- United States

- /

- Biotech

- /

- NasdaqGS:PRAX

Assessing the Valuation of Praxis Precision Medicines (PRAX) Following Short Report, Insider Sales, and Public Offering News

Reviewed by Simply Wall St

A critical short report alleging issues with Praxis Precision Medicines (PRAX) Phase 3 ulixacaltamide trial sent shockwaves through the market. Investors also took note of recent insider share sales and a sizable public offering.

See our latest analysis for Praxis Precision Medicines.

Shares of Praxis Precision Medicines have been on a rollercoaster, with the most recent 3.46% dip following the short report and insider sales. However, the 90-day share price return stands at a staggering 300.63%. Despite a turbulent backdrop, the 1-year total shareholder return of 131.91% highlights that momentum is still very much alive for investors who took the long view.

If market drama like this has you wondering what other high-opportunity companies are out there, now’s a smart time to broaden your search and discover fast growing stocks with high insider ownership

With so much volatility and headline risk swirling around Praxis Precision Medicines, the key question now is whether the stock remains a hidden gem trading at a discount, or if the market is already factoring in its future growth prospects.

Price-to-Book Ratio of 13.4x: Is it justified?

Praxis Precision Medicines currently trades at a price-to-book ratio of 13.4x, noticeably more expensive than both its industry and peer group averages. Its last close price was $184.25, signaling a sizable valuation premium.

The price-to-book ratio measures how much investors are willing to pay for each dollar of net assets on the company's balance sheet. For biotech companies, this metric can reflect the market’s confidence in future breakthroughs and the value of the company’s pipeline. However, given that Praxis is unprofitable and has seen significant losses in recent years, this high ratio stands out even more.

Compared to the US Biotechs industry average of 2.7x and a peer group average of 12.8x, Praxis’s valuation is notably rich. The company’s current fundamentals and future profitability prospects may not fully support such a premium, based on typical sector benchmarks. There is currently insufficient data to determine what a "fair" price-to-book ratio should be for Praxis.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 13.4x (OVERVALUED)

However, ongoing revenue volatility and continuing net losses remain significant risks that could quickly shift the outlook for Praxis Precision Medicines.

Find out about the key risks to this Praxis Precision Medicines narrative.

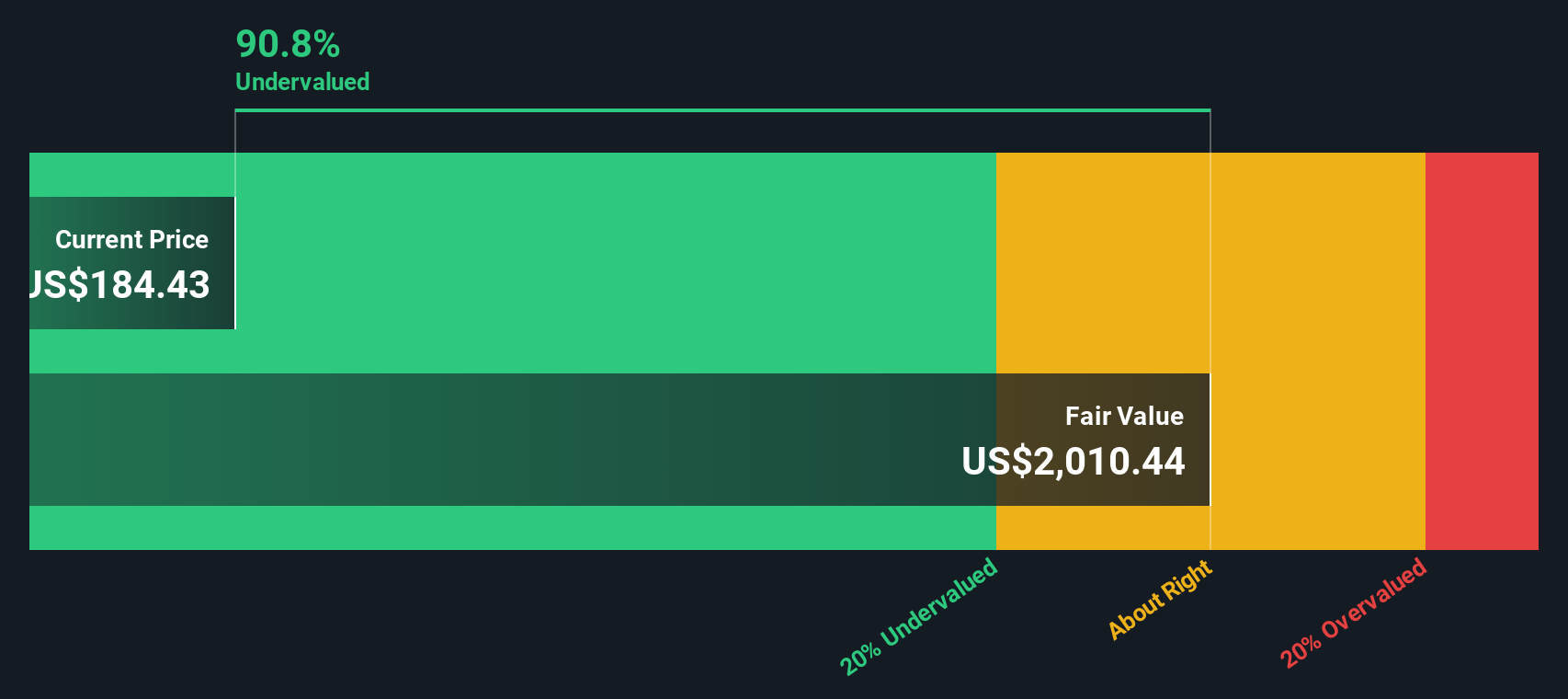

Another View: SWS DCF Model Suggests Undervaluation

While the price-to-book multiple implies Praxis Precision Medicines is highly overvalued, our DCF model presents a very different perspective. According to its projections, the stock is trading 92.3% below fair value, which could suggest significant upside potential if growth occurs. Could the reality lie somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Praxis Precision Medicines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 926 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Praxis Precision Medicines Narrative

If you want to interpret the numbers differently or prefer hands-on research, crafting your own perspective takes just a few minutes. Do it your way

A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Your next winning stock could be just a click away. Don’t sit on the sidelines while new opportunities take shape across the market landscape.

- Capture potential high yields by targeting future income with these 14 dividend stocks with yields > 3%, which offers attractive returns above 3%.

- Seize the AI trend and stay ahead of the curve by checking out these 26 AI penny stocks at the forefront of artificial intelligence innovation.

- Tap into value opportunities and consider these 926 undervalued stocks based on cash flows, fueled by robust cash flows while they are still flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PRAX

Praxis Precision Medicines

A clinical-stage biopharmaceutical company, engages in the development of therapies for central nervous system (CNS) disorders characterized by neuronal excitation-inhibition imbalance.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026