- United States

- /

- Airlines

- /

- NasdaqCM:BLDE

Blade Air Mobility Leads The Charge Among 3 US Penny Stocks

Reviewed by Simply Wall St

As the U.S. stock market flirts with record highs, investors are keenly watching for opportunities that may not be immediately apparent in the headlines. Penny stocks, often representing smaller or newer companies, continue to intrigue those looking beyond established giants for potential growth. Despite their historical reputation as speculative bets, some penny stocks today boast robust financial health and present intriguing possibilities for investors seeking unique opportunities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.88 | $6.39M | ★★★★★★ |

| QuantaSing Group (NasdaqGM:QSG) | $3.08 | $127.27M | ★★★★★★ |

| ZTEST Electronics (OTCPK:ZTST.F) | $0.249 | $9.16M | ★★★★★★ |

| Imperial Petroleum (NasdaqCM:IMPP) | $2.79 | $84.63M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.41 | $46.53M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $67.38M | ★★★★★★ |

| Smith Micro Software (NasdaqCM:SMSI) | $1.39 | $24.65M | ★★★★★☆ |

| PHX Minerals (NYSE:PHX) | $4.13 | $154.8M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $0.8718 | $78.41M | ★★★★★☆ |

| Safe Bulkers (NYSE:SB) | $3.59 | $383.33M | ★★★★☆☆ |

Click here to see the full list of 705 stocks from our US Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Blade Air Mobility (NasdaqCM:BLDE)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Blade Air Mobility, Inc. offers air transportation services as an alternative to congested ground routes in the United States, with a market cap of approximately $293.68 million.

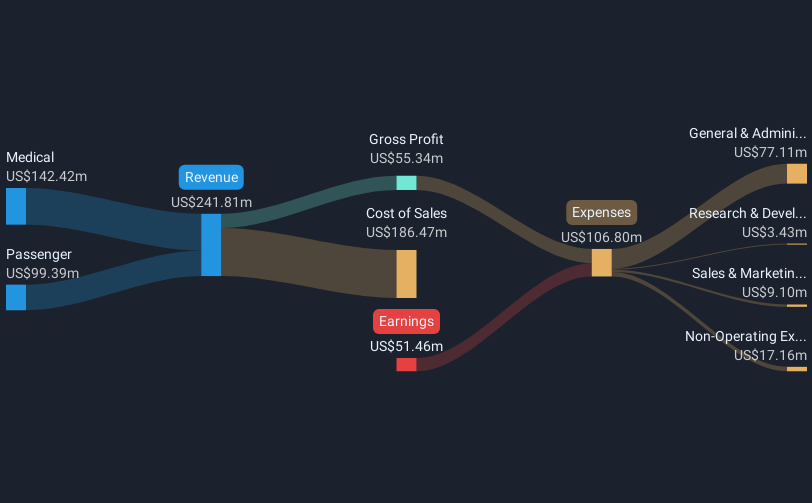

Operations: The company's revenue is derived from its Medical segment, generating $142.42 million, and its Passenger segment, contributing $99.39 million.

Market Cap: $293.68M

Blade Air Mobility, Inc. operates with a market cap of approximately US$293.68 million and generates significant revenue from its Medical segment (US$142.42 million) and Passenger segment (US$99.39 million). Despite being unprofitable with increasing losses over the past five years, the company is debt-free and has a strong cash position of around US$140 million, earmarked for tactical acquisitions in its medical division. The management team is experienced, though recent insider selling could be concerning for investors. Although volatile, Blade trades at a substantial discount to estimated fair value and maintains sufficient cash runway for over three years.

- Get an in-depth perspective on Blade Air Mobility's performance by reading our balance sheet health report here.

- Gain insights into Blade Air Mobility's outlook and expected performance with our report on the company's earnings estimates.

Nautilus Biotechnology (NasdaqGS:NAUT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Nautilus Biotechnology, Inc. is a development stage life sciences company focused on creating platform technology to quantify and unlock the complexity of the proteome, with a market cap of $214.71 million.

Operations: Nautilus Biotechnology, Inc. does not currently report any revenue segments as it is in the development stage.

Market Cap: $214.71M

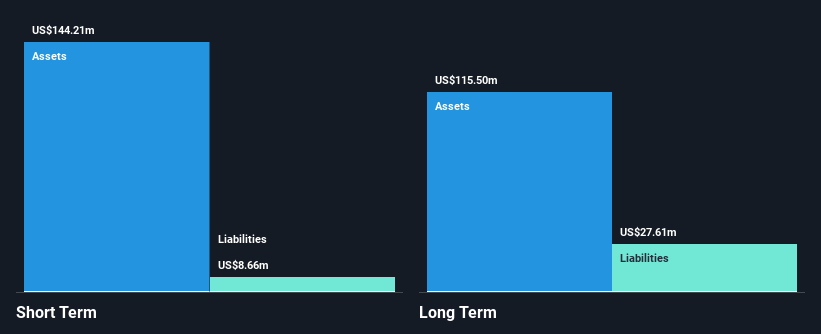

Nautilus Biotechnology, Inc., with a market cap of US$214.71 million, is a pre-revenue entity in the development stage, focusing on proteome technology. Despite its unprofitability and forecasted earnings decline of 10.8% annually over the next three years, Nautilus remains debt-free and holds short-term assets of US$144.2 million that comfortably cover both short- and long-term liabilities. The company has a cash runway exceeding two years even if free cash flow continues to decrease at historical rates. Recent board changes are not due to operational disagreements, though removal from the NASDAQ Biotechnology Index may raise concerns for investors.

- Dive into the specifics of Nautilus Biotechnology here with our thorough balance sheet health report.

- Explore Nautilus Biotechnology's analyst forecasts in our growth report.

Pliant Therapeutics (NasdaqGS:PLRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pliant Therapeutics, Inc. is a clinical stage biopharmaceutical company focused on discovering, developing, and commercializing novel therapies for fibrosis and related diseases in the United States, with a market cap of approximately $185 million.

Operations: Pliant Therapeutics, Inc. does not report any revenue segments.

Market Cap: $185M

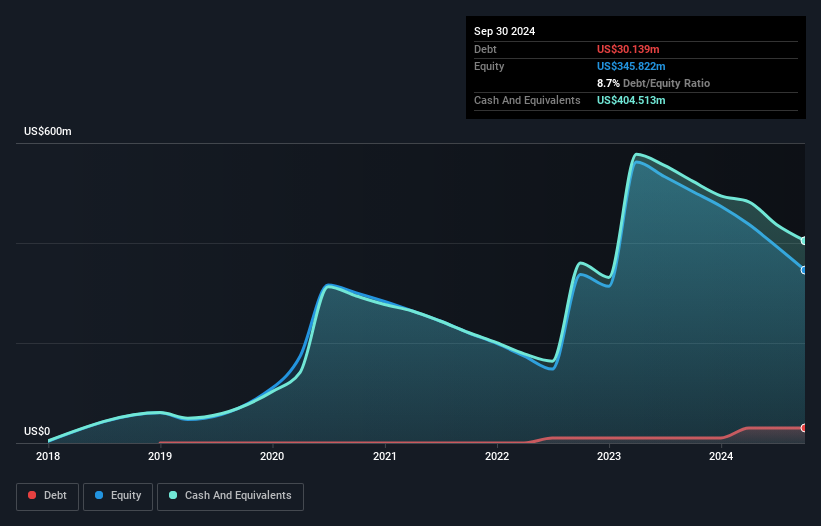

Pliant Therapeutics, Inc., with a market cap of approximately US$185 million, is a pre-revenue biopharmaceutical company focused on fibrosis therapies. Despite its unprofitability and negative return on equity of -58.32%, Pliant maintains financial stability with cash reserves exceeding both short- and long-term liabilities. The company's debt to equity ratio has increased to 8.7% over five years, yet it holds sufficient cash runway for over a year at current free cash flow levels. Recently, Pliant paused enrollment in its BEACON-IPF trial following safety board recommendations, highlighting potential risks in clinical developments despite experienced management oversight.

- Navigate through the intricacies of Pliant Therapeutics with our comprehensive balance sheet health report here.

- Learn about Pliant Therapeutics' future growth trajectory here.

Seize The Opportunity

- Take a closer look at our US Penny Stocks list of 705 companies by clicking here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Blade Air Mobility might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:BLDE

Blade Air Mobility

Provides air transportation alternatives to the congested ground routes in the United States.

Excellent balance sheet low.

Market Insights

Community Narratives