- United States

- /

- Biotech

- /

- NasdaqGS:PBYI

Puma Biotechnology, Inc. (NASDAQ:PBYI) Held Back By Insufficient Growth Even After Shares Climb 34%

Puma Biotechnology, Inc. (NASDAQ:PBYI) shareholders are no doubt pleased to see that the share price has bounced 34% in the last month, although it is still struggling to make up recently lost ground. Notwithstanding the latest gain, the annual share price return of 7.9% isn't as impressive.

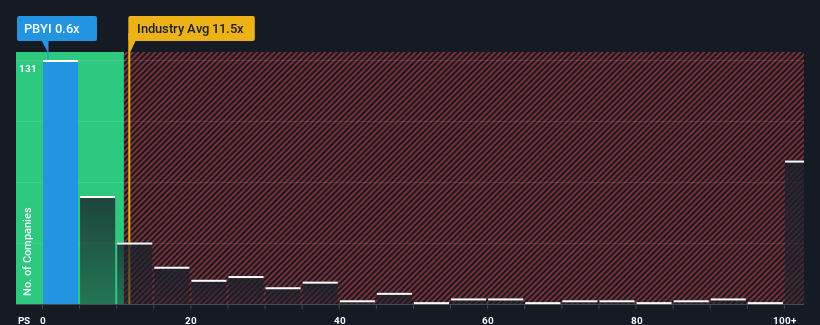

Even after such a large jump in price, Puma Biotechnology may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.6x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 11.5x and even P/S higher than 50x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

Check out our latest analysis for Puma Biotechnology

What Does Puma Biotechnology's P/S Mean For Shareholders?

Puma Biotechnology could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Keen to find out how analysts think Puma Biotechnology's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The Low P/S?

The only time you'd be truly comfortable seeing a P/S as depressed as Puma Biotechnology's is when the company's growth is on track to lag the industry decidedly.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 9.9%. This means it has also seen a slide in revenue over the longer-term as revenue is down 16% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 3.5% per year over the next three years. Meanwhile, the rest of the industry is forecast to expand by 92% each year, which is noticeably more attractive.

With this in consideration, its clear as to why Puma Biotechnology's P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Puma Biotechnology's recent share price jump still sees fails to bring its P/S alongside the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Puma Biotechnology maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 5 warning signs for Puma Biotechnology you should be aware of, and 3 of them are a bit concerning.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NasdaqGS:PBYI

Puma Biotechnology

A biopharmaceutical company, focuses on the development and commercialization of products to enhance cancer care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives