- United States

- /

- Biotech

- /

- NasdaqGS:PGEN

Exploring 3 High Growth Tech Stocks in the United States

Reviewed by Simply Wall St

The United States market has been flat in the last week, but it has risen by 20% over the past 12 months, with earnings expected to grow by 15% per annum in the coming years. In this environment, identifying high growth tech stocks that can capitalize on these trends involves looking for companies with strong innovation potential and robust business models.

Top 10 High Growth Tech Companies In The United States

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Super Micro Computer | 24.36% | 24.28% | ★★★★★★ |

| Ardelyx | 21.09% | 55.29% | ★★★★★★ |

| AVITA Medical | 33.20% | 51.87% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| TG Therapeutics | 29.48% | 43.58% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Clene | 61.16% | 59.11% | ★★★★★★ |

| Blueprint Medicines | 23.52% | 55.74% | ★★★★★★ |

| Lumentum Holdings | 21.25% | 118.58% | ★★★★★★ |

Click here to see the full list of 231 stocks from our US High Growth Tech and AI Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Travere Therapeutics (NasdaqGM:TVTX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Travere Therapeutics, Inc. is a biopharmaceutical company focused on identifying, developing, and delivering therapies for rare kidney and metabolic diseases with a market cap of $1.89 billion.

Operations: The company generates revenue through the development and commercialization of innovative therapies, amounting to $203.45 million. Its focus is on addressing rare kidney and metabolic diseases.

Travere Therapeutics, forecasting a robust 61.89% annual earnings growth and a revenue increase of 30.5%, is outpacing the broader US market's growth rate of 8.8%. Despite being unprofitable, its strategic focus on innovative drug developments like FILSPARI for IgAN, which has gained traction in Europe and is under FDA review, signals potential upside. The company's recent guidance anticipates substantial sales milestones from international partnerships and regulatory advancements, reflecting an aggressive push towards profitability within three years and a projected exceptional Return on Equity of 60%.

- Dive into the specifics of Travere Therapeutics here with our thorough health report.

Evaluate Travere Therapeutics' historical performance by accessing our past performance report.

Precigen (NasdaqGS:PGEN)

Simply Wall St Growth Rating: ★★★★★☆

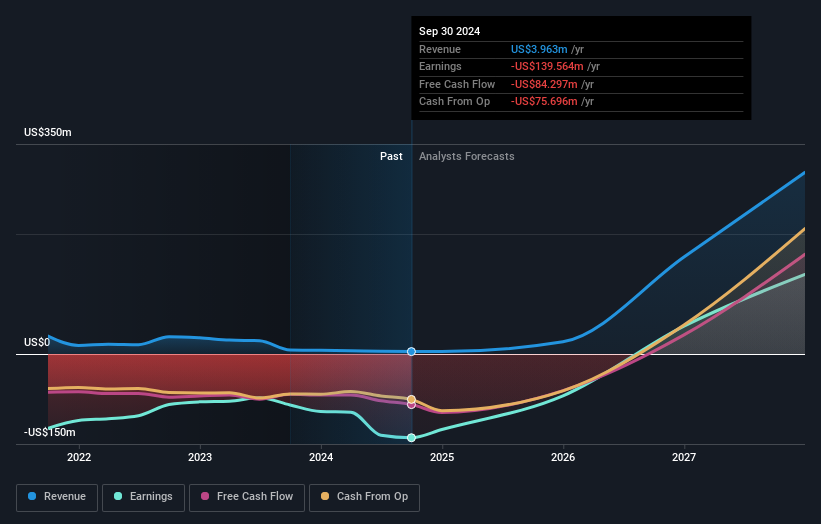

Overview: Precigen, Inc. is a discovery and clinical-stage biopharmaceutical company focused on developing gene and cell therapies using precision technology to address diseases in immuno-oncology, autoimmune disorders, and infectious diseases, with a market cap of $497.88 million.

Operations: The company develops gene and cell therapies targeting immuno-oncology, autoimmune disorders, and infectious diseases. It generates revenue primarily from its Exemplar segment, amounting to $3.89 million.

Precigen stands out in the high-growth tech landscape with a forecasted annual revenue increase of 48.1%, significantly surpassing the U.S. market average of 8.8%. This biotech innovator, although currently unprofitable, is poised for a turnaround with expected profitability within three years, driven by advancements like its gene therapy PRGN-2012 for recurrent respiratory papillomatosis—a potential first FDA-approved therapeutic in its category. Recent strategic moves include a $79 million private placement to fuel these innovations and a robust R&D commitment that aligns with its forward-looking revenue projections and clinical milestones, marking it as a dynamic player shaping future biotech trends.

- Navigate through the intricacies of Precigen with our comprehensive health report here.

Assess Precigen's past performance with our detailed historical performance reports.

Tripadvisor (NasdaqGS:TRIP)

Simply Wall St Growth Rating: ★★★★☆☆

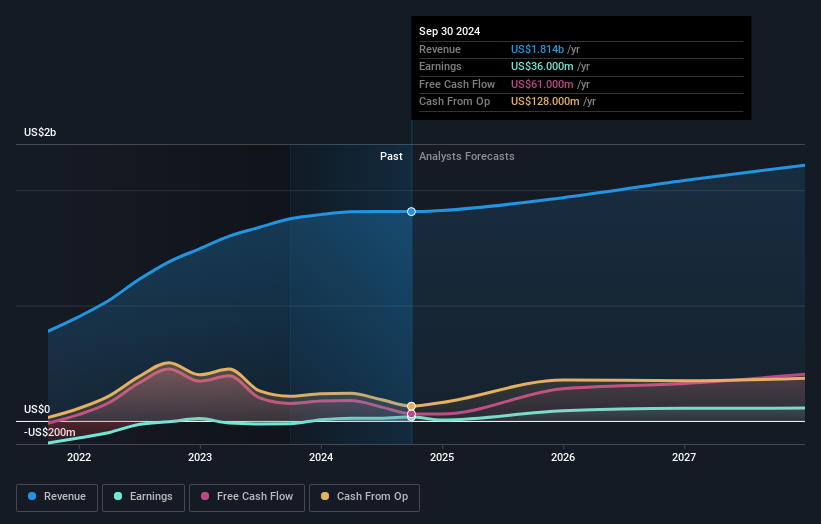

Overview: TripAdvisor, Inc. is an online travel company that provides travel guidance products and services globally, with a market capitalization of approximately $2.55 billion.

Operations: TripAdvisor generates revenue through its main segments: Viator ($816 million), Thefork ($172 million), and Brand Tripadvisor ($963 million). The company focuses on offering travel guidance products and services across these platforms.

Tripadvisor, transitioning from a challenging past, has recently pivoted towards profitability, marking a significant turnaround with its earnings forecasted to surge by 30.9% annually. This growth outpaces the broader U.S. market's average of 14.5%, signaling robust potential in its operational strategies and market positioning. Despite revenue growth projections being modest at 6.5% annually—below the U.S. market average of 8.8%—the company's strategic presentations at key industry events like the UBS Global Technology and AI Conference highlight its ongoing efforts to innovate and capture greater market share in the digital travel space. With a positive free cash flow status and high-quality past earnings, Tripadvisor is reinforcing its foundation for sustained growth amidst evolving industry dynamics.

- Get an in-depth perspective on Tripadvisor's performance by reading our health report here.

Gain insights into Tripadvisor's past trends and performance with our Past report.

Seize The Opportunity

- Dive into all 231 of the US High Growth Tech and AI Stocks we have identified here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PGEN

Precigen

Operates as a discovery and clinical-stage biopharmaceutical company that develops gene and cell therapies using precision technology to target diseases in therapeutic areas of immuno-oncology, autoimmune disorders, and infectious diseases.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives