- United States

- /

- Biotech

- /

- NasdaqGM:RAPT

RAPT Therapeutics (NASDAQ:RAPT) shareholders are still up 82% over 3 years despite pulling back 11% in the past week

RAPT Therapeutics, Inc. (NASDAQ:RAPT) shareholders might be concerned after seeing the share price drop 11% in the last week. But that doesn't change the fact that the returns over the last three years have been respectable. It beat the market return of 69% in that time, gaining 82%.

Although RAPT Therapeutics has shed US$108m from its market cap this week, let's take a look at its longer term fundamental trends and see if they've driven returns.

Check out our latest analysis for RAPT Therapeutics

With just US$2,283,000 worth of revenue in twelve months, we don't think the market considers RAPT Therapeutics to have proven its business plan. So it seems shareholders are too busy dreaming about the progress to come than dwelling on the current (lack of) revenue. For example, they may be hoping that RAPT Therapeutics comes up with a great new product, before it runs out of money.

We think companies that have neither significant revenues nor profits are pretty high risk. There is almost always a chance they will need to raise more capital, and their progress - and share price - will dictate how dilutive that is to current holders. While some companies like this go on to deliver on their plan, making good money for shareholders, many end in painful losses and eventual de-listing. Of course, if you time it right, high risk investments like this can really pay off, as RAPT Therapeutics investors might know.

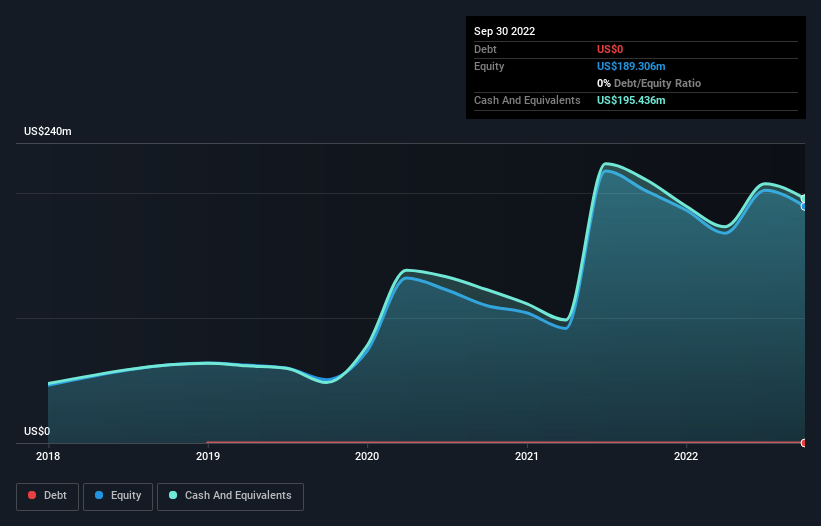

RAPT Therapeutics had cash in excess of all liabilities of US$175m when it last reported (September 2022). That's not too bad but management may have to think about raising capital or taking on debt, unless the company is close to breaking even. Given the share price has increased by a solid 108% per year, over 3 years , it's fair to say investors remain excited about the future, despite the potential need for cash. You can see in the image below, how RAPT Therapeutics' cash levels have changed over time (click to see the values).

It can be extremely risky to invest in a company that doesn't even have revenue. There's no way to know its value easily. One thing you can do is check if company insiders are buying shares. It's usually a positive if they have, as it may indicate they see value in the stock. Luckily we are in a position to provide you with this free chart of insider buying (and selling).

A Different Perspective

It's nice to see that RAPT Therapeutics shareholders have gained 23% (in total) over the last year. So this year's TSR was actually better than the three-year TSR (annualized) of 22%. Given the track record of solid returns over varying time frames, it might be worth putting RAPT Therapeutics on your watchlist. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider risks, for instance. Every company has them, and we've spotted 4 warning signs for RAPT Therapeutics you should know about.

RAPT Therapeutics is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

If you're looking to trade RAPT Therapeutics, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RAPT

RAPT Therapeutics

Operates as a clinical-stage immunology-based biopharmaceutical company that focuses on the discovery, development, and commercialization of oral small molecule therapies for patients with unmet needs in oncology and inflammatory diseases in the United States.

Flawless balance sheet medium-low.

Market Insights

Community Narratives