- United States

- /

- Biotech

- /

- NasdaqGS:PBYI

Even after rising 23% this past week, Puma Biotechnology (NASDAQ:PBYI) shareholders are still down 63% over the past five years

This week we saw the Puma Biotechnology, Inc. (NASDAQ:PBYI) share price climb by 23%. But that can't change the reality that over the longer term (five years), the returns have been really quite dismal. The share price has failed to impress anyone , down a sizable 63% during that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. But it could be that the fall was overdone.

While the stock has risen 23% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

View our latest analysis for Puma Biotechnology

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

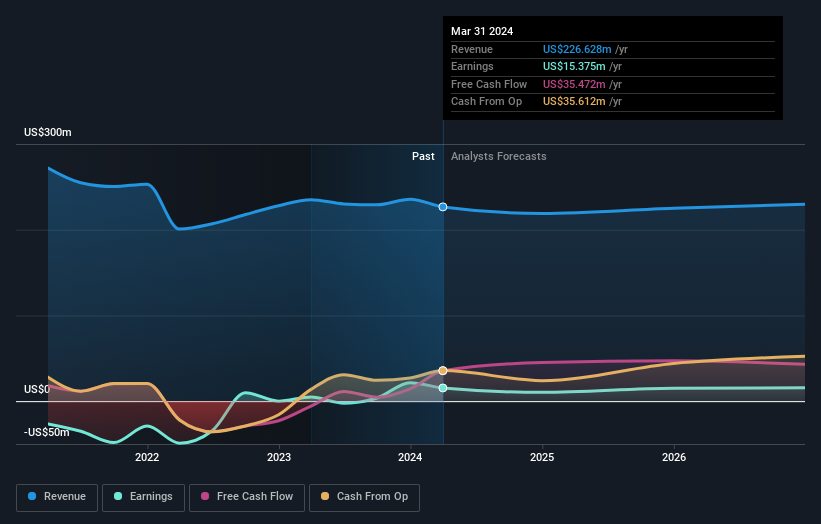

Puma Biotechnology became profitable within the last five years. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics might give us a better handle on how its value is changing over time.

Arguably, the revenue drop of 4.3% a year for half a decade suggests that the company can't grow in the long term. That could explain the weak share price.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Puma Biotechnology has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Puma Biotechnology stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Puma Biotechnology shareholders gained a total return of 6.7% during the year. Unfortunately this falls short of the market return. But at least that's still a gain! Over five years the TSR has been a reduction of 10% per year, over five years. So this might be a sign the business has turned its fortunes around. It's always interesting to track share price performance over the longer term. But to understand Puma Biotechnology better, we need to consider many other factors. To that end, you should learn about the 2 warning signs we've spotted with Puma Biotechnology (including 1 which is potentially serious) .

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PBYI

Puma Biotechnology

A biopharmaceutical company, focuses on the development and commercialization of products to enhance cancer care in the United States and internationally.

Flawless balance sheet and undervalued.