- United States

- /

- Pharma

- /

- NasdaqCM:BGM

Qilian International Holding Group Limited's (NASDAQ:QLI) Share Price Boosted 34% But Its Business Prospects Need A Lift Too

The Qilian International Holding Group Limited (NASDAQ:QLI) share price has done very well over the last month, posting an excellent gain of 34%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 15% in the last twelve months.

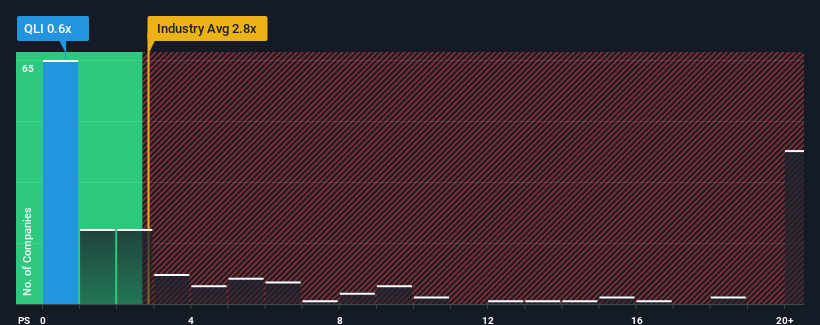

Although its price has surged higher, Qilian International Holding Group may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Pharmaceuticals industry in the United States have P/S ratios greater than 2.8x and even P/S higher than 12x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

View our latest analysis for Qilian International Holding Group

What Does Qilian International Holding Group's Recent Performance Look Like?

For instance, Qilian International Holding Group's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. Those who are bullish on Qilian International Holding Group will be hoping that this isn't the case so that they can pick up the stock at a lower valuation.

Although there are no analyst estimates available for Qilian International Holding Group, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Qilian International Holding Group?

In order to justify its P/S ratio, Qilian International Holding Group would need to produce anemic growth that's substantially trailing the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 28%. This means it has also seen a slide in revenue over the longer-term as revenue is down 7.1% in total over the last three years. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to deliver 17% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

In light of this, it's understandable that Qilian International Holding Group's P/S would sit below the majority of other companies. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

The Key Takeaway

Qilian International Holding Group's recent share price jump still sees fails to bring its P/S alongside the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Qilian International Holding Group confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Qilian International Holding Group (2 are concerning) you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if BGM Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BGM

BGM Group

Manufactures and distributes active pharmaceutical ingredients (APIs), traditional Chinese medicine derivatives (TCMD), and other by-products in China.

Flawless balance sheet low.