- United States

- /

- Software

- /

- NasdaqCM:ZENV

Top Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

As the U.S. market experiences a downturn with major indexes like the Dow Jones dropping significantly, investors are seeking opportunities that can weather current uncertainties. Penny stocks, though an older term, remain relevant for those looking to invest in smaller or newer companies that might offer unique growth prospects. By focusing on penny stocks with strong financial health, investors can potentially uncover hidden gems amidst market volatility.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.69 | $370.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.66 | $575.04M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.96 | $684.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.96 | $246.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.19 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.21 | $569.89M | ✅ 5 ⚠️ 0 View Analysis > |

| VAALCO Energy (EGY) | $3.70 | $402.44M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.895025 | $6.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.28 | $72.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.11 | $9.95M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 364 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Zenvia (ZENV)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Zenvia Inc. operates a cloud-based platform that facilitates integrated communication solutions for organizations across multiple countries, with a market cap of $72.19 million.

Operations: The company's revenue is derived from two main segments: SaaS, contributing R$325.22 million, and CPaaS, which accounts for R$772.32 million.

Market Cap: $72.19M

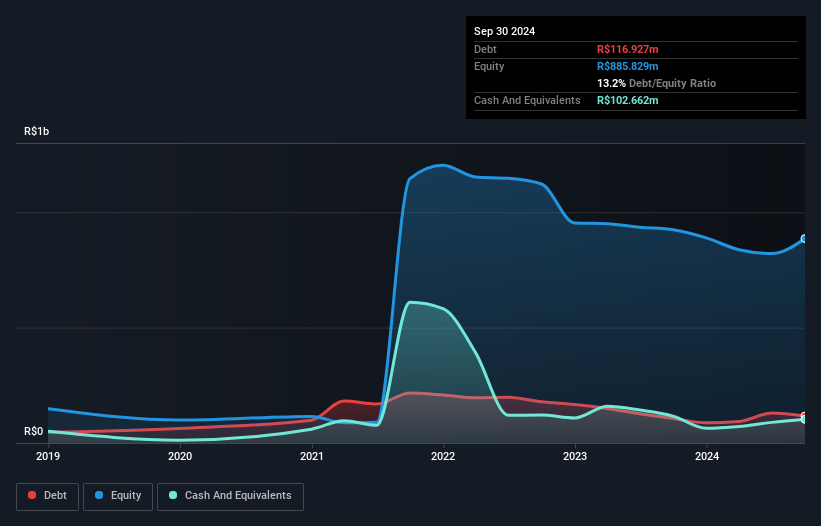

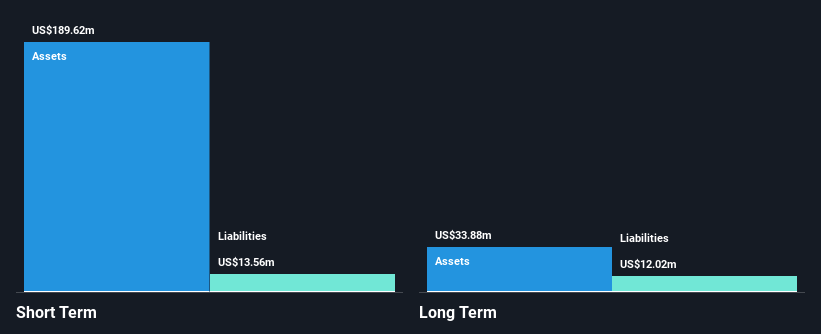

Zenvia Inc., with a market cap of US$72.19 million, operates in the cloud communication sector, deriving significant revenue from its SaaS (R$325.22M) and CPaaS (R$772.32M) segments. Despite being unprofitable with increasing losses over five years at 16.2% annually, Zenvia's cash runway remains robust for over three years due to positive free cash flow growth of 30.7%. While its debt-to-equity ratio has improved significantly from 75.5% to 12.5%, the company's short-term liabilities exceed its assets by R$444.3M, highlighting financial challenges amidst recent executive changes with Piero Rosatelli as CFO and IRO.

- Get an in-depth perspective on Zenvia's performance by reading our balance sheet health report here.

- Understand Zenvia's earnings outlook by examining our growth report.

PMV Pharmaceuticals (PMVP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: PMV Pharmaceuticals, Inc. is a precision oncology company focused on discovering and developing small molecule and tumor-agnostic therapies for p53 mutations in cancer, with a market cap of $73.13 million.

Operations: PMV Pharmaceuticals does not report any revenue segments.

Market Cap: $73.13M

PMV Pharmaceuticals, with a market cap of US$73.13 million, is pre-revenue and focuses on developing therapies for p53 mutations in cancer. Despite its unprofitability and increasing losses over the past five years, the company maintains a strong financial position with short-term assets of US$132.4 million surpassing both its short- and long-term liabilities. Recent data from its Phase 2 PYNNACLE trial showed promising results for rezatapopt in treating various cancers, achieving an overall response rate of 34%. The company's management team is experienced, but it faces high share price volatility and has sufficient cash runway for approximately 1.6 years without debt concerns.

- Click here to discover the nuances of PMV Pharmaceuticals with our detailed analytical financial health report.

- Learn about PMV Pharmaceuticals' future growth trajectory here.

Vaso (VASO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vaso Corporation, along with its subsidiaries, operates in the healthcare equipment and information technology sectors both in the United States and internationally, with a market cap of $21.82 million.

Operations: Vaso's revenue segments are not reported.

Market Cap: $21.82M

Vaso Corporation, with a market cap of US$21.82 million, has recently turned profitable, reporting third-quarter sales of US$22.66 million and net income of US$1.71 million. The company's financial health is robust; short-term assets of US$50 million exceed both short- and long-term liabilities, while its debt is well covered by operating cash flow. Despite a low return on equity at 9.8% and an inexperienced management team with an average tenure of 0.8 years, Vaso's board is seasoned with 14.8 years average tenure, providing stability amidst large one-off losses impacting recent earnings results.

- Dive into the specifics of Vaso here with our thorough balance sheet health report.

- Assess Vaso's previous results with our detailed historical performance reports.

Taking Advantage

- Investigate our full lineup of 364 US Penny Stocks right here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zenvia might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:ZENV

Zenvia

Develops a cloud-based platform that enables organizations to integrate various communication capabilities in Brazil, the United States, Argentina, Mexico, the Netherlands, Malta, Peru, Switzerland, Colombia, Chile, and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives