- United States

- /

- Biotech

- /

- NasdaqGM:PTGX

Protagonist Therapeutics (PTGX): Evaluating Valuation After Positive Phase 2b Trial Data and Pipeline Momentum

Reviewed by Kshitija Bhandaru

Protagonist Therapeutics (PTGX) announced encouraging results from its Phase 2b ANTHEM-UC trial for icotrokinra in ulcerative colitis, revealing clear clinical improvements. The company now plans to begin a Phase 3 study in this indication.

See our latest analysis for Protagonist Therapeutics.

Protagonist Therapeutics has caught investors’ attention with strong clinical results and rising optimism, reflected by a 72% year-to-date share price gain and solid total shareholder returns over the past several years. Momentum appears to be building, thanks to recent pipeline progress and increasing confidence in the company’s growth prospects.

If you want to discover what other biopharma innovators are making waves in healthcare, check out the full list via our healthcare screener: See the full list for free.

With the stock now up over 70% this year and trading near analyst targets, investors face a critical question: is Protagonist Therapeutics still undervalued, or is the market already factoring in its next wave of growth?

Price-to-Earnings of 80.1x: Is it justified?

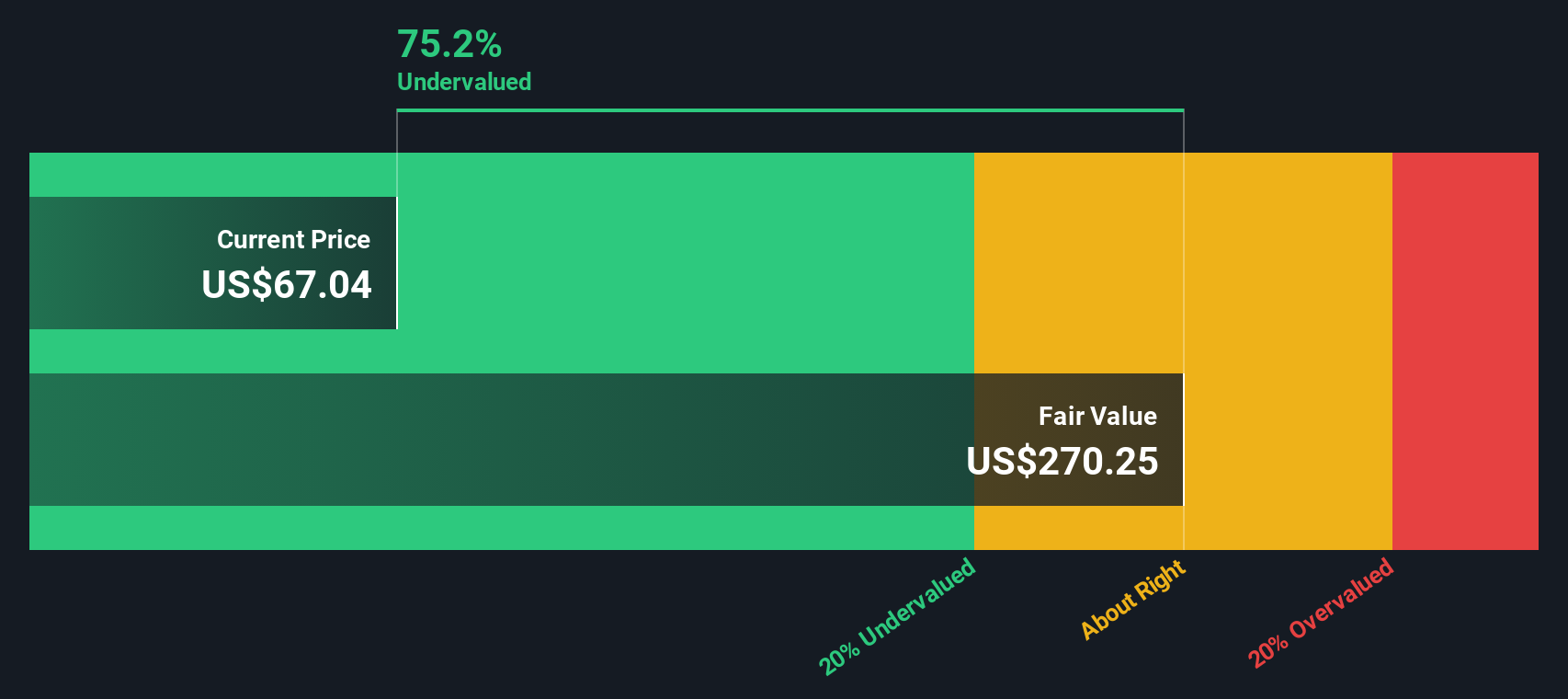

Protagonist Therapeutics trades at a Price-to-Earnings (P/E) ratio of 80.1x, which stands out compared with both its peers and the broader biotech sector. At a recent closing price of $67.04, this valuation positions the stock well above traditional benchmarks and could signal either great expectations for future growth or an overheated market premium.

The P/E ratio measures how much investors are willing to pay today for a dollar of current earnings. In biotechs, elevated multiples often reflect optimism about breakthrough therapies or accelerating profit growth. For Protagonist, this high P/E suggests the market is pricing in strong future profitability and pipeline execution, but it does raise questions about sustainability if earnings growth fails to materialize.

Compared to the US Biotechs industry average of just 16.7x and the peer group average of 44.9x, Protagonist’s multiple is strikingly higher. This is also much higher than the estimated fair P/E ratio of 29.4x, indicating a significant premium and highlighting the anticipation built into the share price.

Explore the SWS fair ratio for Protagonist Therapeutics

Result: Price-to-Earnings of 80.1x (OVERVALUED)

However, disappointing Phase 3 results or a slowdown in revenue growth could quickly challenge the optimistic outlook that is currently driving the shares higher.

Find out about the key risks to this Protagonist Therapeutics narrative.

Another View: What Does the DCF Model Say?

While the lofty P/E ratio raises concerns about overvaluation, the SWS DCF model presents a strikingly different picture. According to our analysis, Protagonist Therapeutics is currently trading at over 75% below its estimated fair value. This suggests significant potential upside. Could the market be missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Protagonist Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Protagonist Therapeutics Narrative

Keep in mind, if you have a different perspective or enjoy digging into the details, you can easily craft your own view in just a few minutes with our tools. Do it your way.

A great starting point for your Protagonist Therapeutics research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let opportunity pass you by. Jump on the latest trends and future movers with these handpicked stock ideas you can filter and compare instantly.

- Maximize your passive income by checking out these 18 dividend stocks with yields > 3% offering attractive yields above 3 percent and standout financial stability.

- Spot emerging trends in technology with these 25 AI penny stocks, featuring companies harnessing AI for innovation and long-term growth potential.

- Stay ahead of the crowd and browse these 892 undervalued stocks based on cash flows to catch undervalued opportunities before the market catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGM:PTGX

Protagonist Therapeutics

A biopharmaceutical company, develops peptide therapeutics for hematology and blood disorders, and inflammatory and immunomodulatory diseases.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives