- United States

- /

- Communications

- /

- NasdaqGS:COMM

High Growth Tech Stocks In The US Market To Watch

Reviewed by Simply Wall St

Over the last 7 days, the United States market has dropped 3.6%, yet over the longer term, it has risen by 17% in the last year with earnings forecasted to grow by 14% annually. In light of these conditions, identifying high growth tech stocks involves looking for companies with strong innovation potential and robust financial health that can capitalize on future earnings growth.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 25.17% | 29.10% | ★★★★★★ |

| Travere Therapeutics | 28.43% | 65.01% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| AVITA Medical | 27.78% | 55.33% | ★★★★★★ |

| TG Therapeutics | 29.48% | 45.20% | ★★★★★★ |

| Bitdeer Technologies Group | 58.83% | 147.78% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.39% | 58.74% | ★★★★★★ |

| Alvotech | 31.17% | 100.18% | ★★★★★★ |

| Lumentum Holdings | 21.24% | 119.37% | ★★★★★★ |

Click here to see the full list of 229 stocks from our US High Growth Tech and AI Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

CommScope Holding Company (NasdaqGS:COMM)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: CommScope Holding Company, Inc. offers infrastructure solutions for communications, data center, and entertainment networks globally with a market capitalization of $1.06 billion.

Operations: CommScope generates revenue through its infrastructure solutions for communications, data centers, and entertainment networks on a global scale. The company's market capitalization is approximately $1.06 billion.

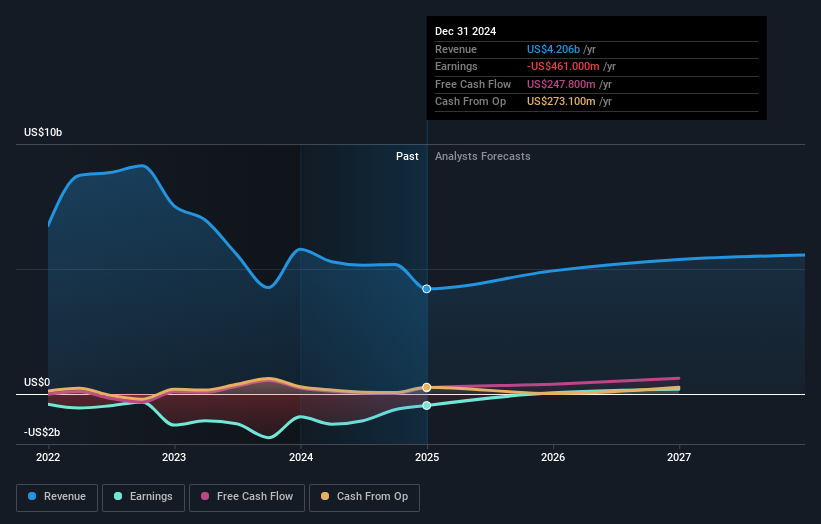

CommScope Holding Company, despite its challenging past, is pivoting towards profitability with a promising outlook underscored by a substantial 140.1% forecasted annual earnings growth. In 2024, the firm reversed a significant net loss from the previous year to a net income of $6.7 million in Q4 and showcased resilience with yearly sales reaching $4.21 billion. Innovatively, CommScope is enhancing its technological footprint through AI-driven solutions in enterprise networks and strategic alliances like that with Nokia for advanced LAN solutions and NCTC to expand broadband access in rural America. These initiatives not only demonstrate CommScope's adaptability but also position it well to capitalize on growing tech demands, potentially outpacing the average U.S market revenue growth rate of 9.2%.

- Click here and access our complete health analysis report to understand the dynamics of CommScope Holding Company.

Understand CommScope Holding Company's track record by examining our Past report.

Rigel Pharmaceuticals (NasdaqGS:RIGL)

Simply Wall St Growth Rating: ★★★★★☆

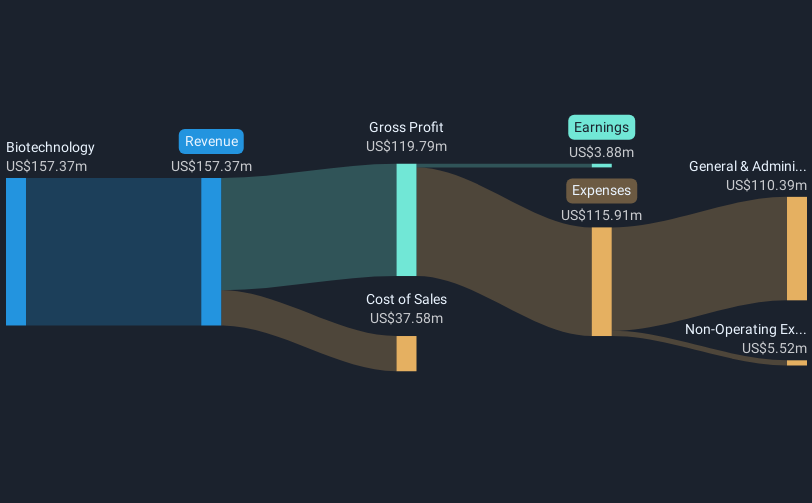

Overview: Rigel Pharmaceuticals, Inc. is a biotechnology company focused on discovering, developing, and providing therapies for hematologic disorders and cancer, with a market cap of approximately $378.72 million.

Operations: Rigel Pharmaceuticals focuses on biotechnology, generating $157.37 million in revenue from therapies for hematologic disorders and cancer.

Rigel Pharmaceuticals is on a promising trajectory with its strategic focus on expanding its product lines and pursuing acquisitions, as emphasized by the CEO's commitment to fostering growth alongside financial prudence. The company's recent inclusion in the NASDAQ Biotechnology Index underscores its rising industry profile. Notably, Rigel anticipates a revenue increase to between $200 million and $210 million for 2025, reflecting an annual growth rate of approximately 11.5%. This projection is bolstered by innovative clinical trials such as the Phase 1 study of fostamatinib in sickle cell disease, highlighting Rigel’s dedication to addressing complex medical needs through advanced R&D initiatives.

- Dive into the specifics of Rigel Pharmaceuticals here with our thorough health report.

Evaluate Rigel Pharmaceuticals' historical performance by accessing our past performance report.

Grindr (NYSE:GRND)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Grindr Inc. operates a social network and dating application catering to the LGBTQ communities globally, with a market cap of approximately $3.17 billion.

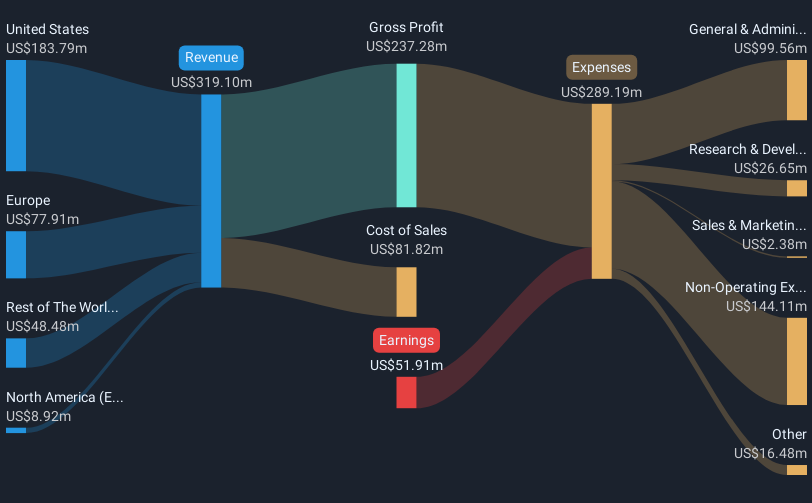

Operations: The company generates revenue primarily from its Internet Information Providers segment, amounting to $319.10 million.

Grindr's trajectory in the high-growth tech landscape is marked by robust revenue and innovative product expansions. Recently, the company raised its 2024 revenue forecast to between $343 million and $345 million, indicating a growth of 32%-33% year-over-year, fueled by strong performances in direct ad sales and subscriptions. This upward revision reflects Grindr's effective engagement strategies and its ability to exceed financial expectations. Looking ahead, Grindr plans to launch at least six new products in 2025, including AI-driven features like Chat Summaries and a Travel Pass for enhanced user connectivity globally. These initiatives not only broaden Grindr’s service offerings but also cater to evolving user needs, positioning the company well within the competitive tech space.

Next Steps

- Unlock more gems! Our US High Growth Tech and AI Stocks screener has unearthed 226 more companies for you to explore.Click here to unveil our expertly curated list of 229 US High Growth Tech and AI Stocks.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CommScope Holding Company, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:COMM

CommScope Holding Company

Provides infrastructure solutions for communications, data center, and entertainment networks worldwide.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives