Unfortunately for shareholders, when Regulus Therapeutics Inc. (NASDAQ:RGLS) reported results for the period to December 2020, its auditors, Ernst & Young LLP, expressed uncertainty about whether it can continue as a going concern. Thus we can say that, based on the results to that date, the company should raise capital or otherwise raise cash, without much delay.

If the company does have to issue more shares, potential investors will be sure to consider how desperate it is for capital. So it is suddenly extremely important to consider whether the company is taking too much risk on its balance sheet. The biggest concern we would have is the company's debt, since its lenders might force the company into administration if it cannot repay them.

See our latest analysis for Regulus Therapeutics

What Is Regulus Therapeutics's Debt?

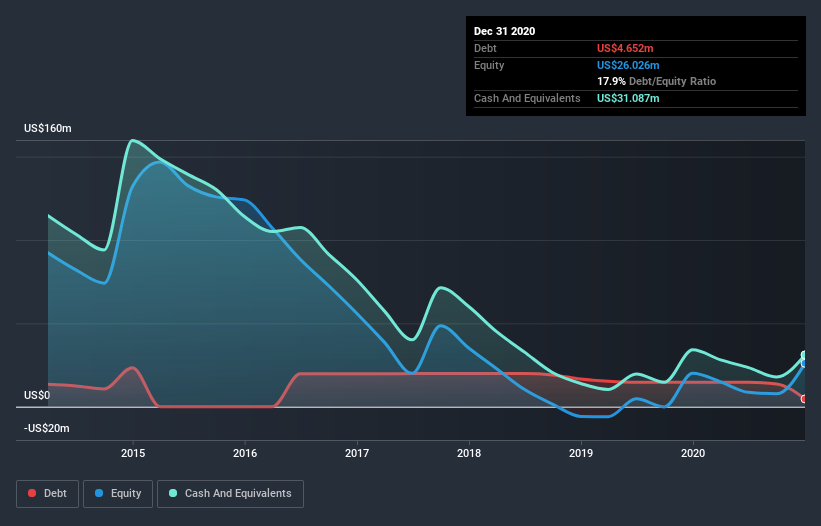

You can click the graphic below for the historical numbers, but it shows that Regulus Therapeutics had US$4.54m of debt in December 2020, down from US$14.6m, one year before. However, its balance sheet shows it holds US$31.1m in cash, so it actually has US$26.5m net cash.

How Healthy Is Regulus Therapeutics' Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Regulus Therapeutics had liabilities of US$11.6m due within 12 months and no liabilities due beyond that. Offsetting these obligations, it had cash of US$31.1m as well as receivables valued at US$503.0k due within 12 months. So it actually has US$20.0m more liquid assets than total liabilities.

This surplus suggests that Regulus Therapeutics is using debt in a way that is appears to be both safe and conservative. Given it has easily adequate short term liquidity, we don't think it will have any issues with its lenders. Simply put, the fact that Regulus Therapeutics has more cash than debt is arguably a good indication that it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine Regulus Therapeutics's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Regulus Therapeutics reported revenue of US$10m, which is a gain of 48%, although it did not report any earnings before interest and tax. Shareholders probably have their fingers crossed that it can grow its way to profits.

So How Risky Is Regulus Therapeutics?

Statistically speaking companies that lose money are riskier than those that make money. And we do note that Regulus Therapeutics had an earnings before interest and tax (EBIT) loss, over the last year. Indeed, in that time it burnt through US$13m of cash and made a loss of US$16m. But at least it has US$26.5m on the balance sheet to spend on growth, near-term. Regulus Therapeutics's revenue growth shone bright over the last year, so it may well be in a position to turn a profit in due course. Pre-profit companies are often risky, but they can also offer great rewards. We prefer to avoid a company after its auditor has expressed any uncertainty about its ability to continue as a going concern. That's because companies should always make sure the auditor has confidence that the company will continue as a going concern, in our view. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. For example, we've discovered 4 warning signs for Regulus Therapeutics (2 make us uncomfortable!) that you should be aware of before investing here.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

When trading Regulus Therapeutics or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About NasdaqCM:RGLS

Regulus Therapeutics

A clinical-stage biopharmaceutical company, focuses on discovery and development of drugs that targets microRNAs to treat a range of diseases in the United States.

Flawless balance sheet slight.