- United States

- /

- Biotech

- /

- NasdaqGS:PGEN

Precigen (PGEN) Is Up 9.6% After Durable PAPZIMEOS Data and FDA Nod for Rare Disease Therapy – Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- Precigen announced long-term follow-up data at the AAO-HNSF 2025 Annual Meeting showing durable responses from PAPZIMEOS™ (zopapogene imadenovec-drba) in adults with recurrent respiratory papillomatosis, following its full FDA approval in August 2025 as the first and only approved therapy for this condition.

- The majority of patients who achieved complete response in the pivotal study maintained their response for at least three years with no new safety concerns reported.

- We'll explore how the durability of PAPZIMEOS’s effect and FDA approval shape Precigen’s investment narrative and future expectations.

The latest GPUs need a type of rare earth metal called Terbium and there are only 39 companies in the world exploring or producing it. Find the list for free.

What Is Precigen's Investment Narrative?

For anyone considering Precigen as an investment, the fundamentals are defined by its bet on PAPZIMEOS™, now the only FDA-approved therapy for adult recurrent respiratory papillomatosis and, on the back of long-term data, an asset showing durable patient responses three years post-treatment. This recent news meaningfully shifts the short-term picture: previous catalysts were tied to regulatory milestones and clinical updates, but with full approval now granted and confirmation of long-lasting benefit, market attention likely pivots to commercial execution and uptake rates. While the data relieves some risk around clinical durability, questions around the company's ability to translate scientific progress into meaningful revenue and manage ongoing financial losses remain front and center; Precigen is still unprofitable, and the volatility of its share price hasn’t let up. There’s also the overhang of past shareholder litigation and the lingering impact of negative equity, which could complicate future fundraising or partnerships as the business scales from clinical to commercial phases.

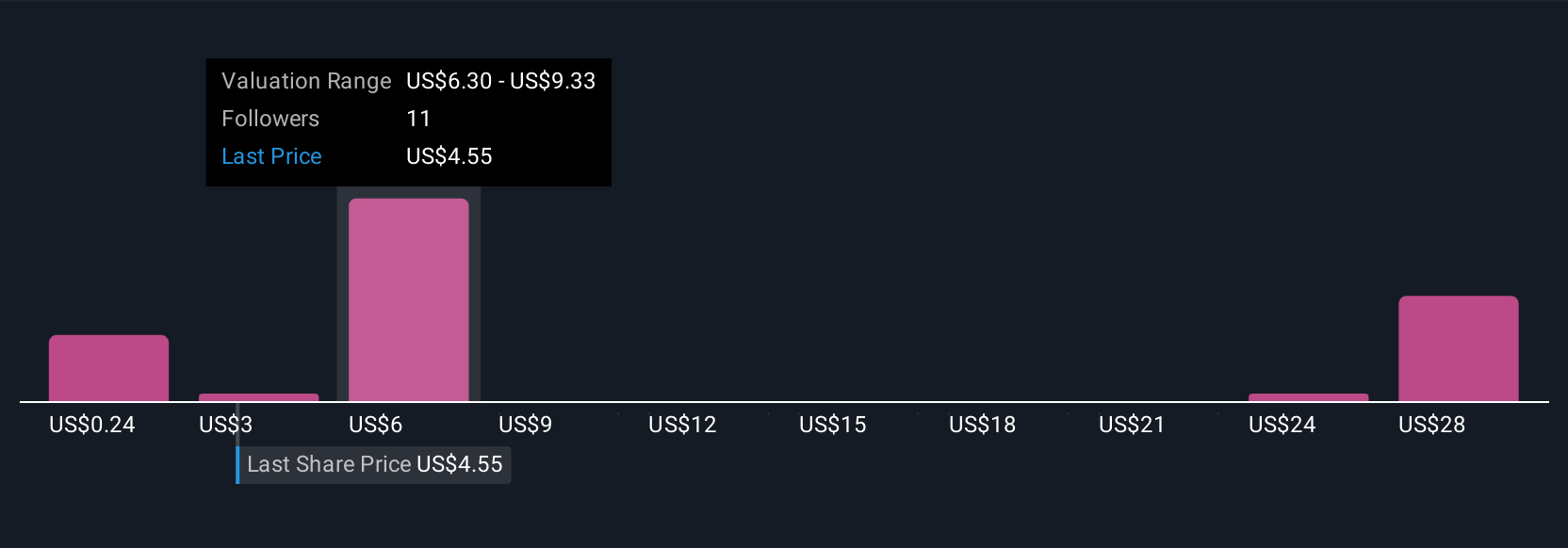

But is market enthusiasm enough to counter ongoing financial pressures? Investors should know the answer. The analysis detailed in our Precigen valuation report hints at an inflated share price compared to its estimated value.Exploring Other Perspectives

Explore 10 other fair value estimates on Precigen - why the stock might be worth over 8x more than the current price!

Build Your Own Precigen Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Precigen research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free Precigen research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Precigen's overall financial health at a glance.

Curious About Other Options?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGEN

Precigen

A discovery and clinical-stage biopharmaceutical company, develops gene and cell therapies using precision technology to target diseases in areas of immuno-oncology, autoimmune disorders, and infectious diseases.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives