- United States

- /

- Biotech

- /

- NasdaqGS:PBYI

1stdibs.Com And 2 Other Penny Stocks To Watch Closely

Reviewed by Simply Wall St

The U.S. stock market recently experienced a sharp decline, with major indexes like the Dow Jones Industrial Average and S&P 500 posting significant losses. Amidst this volatility, investors often seek out unique opportunities that may not be immediately apparent in larger, more established companies. Penny stocks, though considered somewhat outdated as a term, still represent an intriguing investment area for those looking to explore smaller or newer companies with potential growth prospects. By focusing on those penny stocks with strong financials and resilience, investors can uncover opportunities that might offer both stability and upside potential.

Top 10 Penny Stocks In The United States

| Name | Share Price | Market Cap | Rewards & Risks |

| Dingdong (Cayman) (DDL) | $1.69 | $370.75M | ✅ 4 ⚠️ 0 View Analysis > |

| Waterdrop (WDH) | $1.66 | $575.04M | ✅ 4 ⚠️ 0 View Analysis > |

| LexinFintech Holdings (LX) | $3.96 | $684.83M | ✅ 4 ⚠️ 2 View Analysis > |

| Puma Biotechnology (PBYI) | $4.96 | $246.41M | ✅ 3 ⚠️ 3 View Analysis > |

| Performance Shipping (PSHG) | $2.19 | $27.72M | ✅ 4 ⚠️ 2 View Analysis > |

| CI&T (CINT) | $4.21 | $569.89M | ✅ 5 ⚠️ 0 View Analysis > |

| VAALCO Energy (EGY) | $3.70 | $402.44M | ✅ 2 ⚠️ 3 View Analysis > |

| BAB (BABB) | $0.895025 | $6.5M | ✅ 2 ⚠️ 3 View Analysis > |

| Lifetime Brands (LCUT) | $3.28 | $72.95M | ✅ 3 ⚠️ 2 View Analysis > |

| Universal Safety Products (UUU) | $4.11 | $9.95M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 364 stocks from our US Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

1stdibs.Com (DIBS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 1stdibs.Com, Inc. operates an online marketplace for luxury design products worldwide and has a market cap of $181.61 million.

Operations: The company generates revenue through its online retail segment, amounting to $89.42 million.

Market Cap: $181.61M

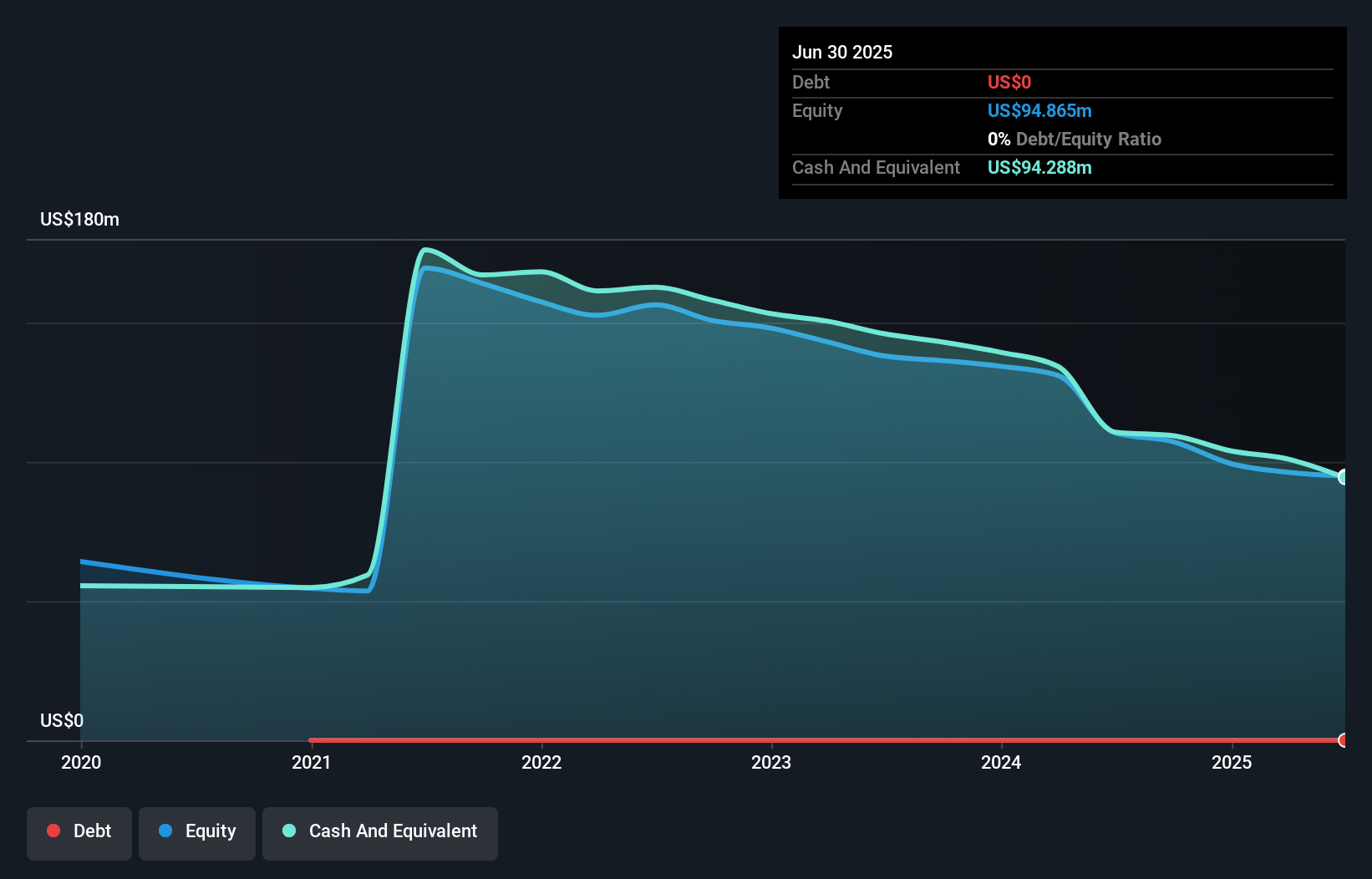

1stdibs.Com, Inc. is navigating the penny stock landscape with a market cap of US$181.61 million and annual revenue of US$89.42 million from its online retail segment. Despite being unprofitable, it has reduced losses over the past five years by 8.7% annually and maintains a strong cash runway exceeding three years without debt reliance. Recent earnings showed slight sales growth to US$21.97 million for Q3 2025, while losses narrowed compared to last year. The company has also initiated a share repurchase program worth up to US$12 million, indicating confidence in its financial strategy amidst ongoing challenges.

- Navigate through the intricacies of 1stdibs.Com with our comprehensive balance sheet health report here.

- Gain insights into 1stdibs.Com's future direction by reviewing our growth report.

ALX Oncology Holdings (ALXO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: ALX Oncology Holdings Inc. is a clinical-stage immuno-oncology company dedicated to developing cancer therapies in the United States, with a market cap of $74.82 million.

Operations: ALX Oncology Holdings Inc. does not report any revenue segments as it is focused on developing cancer therapies in the clinical stage.

Market Cap: $74.82M

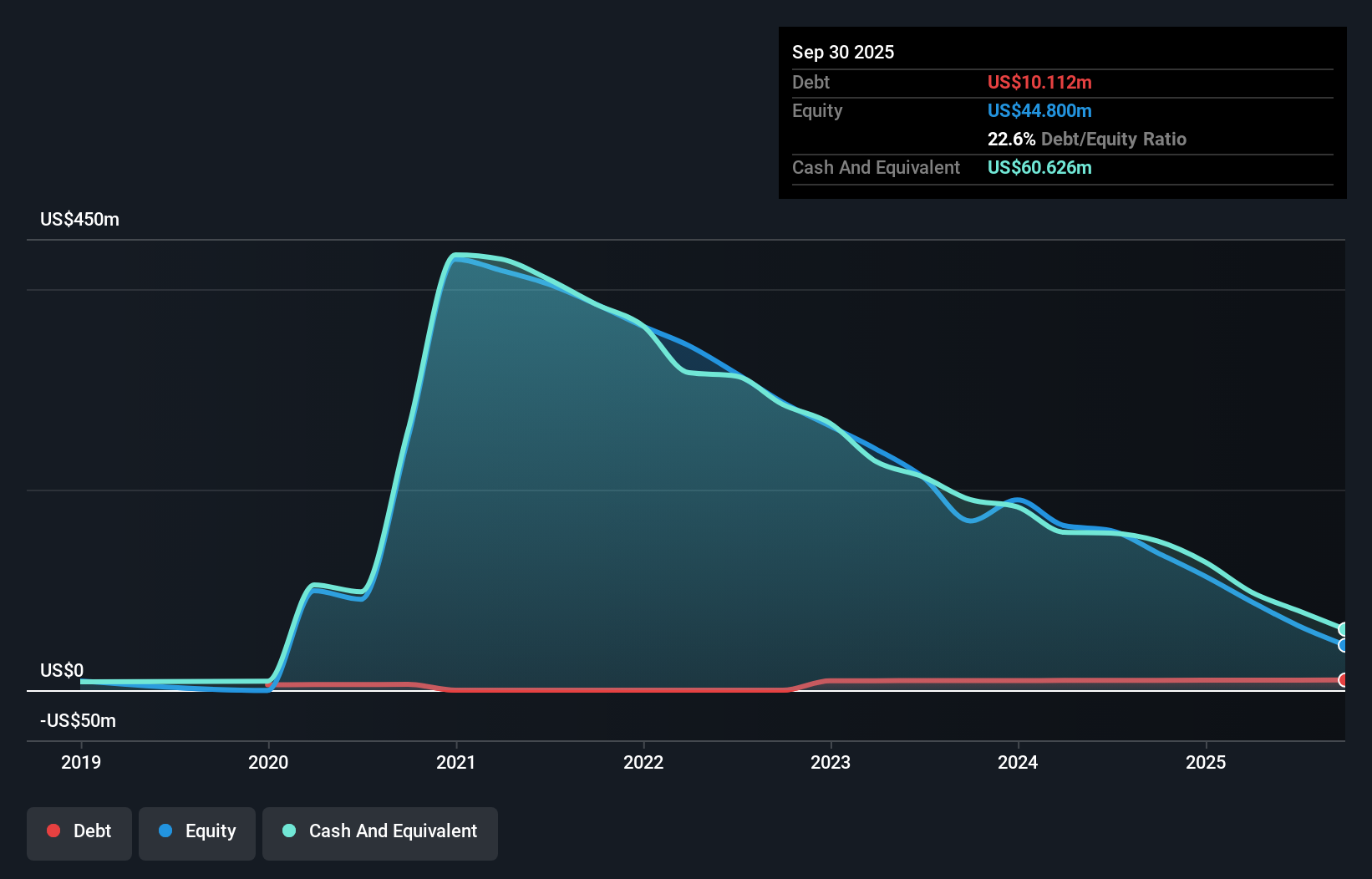

ALX Oncology Holdings Inc., operating with a market cap of US$74.82 million, is pre-revenue and focused on developing cancer therapies in the clinical stage. Despite being unprofitable, recent earnings reports show a reduction in net loss from US$30.71 million to US$22.14 million year-over-year for Q3 2025, indicating some financial improvement. The company has sufficient short-term assets to cover liabilities and more cash than total debt but faces less than a year of cash runway if current spending continues. ALX's ongoing Phase 1 trial for its ADC candidate ALX2004 shows promise in targeting EGFR-expressing tumors without significant skin toxicity observed at clinically relevant doses.

- Jump into the full analysis health report here for a deeper understanding of ALX Oncology Holdings.

- Learn about ALX Oncology Holdings' future growth trajectory here.

Puma Biotechnology (PBYI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Puma Biotechnology, Inc. is a biopharmaceutical company dedicated to developing and commercializing cancer care products in the United States and internationally, with a market cap of approximately $246.41 million.

Operations: The company generates revenue of $212 million from the development and commercialization of innovative cancer care products.

Market Cap: $246.41M

Puma Biotechnology, Inc., with a market cap of US$246.41 million, has demonstrated financial resilience despite recent challenges. The company reported a decline in Q3 2025 revenue to US$54.48 million from US$80.5 million the previous year but managed to increase net income for the nine months to US$17.67 million from US$11 million year-over-year. Puma's strong cash position exceeds its total debt, and its earnings quality is high with an impressive Return on Equity of 32.1%. Despite significant insider selling recently and high share price volatility, it trades below estimated fair value and offers good relative value compared to peers.

- Unlock comprehensive insights into our analysis of Puma Biotechnology stock in this financial health report.

- Review our growth performance report to gain insights into Puma Biotechnology's future.

Where To Now?

- Navigate through the entire inventory of 364 US Penny Stocks here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PBYI

Puma Biotechnology

A biopharmaceutical company, focuses on the development and commercialization of products to enhance cancer care in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives