- United States

- /

- Biotech

- /

- NasdaqGS:PCVX

How Vaxcyte's (PCVX) $1 Billion Thermo Fisher Deal Could Shape Its US Vaccine Supply Chain

Reviewed by Sasha Jovanovic

- Vaxcyte announced a new agreement with Thermo Fisher Scientific to bring additional fill-finish commercial manufacturing for its broad-spectrum pneumococcal conjugate vaccines to the US, representing a commitment of up to US$1 billion at the Greenville, North Carolina facility.

- This move reinforces Vaxcyte’s long-term goal of securing robust, domestic supply chains for its vaccine portfolio as it advances commercial readiness.

- We will explore how expanding domestic manufacturing capacity with Thermo Fisher could strengthen Vaxcyte’s investment narrative in the US market.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Vaxcyte's Investment Narrative?

To be a shareholder in Vaxcyte right now, conviction centers on whether the company can progress its broad-spectrum pneumococcal vaccine pipeline to commercialization while managing rising losses and zero revenue to date. The Thermo Fisher partnership marks a tangible step forward in supply chain reliability and commercial readiness, potentially laying important groundwork ahead of the next key catalyst: pivotal Phase 3 trial results and future regulatory milestones. This manufacturing expansion may not immediately move the needle on short-term catalysts, like clinical data or FDA approvals, but it can reduce one of the company’s largest operational risks: inadequate US production capacity if or when products are approved. However, Vaxcyte’s forecast to remain unprofitable for several years means dilutive financing, spending on scale-up, and uncertain timelines are still front and center among the biggest risks, even with the new agreement in place.

On the other hand, the need for further capital raises is information every investor should keep in mind.

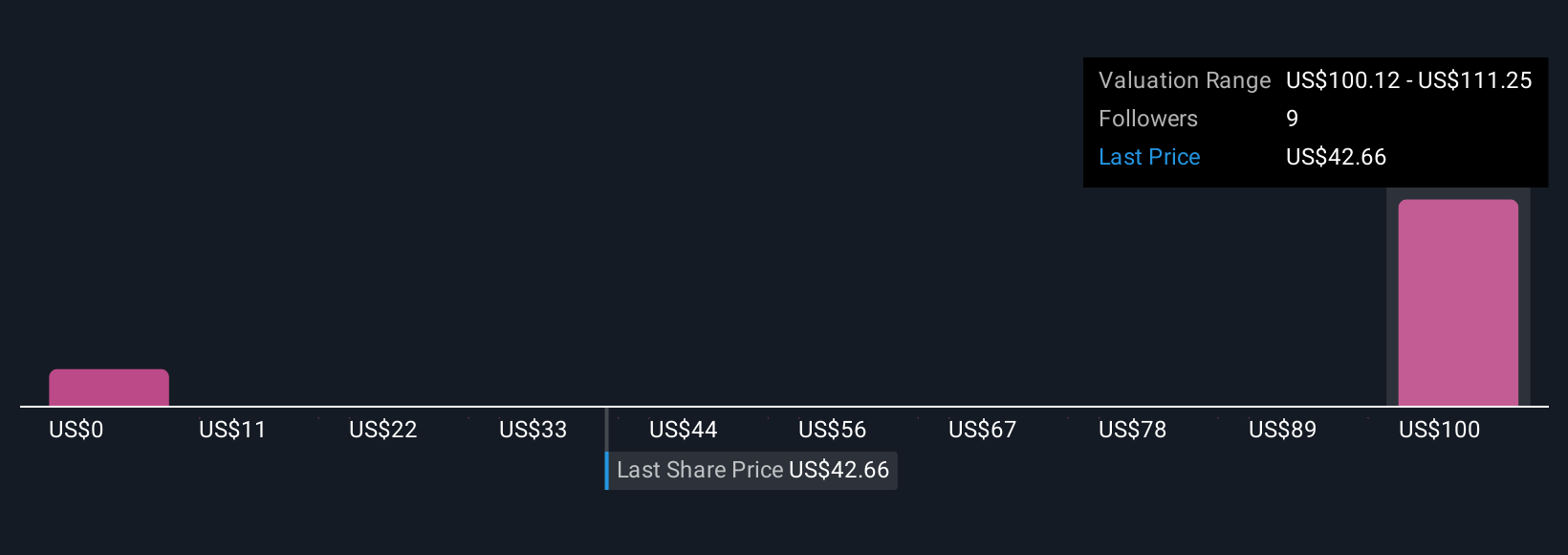

Upon reviewing our latest valuation report, Vaxcyte's share price might be too optimistic.Exploring Other Perspectives

Explore 4 other fair value estimates on Vaxcyte - why the stock might be worth over 2x more than the current price!

Build Your Own Vaxcyte Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Vaxcyte research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Vaxcyte research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Vaxcyte's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PCVX

Vaxcyte

A clinical-stage vaccine innovation company, develops conjugate and novel protein vaccines to prevent or treat bacterial infectious diseases.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives