- United States

- /

- Pharma

- /

- NasdaqCM:RDHL

This Is Why RedHill Biopharma Ltd.'s (NASDAQ:RDHL) CEO Compensation Looks Appropriate

Key Insights

- RedHill Biopharma's Annual General Meeting to take place on 17th of September

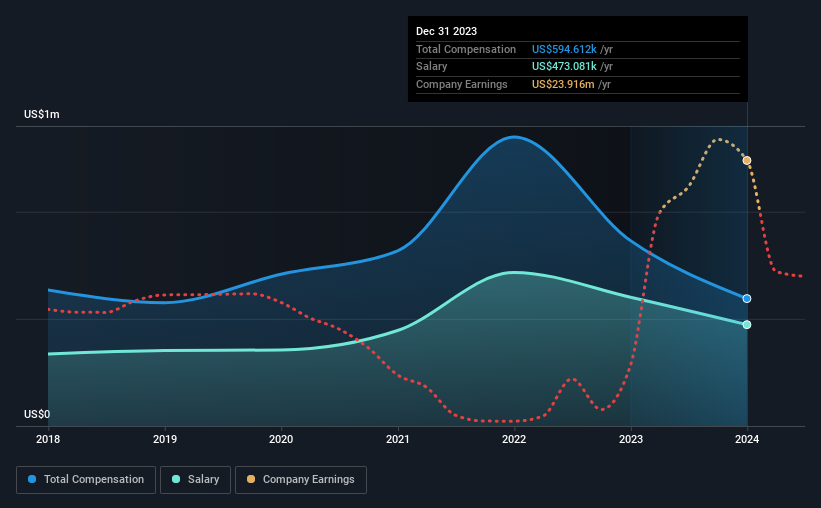

- Total pay for CEO Dror Ben-Asher includes US$473.1k salary

- The total compensation is 33% less than the average for the industry

- RedHill Biopharma's EPS grew by 87% over the past three years while total shareholder loss over the past three years was 100%

Shareholders may be wondering what CEO Dror Ben-Asher plans to do to improve the less than great performance at RedHill Biopharma Ltd. (NASDAQ:RDHL) recently. One way they can exercise their influence on management is through voting on resolutions, such as executive remuneration at the next AGM, coming up on 17th of September. Setting appropriate executive remuneration to align with the interests of shareholders may also be a way to influence the company performance in the long run. In our opinion, CEO compensation does not look excessive and we discuss why.

Check out our latest analysis for RedHill Biopharma

Comparing RedHill Biopharma Ltd.'s CEO Compensation With The Industry

According to our data, RedHill Biopharma Ltd. has a market capitalization of US$13m, and paid its CEO total annual compensation worth US$595k over the year to December 2023. Notably, that's a decrease of 31% over the year before. We note that the salary portion, which stands at US$473.1k constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the American Pharmaceuticals industry with market capitalizations below US$200m, reported a median total CEO compensation of US$881k. In other words, RedHill Biopharma pays its CEO lower than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | US$473k | US$601k | 80% |

| Other | US$122k | US$264k | 20% |

| Total Compensation | US$595k | US$865k | 100% |

On an industry level, roughly 26% of total compensation represents salary and 74% is other remuneration. RedHill Biopharma is paying a higher share of its remuneration through a salary in comparison to the overall industry. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

RedHill Biopharma Ltd.'s Growth

RedHill Biopharma Ltd.'s earnings per share (EPS) grew 87% per year over the last three years. In the last year, its revenue is down 90%.

This demonstrates that the company has been improving recently and is good news for the shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business. We don't have analyst forecasts, but you could get a better understanding of its growth by checking out this more detailed historical graph of earnings, revenue and cash flow.

Has RedHill Biopharma Ltd. Been A Good Investment?

With a total shareholder return of -100% over three years, RedHill Biopharma Ltd. shareholders would by and large be disappointed. This suggests it would be unwise for the company to pay the CEO too generously.

In Summary...

The fact that shareholders have earned a negative share price return is certainly disconcerting. The share price trend has diverged with the robust growth in EPS however, suggesting there may be other factors that could be driving the price performance. A key question may be why the fundamentals have not yet been reflected into the share price. The upcoming AGM will provide shareholders the opportunity to raise their concerns and evaluate if the board’s judgement and decision-making is aligned with their expectations.

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 5 warning signs for RedHill Biopharma you should be aware of, and 3 of them don't sit too well with us.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you're looking to trade RedHill Biopharma, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqCM:RDHL

RedHill Biopharma

A specialty biopharmaceutical company, primarily focuses on gastrointestinal and infectious diseases.

Slight with mediocre balance sheet.

Market Insights

Community Narratives