- United States

- /

- Biotech

- /

- NasdaqGS:PRLD

Prelude Therapeutics Incorporated's (NASDAQ:PRLD) 66% Share Price Plunge Could Signal Some Risk

Prelude Therapeutics Incorporated (NASDAQ:PRLD) shares have retraced a considerable 66% in the last month, reversing a fair amount of their solid recent performance. Looking at the bigger picture, even after this poor month the stock is up 42% in the last year.

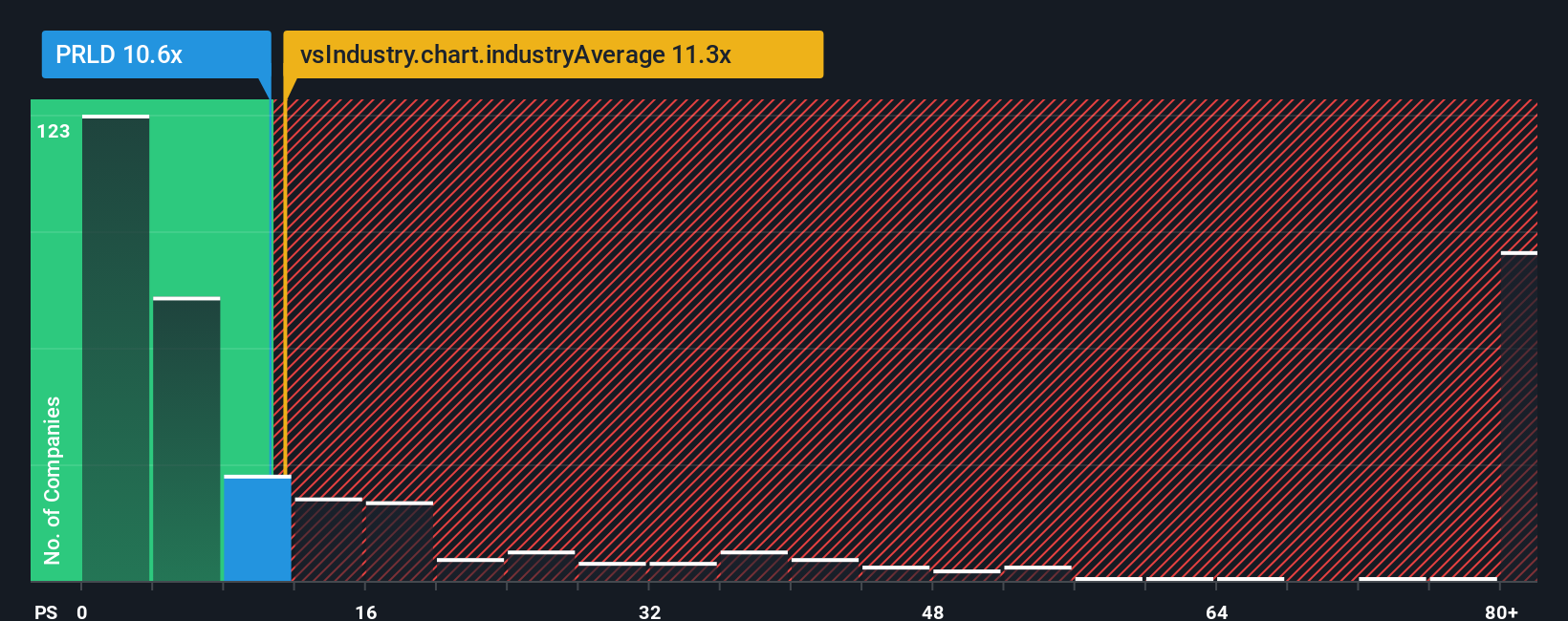

Even after such a large drop in price, you could still be forgiven for feeling indifferent about Prelude Therapeutics' P/S ratio of 10.6x, since the median price-to-sales (or "P/S") ratio for the Biotechs industry in the United States is also close to 11.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Prelude Therapeutics

What Does Prelude Therapeutics' Recent Performance Look Like?

Recent times haven't been great for Prelude Therapeutics as its revenue has been rising slower than most other companies. It might be that many expect the uninspiring revenue performance to strengthen positively, which has kept the P/S ratio from falling. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Prelude Therapeutics' future stacks up against the industry? In that case, our free report is a great place to start.How Is Prelude Therapeutics' Revenue Growth Trending?

In order to justify its P/S ratio, Prelude Therapeutics would need to produce growth that's similar to the industry.

Retrospectively, the last year delivered an exceptional 250% gain to the company's top line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Turning to the outlook, the next three years should generate growth of 103% per year as estimated by the three analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 124% each year, which is noticeably more attractive.

With this in mind, we find it intriguing that Prelude Therapeutics' P/S is closely matching its industry peers. Apparently many investors in the company are less bearish than analysts indicate and aren't willing to let go of their stock right now. Maintaining these prices will be difficult to achieve as this level of revenue growth is likely to weigh down the shares eventually.

What We Can Learn From Prelude Therapeutics' P/S?

Following Prelude Therapeutics' share price tumble, its P/S is just clinging on to the industry median P/S. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our look at the analysts forecasts of Prelude Therapeutics' revenue prospects has shown that its inferior revenue outlook isn't negatively impacting its P/S as much as we would have predicted. At present, we aren't confident in the P/S as the predicted future revenues aren't likely to support a more positive sentiment for long. A positive change is needed in order to justify the current price-to-sales ratio.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Prelude Therapeutics, and understanding should be part of your investment process.

If these risks are making you reconsider your opinion on Prelude Therapeutics, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PRLD

Prelude Therapeutics

A clinical-stage precision oncology company, focuses on the discovery and development of novel precision cancer medicines to underserved patients.

Undervalued with high growth potential.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Staggered by dilution; positions for growth

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026