- United States

- /

- Biotech

- /

- NasdaqGS:PTCT

PTC Therapeutics, Inc.'s (NASDAQ:PTCT) Business And Shares Still Trailing The Industry

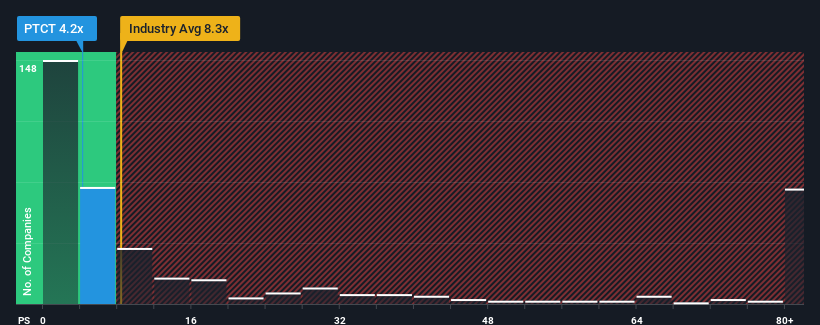

PTC Therapeutics, Inc.'s (NASDAQ:PTCT) price-to-sales (or "P/S") ratio of 4.2x might make it look like a buy right now compared to the Biotechs industry in the United States, where around half of the companies have P/S ratios above 8.3x and even P/S above 43x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

See our latest analysis for PTC Therapeutics

What Does PTC Therapeutics' Recent Performance Look Like?

While the industry has experienced revenue growth lately, PTC Therapeutics' revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on PTC Therapeutics will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For PTC Therapeutics?

PTC Therapeutics' P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

Retrospectively, the last year delivered a frustrating 14% decrease to the company's top line. Even so, admirably revenue has lifted 50% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 9.3% per year during the coming three years according to the analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 172% each year, which is noticeably more attractive.

With this information, we can see why PTC Therapeutics is trading at a P/S lower than the industry. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

What Does PTC Therapeutics' P/S Mean For Investors?

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

As we suspected, our examination of PTC Therapeutics' analyst forecasts revealed that its inferior revenue outlook is contributing to its low P/S. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for PTC Therapeutics (1 is concerning!) that you should be aware of before investing here.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PTCT

PTC Therapeutics

A biopharmaceutical company, focuses on the discovery, development, and commercialization of medicines to children and adults living with rare disorders in the United States and internationally.

Undervalued slight.

Similar Companies

Market Insights

Community Narratives