- United States

- /

- Biotech

- /

- NasdaqGS:PBYI

3 US Penny Stocks With Market Caps Under $700M

Reviewed by Simply Wall St

As the U.S. stock market experiences a rise amidst a significant week of earnings reports and economic data releases, investors are keenly observing potential opportunities across various sectors. Penny stocks, often associated with smaller or newer companies, continue to attract attention for their affordability and growth potential despite their somewhat outdated name. By focusing on those with strong financial foundations, these stocks can offer both stability and upside potential for investors looking to explore lesser-known opportunities in the market.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Financial Health Rating |

| BAB (OTCPK:BABB) | $0.78982 | $5.74M | ★★★★★★ |

| LexinFintech Holdings (NasdaqGS:LX) | $3.12 | $512.97M | ★★★★★★ |

| RLX Technology (NYSE:RLX) | $1.61 | $2.05B | ★★★★★★ |

| ARC Document Solutions (NYSE:ARC) | $3.43 | $148.35M | ★★★★★★ |

| Permianville Royalty Trust (NYSE:PVL) | $1.59 | $52.47M | ★★★★★★ |

| Golden Growers Cooperative (OTCPK:GGRO.U) | $4.50 | $69.71M | ★★★★★★ |

| MIND C.T.I (NasdaqGM:MNDO) | $1.88 | $39.06M | ★★★★★★ |

| Better Choice (NYSEAM:BTTR) | $1.68 | $2.78M | ★★★★★★ |

| Zynerba Pharmaceuticals (NasdaqCM:ZYNE) | $1.30 | $65.6M | ★★★★★☆ |

| CBAK Energy Technology (NasdaqCM:CBAT) | $1.10 | $98.93M | ★★★★★☆ |

Click here to see the full list of 760 stocks from our US Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Newegg Commerce (NasdaqCM:NEGG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Newegg Commerce, Inc. is an electronics-focused e-retailer operating in the United States, Canada, and internationally with a market cap of $246.14 million.

Operations: The company's revenue is primarily generated from its online retail segment, which accounts for $1.39 billion.

Market Cap: $246.14M

Newegg Commerce, Inc. operates with a market cap of US$246.14 million, primarily generating revenue from its online retail segment, which stands at US$1.39 billion annually. Despite being unprofitable with a negative return on equity of -47.64%, the company maintains more cash than total debt and has sufficient cash runway for over three years if current positive free cash flow levels are sustained. Short-term assets exceed both short- and long-term liabilities, indicating financial stability in covering obligations. However, shareholders faced dilution last year as shares outstanding increased by 2.3%. Recent earnings show declining sales and reduced net losses compared to the previous year.

- Dive into the specifics of Newegg Commerce here with our thorough balance sheet health report.

- Understand Newegg Commerce's track record by examining our performance history report.

Puma Biotechnology (NasdaqGS:PBYI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Puma Biotechnology, Inc. is a biopharmaceutical company dedicated to developing and commercializing cancer care products globally, with a market cap of approximately $144.69 million.

Operations: The company generates $219.14 million in revenue from its segment focused on the development and commercialization of innovative cancer care products.

Market Cap: $144.69M

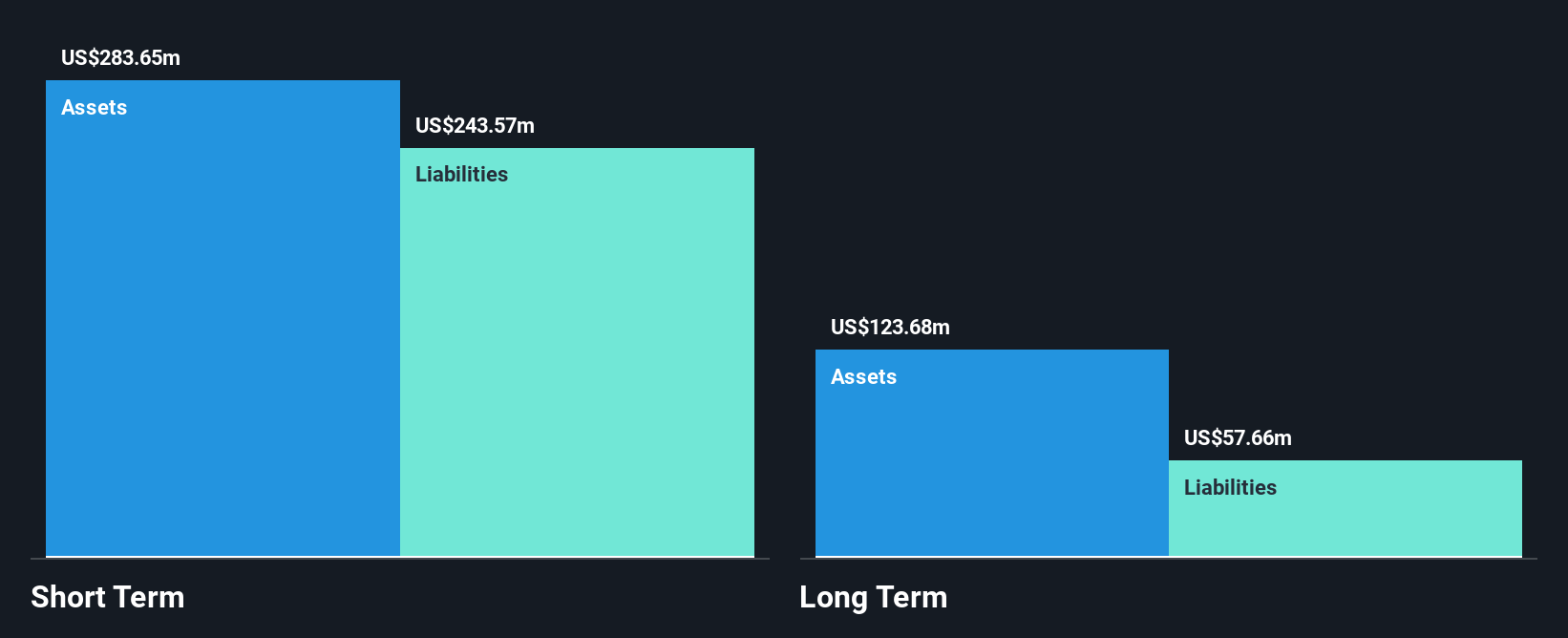

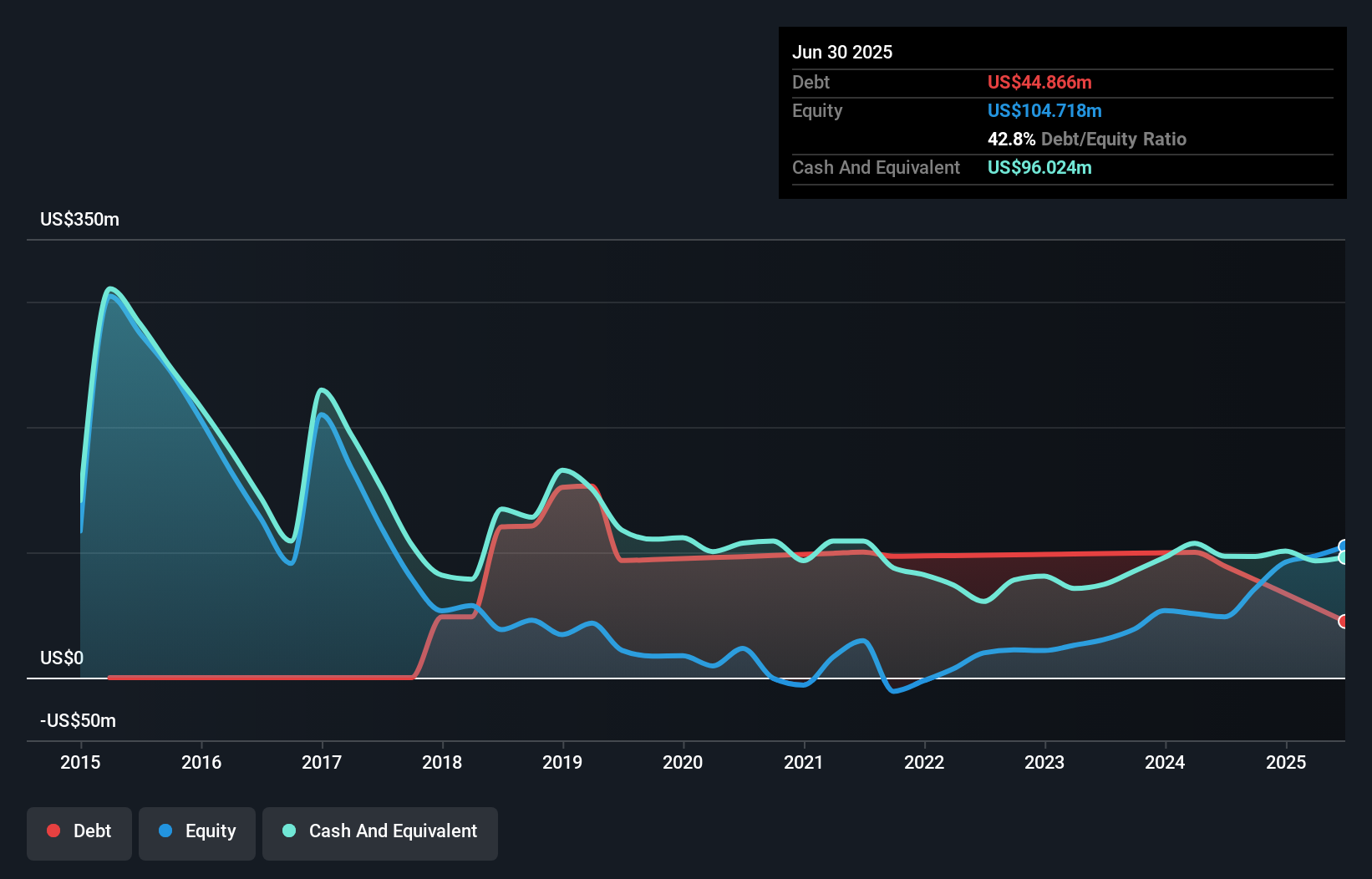

Puma Biotechnology, Inc., with a market cap of US$144.69 million, focuses on innovative cancer care products, generating US$219.14 million in revenue. The company has become profitable over the past five years but recently reported a net loss of US$4.53 million for Q2 2024, compared to a net income of US$2.1 million the previous year. Despite this setback, Puma's short-term assets exceed its liabilities and debt is well covered by cash flow; however, interest coverage remains weak at 2x EBIT. Shareholders experienced dilution as shares outstanding grew by 3.2%. Recent insider selling may raise concerns among investors.

- Click to explore a detailed breakdown of our findings in Puma Biotechnology's financial health report.

- Learn about Puma Biotechnology's future growth trajectory here.

Five Point Holdings (NYSE:FPH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Five Point Holdings, LLC, through its subsidiary Five Point Operating Company, LP, focuses on owning and developing mixed-use and planned communities in Orange County, Los Angeles County, and San Francisco County with a market cap of approximately $603.38 million.

Operations: The company's revenue segments include Valencia ($103.08 million), Commercial ($9.62 million), Great Park ($568.62 million), and San Francisco ($0.67 million).

Market Cap: $603.38M

Five Point Holdings, with a market cap of US$603.38 million, focuses on developing communities in key Californian counties. Recent earnings revealed revenue of US$17.01 million for Q3 2024, down from US$65.92 million the previous year, while net income decreased to US$4.76 million from US$6.6 million. The company's debt-to-equity ratio improved over five years but remains inadequately covered by cash flow at 3.7%. Despite lower profit margins and slower recent earnings growth compared to its historical average, Five Point's short-term assets significantly exceed both short and long-term liabilities, indicating strong liquidity positions.

- Click here and access our complete financial health analysis report to understand the dynamics of Five Point Holdings.

- Learn about Five Point Holdings' historical performance here.

Next Steps

- Click here to access our complete index of 760 US Penny Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Puma Biotechnology, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PBYI

Puma Biotechnology

A biopharmaceutical company, focuses on the development and commercialization of products to enhance cancer care in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives