- United States

- /

- Pharma

- /

- NasdaqCM:RGC

Regencell Bioscience Holdings (RGC) Climbs 11% Over Last Week

Reviewed by Simply Wall St

Regencell Bioscience Holdings (RGC) experienced a 10.9% price increase over the past week despite no specific company-related events attracting attention. This movement aligns with broader market trends, as the Nasdaq Composite reached a record high and major indices posted weekly gains, likely supporting RGC's positive performance. While the company's specific activities last week did not significantly impact the market directly, they coincided with a positive investor sentiment driven by expectations of Federal Reserve interest rate cuts. This buoyancy in market conditions may have provided additional impetus for the rise in shareholder returns for RGC.

Over the past year, Regencell Bioscience Holdings (RGC) has seen an extraordinary total return of over 10000%, driven by significant share price movements and recent strategic corporate actions, like their stock split. In the same period, RGC's performance has outstripped both the US market, which returned 19.9%, and the US Pharmaceuticals industry, which experienced an 11% decline. This strong performance, despite the company's ongoing financial challenges and lack of substantive revenue, reflects investor optimism potentially fueled by broader market trends and favorable external economic factors as highlighted in the introduction.

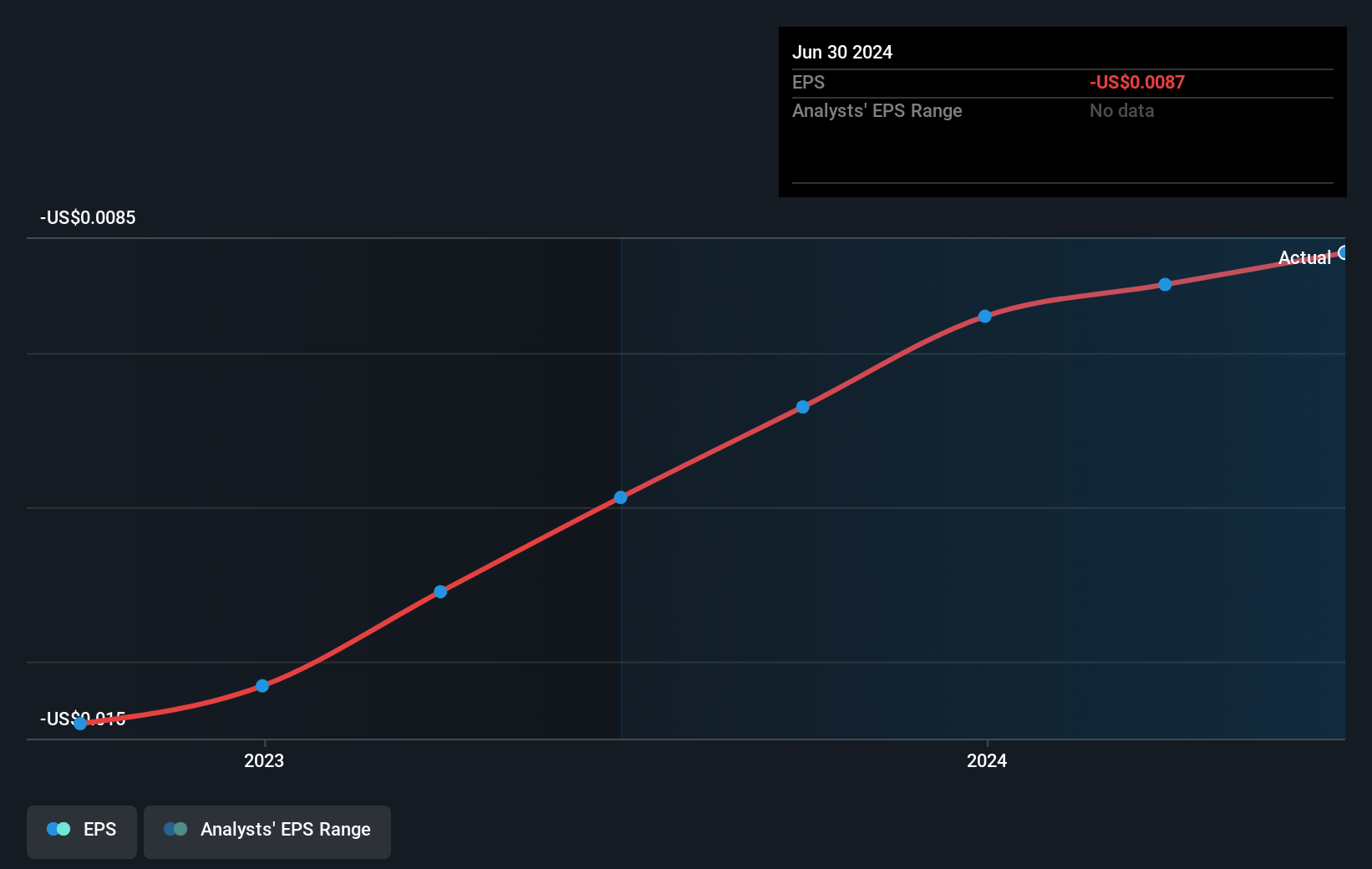

The introduction discusses short-term share price gains possibly spurred by general market sentiment influenced by anticipated Federal Reserve actions. However, with RGC's current unprofitability and no meaningful revenue streams, forecasting earnings growth remains challenging. The current share price of $14.70, without a clear analyst price target, complicates conventional valuation analysis, emphasizing uncertainty in RGC's financial outlook. While the recent market dynamics are critical, the lack of robust revenue and earnings forecasts presents a cautious scenario for investors considering long-term growth potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RGC

Regencell Bioscience Holdings

Operates as a Traditional Chinese medicine (TCM) bioscience company in Hong Kong.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026