- United States

- /

- Metals and Mining

- /

- NYSEAM:VGZ

3 Promising Penny Stocks With Market Caps Under $500M

Reviewed by Simply Wall St

As the U.S. stock market faces volatility with regional bank shares plummeting and bond yields hitting lows, investors are increasingly on the lookout for alternative opportunities. Penny stocks, though often overlooked and considered a relic of past trading days, remain relevant as they can offer surprising value in today's market landscape. When these smaller or newer companies are supported by strong financial health, they hold potential for significant returns; here we explore three such penny stocks that may present hidden value to investors seeking growth opportunities.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.82 | $398.61M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.78 | $672.69M | ✅ 4 ⚠️ 0 View Analysis > |

| CuriosityStream (CURI) | $4.56 | $275.75M | ✅ 4 ⚠️ 2 View Analysis > |

| LexinFintech Holdings (LX) | $5.00 | $843M | ✅ 4 ⚠️ 1 View Analysis > |

| Global Self Storage (SELF) | $4.905 | $55.9M | ✅ 5 ⚠️ 1 View Analysis > |

| Performance Shipping (PSHG) | $1.89 | $22.88M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.17 | $559.47M | ✅ 4 ⚠️ 0 View Analysis > |

| Golden Growers Cooperative (GGRO.U) | $5.00 | $77.45M | ✅ 2 ⚠️ 5 View Analysis > |

| BAB (BABB) | $0.98 | $6.97M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.54 | $81.79M | ✅ 3 ⚠️ 2 View Analysis > |

Click here to see the full list of 362 stocks from our US Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Pliant Therapeutics (PLRX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Pliant Therapeutics, Inc. is a biopharmaceutical company focused on discovering, developing, and commercializing novel therapies for fibrosis and related diseases, with a market cap of approximately $96.38 million.

Operations: Pliant Therapeutics, Inc. has not reported any revenue segments.

Market Cap: $96.38M

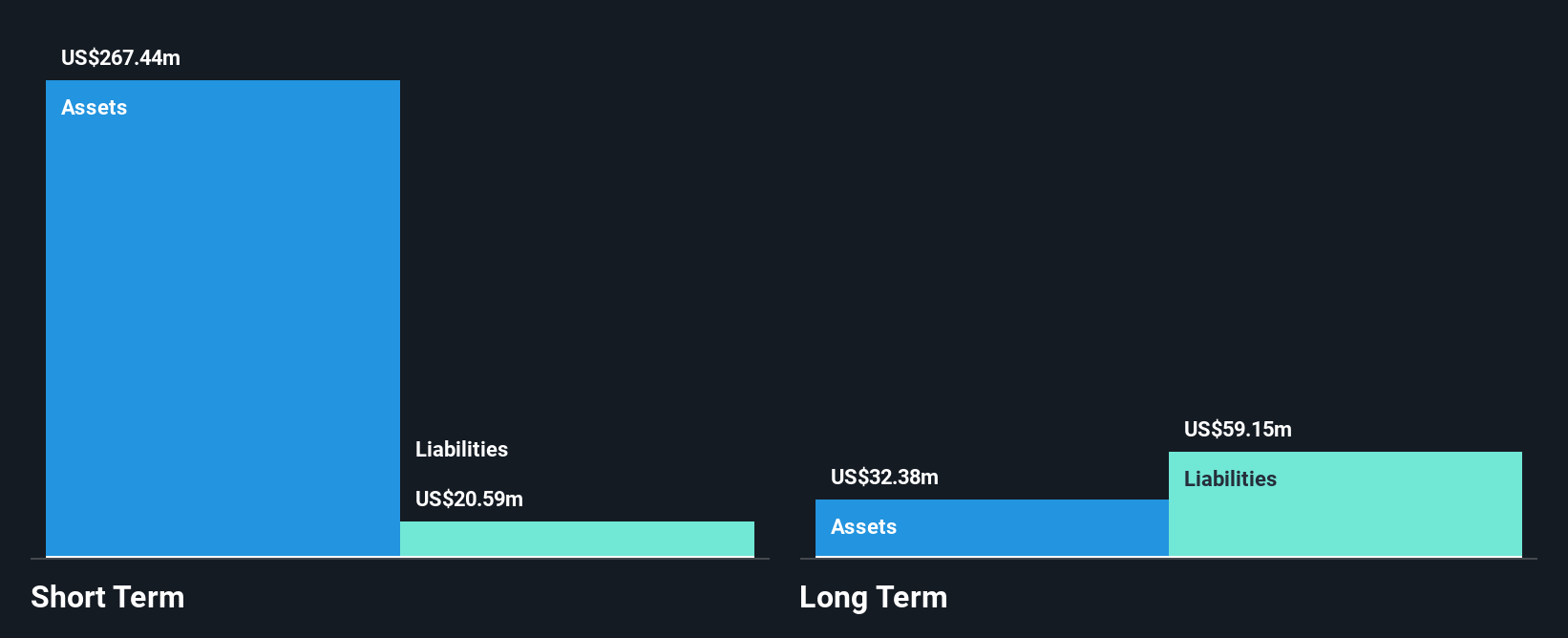

Pliant Therapeutics, Inc., a pre-revenue biopharmaceutical company with a market cap of US$96.38 million, has shown improvement in reducing its net loss from the previous year. Despite being unprofitable and not expected to achieve profitability in the near future, Pliant benefits from an experienced management team and board of directors. The company's short-term assets significantly exceed both its long-term and short-term liabilities, providing financial stability. Although it faces challenges with increasing losses over five years, Pliant maintains a sufficient cash runway for over two years without significant shareholder dilution recently observed.

- Jump into the full analysis health report here for a deeper understanding of Pliant Therapeutics.

- Gain insights into Pliant Therapeutics' outlook and expected performance with our report on the company's earnings estimates.

Vista Gold (VGZ)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Vista Gold Corp., along with its subsidiaries, operates as a development-stage company in the gold mining industry in Australia, with a market cap of approximately $279.15 million.

Operations: Vista Gold Corp. does not report any specific revenue segments as it is a development-stage company in the gold mining industry.

Market Cap: $279.15M

Vista Gold Corp., a pre-revenue development-stage gold mining company, has demonstrated strong financial stability with sufficient cash runway for over a year and no debt. Despite recent losses, the company has reduced its losses over five years by 25.2% annually. The Mt Todd project shows promising potential with robust economics from its feasibility study, including an after-tax NPV of $1.1 billion at a $2,500 gold price and reduced initial capital costs of $425 million. Recent inclusion in the S&P Global BMI Index highlights increased visibility among investors despite high share price volatility and negative return on equity due to ongoing unprofitability.

- Click to explore a detailed breakdown of our findings in Vista Gold's financial health report.

- Assess Vista Gold's previous results with our detailed historical performance reports.

3D Systems (DDD)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: 3D Systems Corporation offers 3D printing and digital manufacturing solutions across multiple regions globally, with a market cap of approximately $419.39 million.

Operations: The company's revenue is divided into two main segments: Healthcare, generating $181.76 million, and Industrial, contributing $231.58 million.

Market Cap: $419.39M

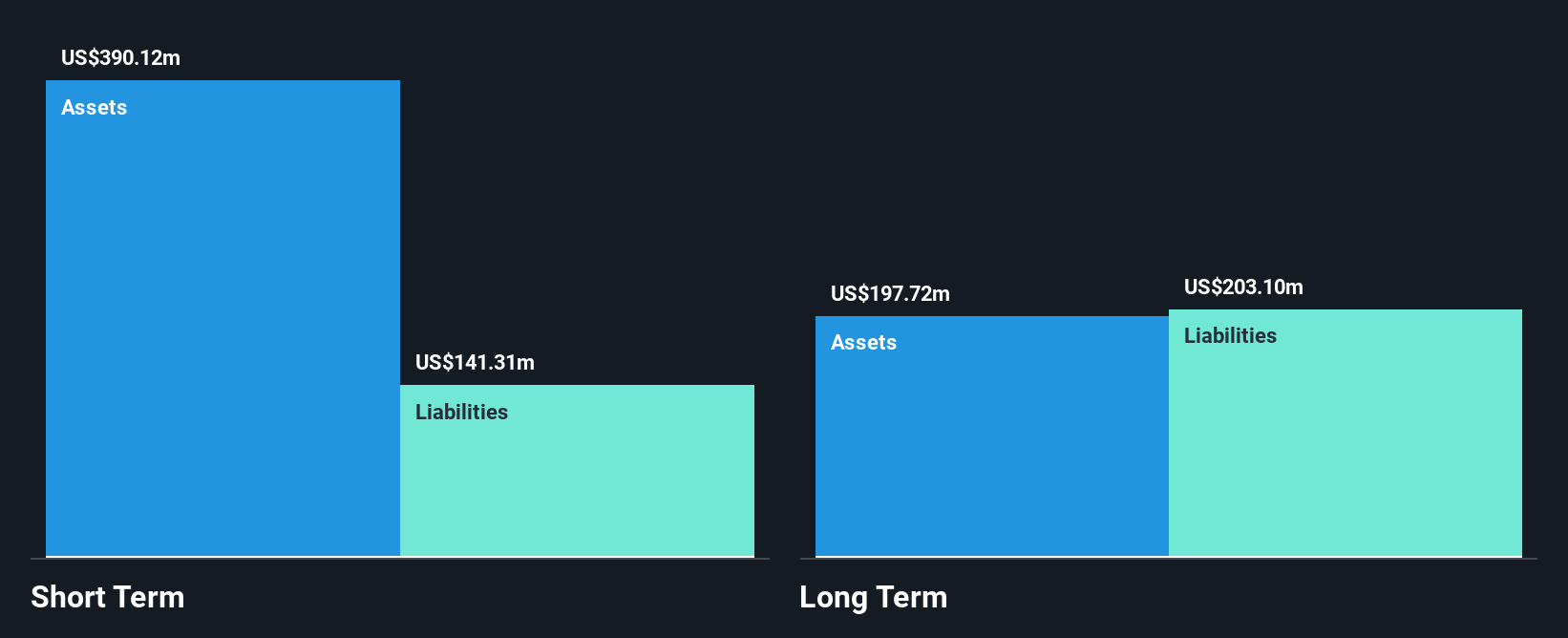

3D Systems, with a market cap of US$419.39 million, is navigating through challenging financials as it remains unprofitable despite its revenue streams in Healthcare and Industrial segments. Recent developments include the introduction of the MJP 300W Plus printer for jewelry manufacturing and a significant U.S. Air Force contract worth US$7.65 million for advanced 3D printing technology. The company's short-term assets significantly exceed liabilities, providing some financial cushion, but its debt to equity ratio has increased over five years. While earnings are forecasted to grow substantially, the stock's high volatility presents risks for investors interested in penny stocks.

- Take a closer look at 3D Systems' potential here in our financial health report.

- Evaluate 3D Systems' prospects by accessing our earnings growth report.

Key Takeaways

- Unlock our comprehensive list of 362 US Penny Stocks by clicking here.

- Want To Explore Some Alternatives? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSEAM:VGZ

Vista Gold

Vista Gold Corp., together with its subsidiaries, operate as a development-stage company in the gold mining industry in Australia.

Flawless balance sheet with very low risk.

Market Insights

Community Narratives