- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Valuing Protagonist Therapeutics (PTGX) After New 52-Week Phase 3 VERIFY Data on Rusfertide

Reviewed by Simply Wall St

Protagonist Therapeutics (PTGX) shares are back on traders radar after the company and partner Takeda highlighted 52 week Phase 3 VERIFY data for rusfertide in polycythemia vera ahead of an ASH oral presentation.

See our latest analysis for Protagonist Therapeutics.

The VERIFY update lands on top of a powerful run, with the share price now at $95.35 after a 63.33% 3 month share price return and a huge 3 year total shareholder return of 882.99%. This suggests momentum and expectations are still firmly pointed at long term growth.

If this kind of biotech re rating has your attention, it could be a good time to scan other innovative healthcare stocks that might be setting up for their next move.

Yet with shares already hovering around Wall Street targets after a spectacular multi year run, are investors still underestimating the value of rusfertide and Protagonist pipeline, or is the market already pricing in future growth?

Price-to-Earnings of 129.8x, Is it justified?

Based on the latest data, Protagonist Therapeutics trades on a steep price-to-earnings multiple of 129.8 times, well above many biotech peers despite the recent rally.

The price-to-earnings ratio compares what investors are paying today for each dollar of current earnings. It is a key yardstick for profitable biotech names transitioning from pure R&D stories to commercial or partnered revenue. A triple digit multiple like this implies the market is front loading considerable optimism about future profitability into the share price.

That optimism has some numerical backing, with earnings forecast to grow at a rapid clip and revenue expected to expand significantly faster than the wider US market. However, when this lofty 129.8 times multiple is stacked against the broader US biotech industry average of 19 times and an estimated fair price-to-earnings ratio of 32.3 times, it points to an exuberant premium that could compress if growth or execution fall short.

Explore the SWS fair ratio for Protagonist Therapeutics

Result: Price-to-Earnings of 129.8x (OVERVALUED)

However, lingering clinical or regulatory setbacks for rusfertide, along with any slowdown in revenue growth, could quickly challenge the current premium valuation.

Find out about the key risks to this Protagonist Therapeutics narrative.

Another Lens on Value

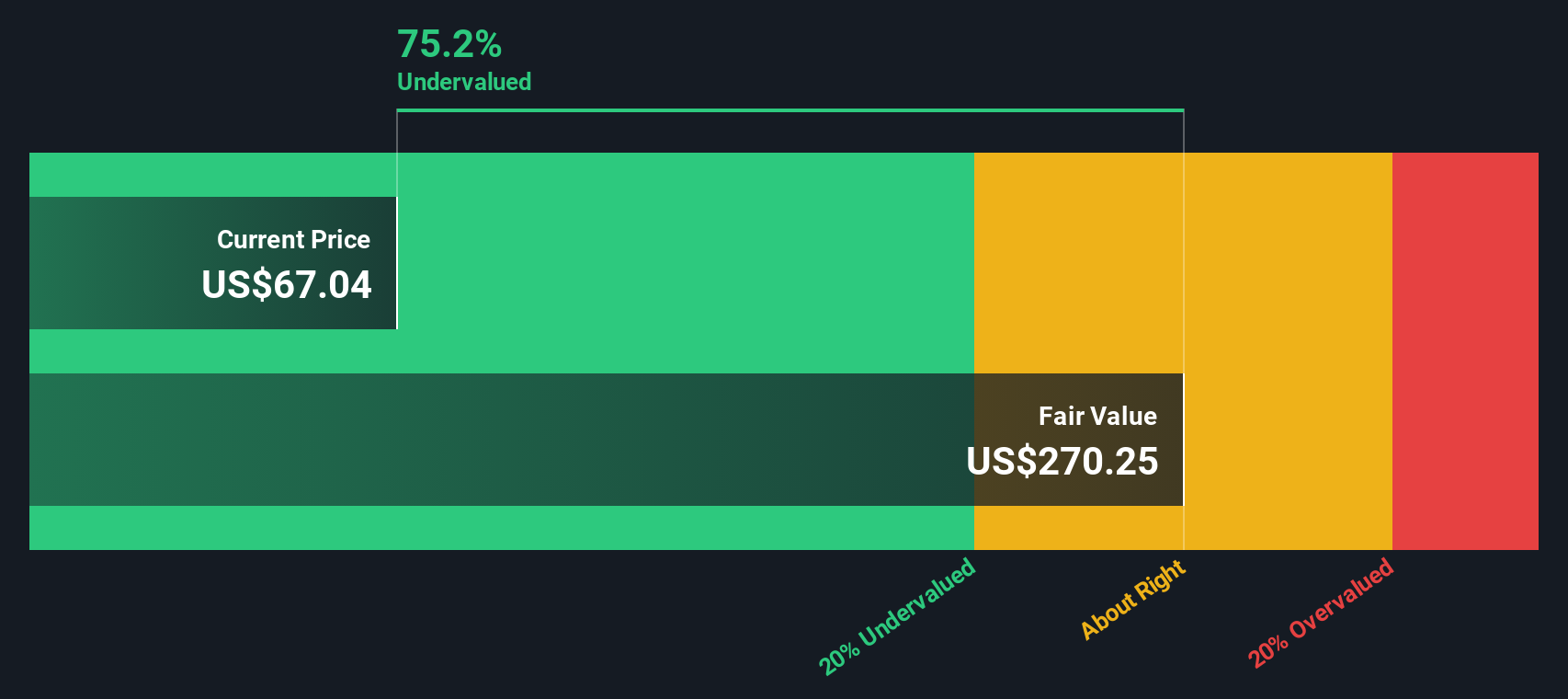

Our DCF model tells a different story, suggesting Protagonist Therapeutics is trading about 18% below its fair value, at roughly $95 versus an estimated $116. If cash flows justify a discount to today price, is the rich earnings multiple really a deal breaker?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Protagonist Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 908 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Protagonist Therapeutics Narrative

If you see the numbers differently or want to dig into the details yourself, you can build a personalized view in minutes: Do it your way.

A great starting point for your Protagonist Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Before momentum shifts again, put Simply Wall Street Screener to work and uncover focused opportunities other investors may overlook, tailored to what you want next.

- Target reliable income streams by reviewing these 13 dividend stocks with yields > 3% that balance yield with financial strength and long term sustainability.

- Capture early growth potential by scanning these 26 AI penny stocks positioned at the forefront of artificial intelligence adoption across multiple industries.

- Position yourself for asymmetric upside by filtering for these 908 undervalued stocks based on cash flows that the market has not fully recognized yet.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion