- United States

- /

- Life Sciences

- /

- NasdaqGS:RGEN

Why We're Not Concerned About Repligen Corporation's (NASDAQ:RGEN) Share Price

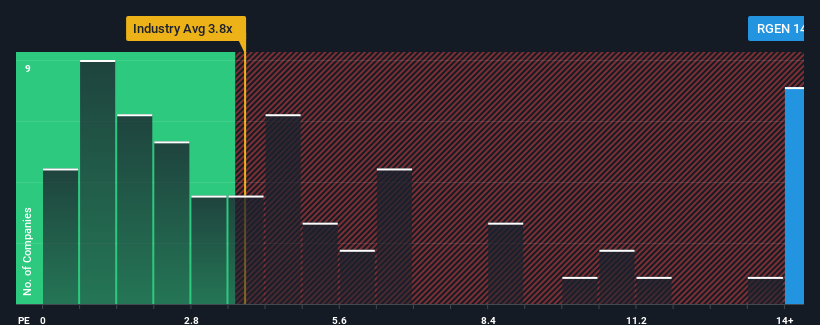

Repligen Corporation's (NASDAQ:RGEN) price-to-sales (or "P/S") ratio of 14.7x may look like a poor investment opportunity when you consider close to half the companies in the Life Sciences industry in the United States have P/S ratios below 3.8x. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Repligen

How Repligen Has Been Performing

With revenue that's retreating more than the industry's average of late, Repligen has been very sluggish. It might be that many expect the dismal revenue performance to recover substantially, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on Repligen will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Repligen?

The only time you'd be truly comfortable seeing a P/S as steep as Repligen's is when the company's growth is on track to outshine the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 16%. However, a few very strong years before that means that it was still able to grow revenue by an impressive 105% in total over the last three years. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the analysts covering the company suggest revenue should grow by 10% per annum over the next three years. With the industry only predicted to deliver 4.6% per year, the company is positioned for a stronger revenue result.

With this information, we can see why Repligen is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Key Takeaway

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As we suspected, our examination of Repligen's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. Right now shareholders are comfortable with the P/S as they are quite confident future revenues aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

Before you take the next step, you should know about the 2 warning signs for Repligen that we have uncovered.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:RGEN

Repligen

Engages in the development and commercialization of bioprocessing technologies and systems for use in biological drug manufacturing process in North America, Europe, the Asia Pacific, and internationally.

Excellent balance sheet with reasonable growth potential.