- United States

- /

- Biotech

- /

- NasdaqGM:RAPT

Loss-making RAPT Therapeutics (NASDAQ:RAPT) sheds a further US$54m, taking total shareholder losses to 13% over 1 year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. But if you buy individual stocks, you can do both better or worse than that. For example, the RAPT Therapeutics, Inc. (NASDAQ:RAPT) share price is down 13% in the last year. That's well below the market decline of 0.6%. RAPT Therapeutics hasn't been listed for long, so although we're wary of recent listings that perform poorly, it may still prove itself with time. Unfortunately the last month hasn't been any better, with the share price down 18%.

If the past week is anything to go by, investor sentiment for RAPT Therapeutics isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for RAPT Therapeutics

Given that RAPT Therapeutics didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

RAPT Therapeutics' revenue didn't grow at all in the last year. In fact, it fell 24%. That looks pretty grim, at a glance. Shareholders have seen the share price drop 13% in that time. What would you expect when revenue is falling, and it doesn't make a profit? It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

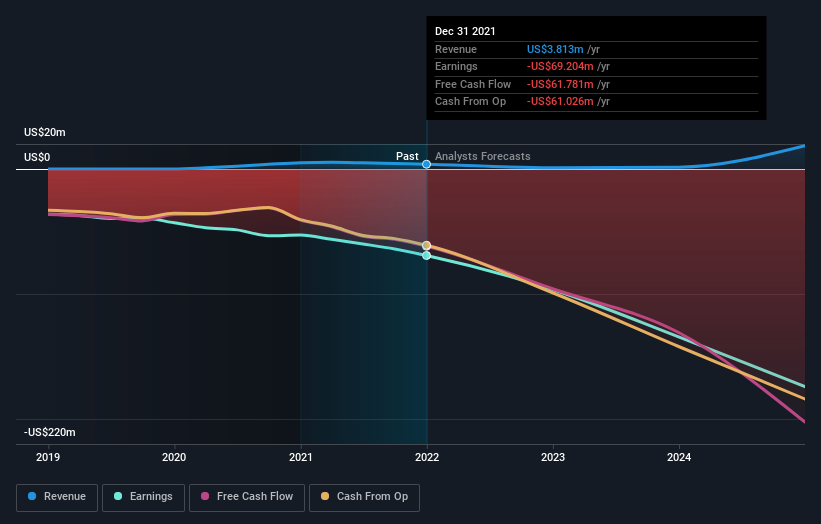

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Having said that, most people consider earnings and revenue growth trends to be a more meaningful guide to the business. If you are thinking of buying or selling RAPT Therapeutics stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

RAPT Therapeutics shareholders are down 13% for the year, even worse than the market loss of 0.6%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock down 9.7% over the last three months, the market doesn't seem to believe that the company has solved all its problems. Given the relatively short history of this stock, we'd remain pretty wary until we see some strong business performance. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that RAPT Therapeutics is showing 4 warning signs in our investment analysis , you should know about...

RAPT Therapeutics is not the only stock that insiders are buying. For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:RAPT

RAPT Therapeutics

A clinical-stage immunology-based biopharmaceutical company, focuses on discovery, development, and commercialization of oral small molecule therapies for patients with unmet needs in oncology and inflammatory diseases in the United States.

Flawless balance sheet moderate.

Market Insights

Community Narratives