- United States

- /

- Life Sciences

- /

- NasdaqGM:QTRX

Take Care Before Jumping Onto Quanterix Corporation (NASDAQ:QTRX) Even Though It's 26% Cheaper

To the annoyance of some shareholders, Quanterix Corporation (NASDAQ:QTRX) shares are down a considerable 26% in the last month, which continues a horrid run for the company. For any long-term shareholders, the last month ends a year to forget by locking in a 56% share price decline.

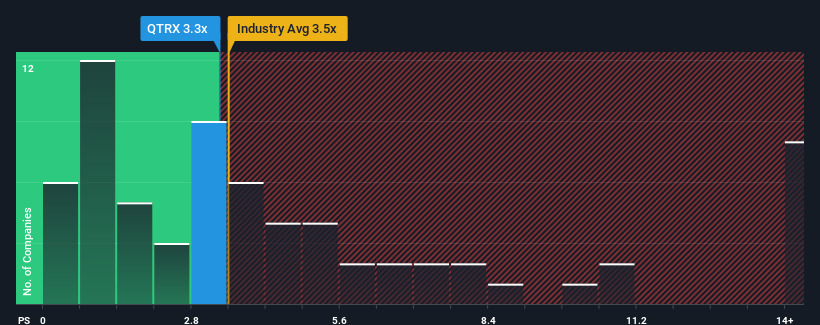

In spite of the heavy fall in price, there still wouldn't be many who think Quanterix's price-to-sales (or "P/S") ratio of 3.3x is worth a mention when the median P/S in the United States' Life Sciences industry is similar at about 3.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Quanterix

What Does Quanterix's P/S Mean For Shareholders?

With its revenue growth in positive territory compared to the declining revenue of most other companies, Quanterix has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Quanterix.Do Revenue Forecasts Match The P/S Ratio?

Quanterix's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 16%. Revenue has also lifted 17% in aggregate from three years ago, mostly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company suggest revenue should grow by 17% each year over the next three years. With the industry only predicted to deliver 7.2% per annum, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Quanterix's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

Following Quanterix's share price tumble, its P/S is just clinging on to the industry median P/S. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at Quanterix's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

Before you take the next step, you should know about the 3 warning signs for Quanterix that we have uncovered.

If these risks are making you reconsider your opinion on Quanterix, explore our interactive list of high quality stocks to get an idea of what else is out there.

Valuation is complex, but we're here to simplify it.

Discover if Quanterix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:QTRX

Quanterix

A life sciences company, engages in development and marketing of digital immunoassay platforms that advances precision health for life sciences research and diagnostics in North America, Europe, the Middle East, Africa, and the Asia Pacific regions.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives