United States

- /

- Biotech

- /

- NasdaqGM:RNAC

Cartesian Therapeutics, Inc.'s (NASDAQ:RNAC) Popularity With Investors Under Threat As Stock Sinks 27%

Cartesian Therapeutics, Inc. (NASDAQ:RNAC) shares have had a horrible month, losing 27% after a relatively good period beforehand. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 24% share price drop.

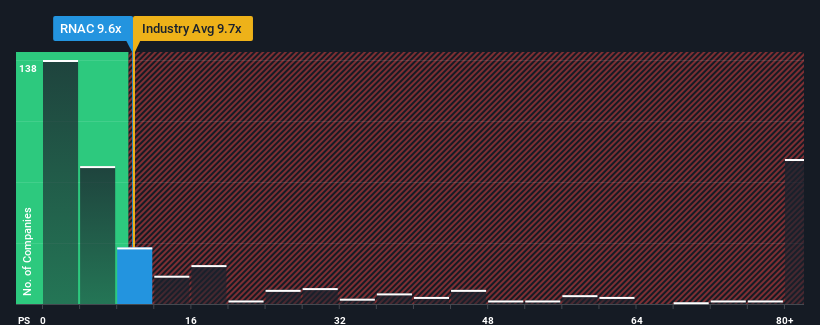

Although its price has dipped substantially, it's still not a stretch to say that Cartesian Therapeutics' price-to-sales (or "P/S") ratio of 9.6x right now seems quite "middle-of-the-road" compared to the Biotechs industry in the United States, where the median P/S ratio is around 9.7x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Cartesian Therapeutics

What Does Cartesian Therapeutics' Recent Performance Look Like?

Cartesian Therapeutics could be doing better as it's been growing revenue less than most other companies lately. One possibility is that the P/S ratio is moderate because investors think this lacklustre revenue performance will turn around. If not, then existing shareholders may be a little nervous about the viability of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Cartesian Therapeutics.What Are Revenue Growth Metrics Telling Us About The P/S?

The only time you'd be comfortable seeing a P/S like Cartesian Therapeutics' is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 50%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 54% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 100% per year during the coming three years according to the eight analysts following the company. Meanwhile, the broader industry is forecast to expand by 141% per year, which paints a poor picture.

With this information, we find it concerning that Cartesian Therapeutics is trading at a fairly similar P/S compared to the industry. Apparently many investors in the company reject the analyst cohort's pessimism and aren't willing to let go of their stock right now. Only the boldest would assume these prices are sustainable as these declining revenues are likely to weigh on the share price eventually.

What Does Cartesian Therapeutics' P/S Mean For Investors?

Following Cartesian Therapeutics' share price tumble, its P/S is just clinging on to the industry median P/S. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

While Cartesian Therapeutics' P/S isn't anything out of the ordinary for companies in the industry, we didn't expect it given forecasts of revenue decline. With this in mind, we don't feel the current P/S is justified as declining revenues are unlikely to support a more positive sentiment for long. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

You need to take note of risks, for example - Cartesian Therapeutics has 4 warning signs (and 3 which are significant) we think you should know about.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RNAC

Cartesian Therapeutics

A clinical-stage biotechnology company, provides mRNA cell therapies for the treatment of autoimmune diseases.

Moderate with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives