- United States

- /

- Life Sciences

- /

- NasdaqGM:PSNL

Personalis (NASDAQ:PSNL) surges 13% this week, taking three-year gains to 153%

The worst result, after buying shares in a company (assuming no leverage), would be if you lose all the money you put in. But in contrast you can make much more than 100% if the company does well. For example, the Personalis, Inc. (NASDAQ:PSNL) share price has soared 153% in the last three years. That sort of return is as solid as granite. And in the last month, the share price has gained 37%.

The past week has proven to be lucrative for Personalis investors, so let's see if fundamentals drove the company's three-year performance.

Given that Personalis didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. When a company doesn't make profits, we'd generally hope to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

Personalis' revenue trended up 7.9% each year over three years. That's not a very high growth rate considering it doesn't make profits. In contrast, the stock has popped 36% per year in that time - an impressive result. Shareholders should be pretty happy with that, although interested investors might want to examine the financial data more closely to see if the gains are really justified. It seems likely that the market is pretty optimistic about Personalis, given it is losing money.

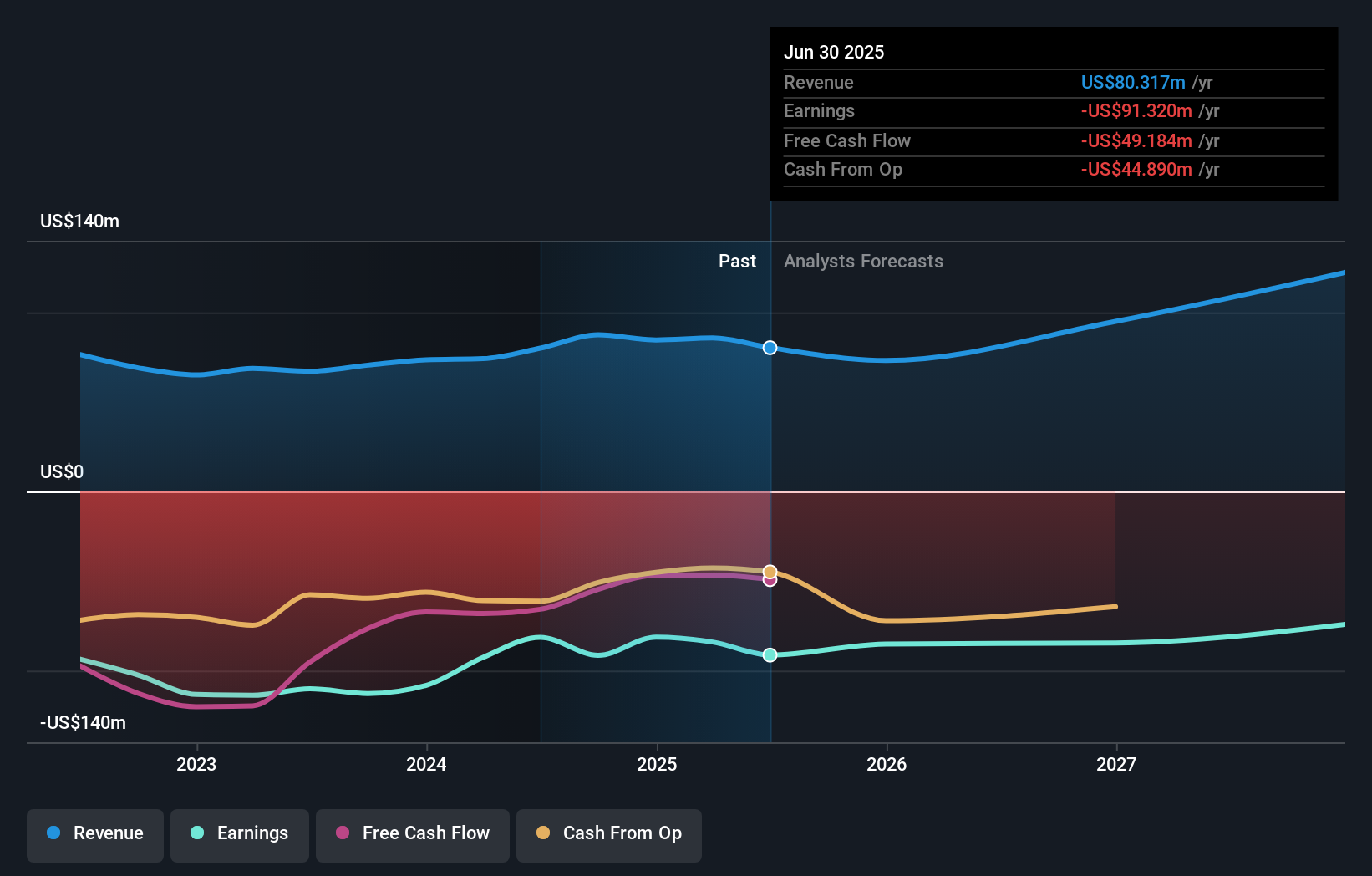

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling Personalis stock, you should check out this free report showing analyst profit forecasts.

A Different Perspective

It's nice to see that Personalis shareholders have received a total shareholder return of 41% over the last year. That certainly beats the loss of about 12% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Consider for instance, the ever-present spectre of investment risk. We've identified 3 warning signs with Personalis (at least 1 which is concerning) , and understanding them should be part of your investment process.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGM:PSNL

Personalis

Develops, markets, and sells advanced cancer genomic tests and services in the United States and internationally.

Excellent balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives